Daily technical highlights – (SIME, UMW)

kiasutrader

Publish date: Tue, 15 Feb 2022, 09:22 AM

Sime Darby Bhd (Trading Buy)

• After plotting lower highs and higher lows recently, SIME shares may stage a breakout from a symmetrical triangle pattern ahead.

• On the chart, a share price run-up is anticipated as: (i) the Parabolic SAR is on an upward trend; (ii) the DMI Plus has just crossed over the DMI Minus; and (iii) the MACD has cut above the signal line.

• As such, the stock will probably climb towards our resistance thresholds of RM2.51 (R1; 10% upside potential) and RM2.69 (R2; 18% upside potential).

• Our stop loss price level is pegged at RM2.07 (or a 9% downside risk from yesterday’s close of RM2.28).

• A conglomerate with businesses in the industrial, automotive, healthcare and logistics sectors, SIME reported net profit of RM1.42b (+74% YoY) in FY June 2021.

• For 1QFY22, the group made net earnings of RM236m (-16% YoY) as its overall performance was mainly affected by lower profit contribution from the industrial division and the absence of foreign exchange gains (that were previously recorded in 1QFY21).

• Going forward, consensus is forecasting SIME’s net profit to come in at RM1.23b in FY June 2022 and RM1.29b in FY June 2023. This translates to forward PERs of 12.7x this year and 12.1x next year, respectively.

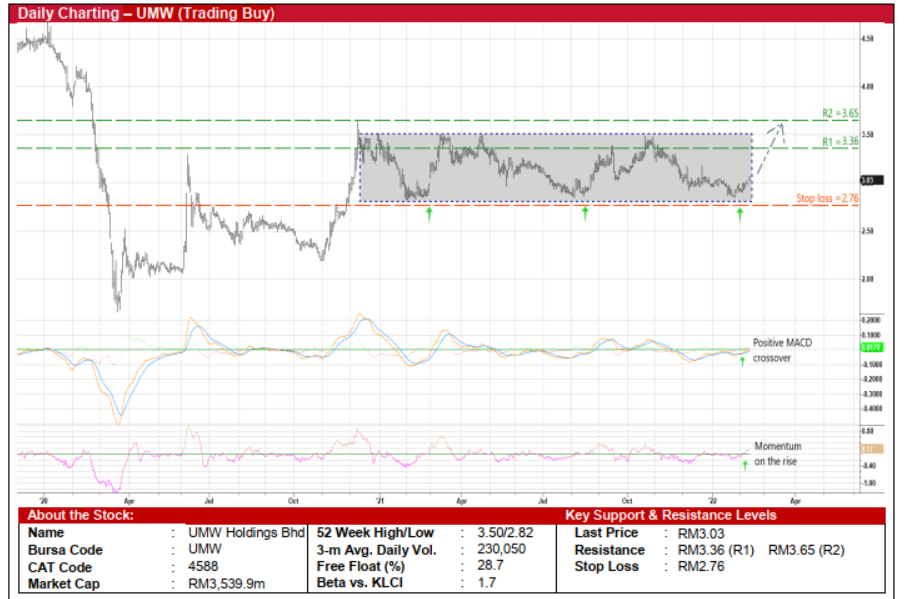

UMW Holdings Bhd (Trading Buy)

• UMW shares – which ended at RM3.03 yesterday – will probably show an upward bias ahead, rising from the bottom of a rectangle pattern that stretches back to December 2020.

• The bullish technical signals – as triggered by the MACD crossing over the signal line and the increasing momentum indicator above the zero-line – are also suggesting a run-up in the stock may be forthcoming.

• With that, the share price is expected to advance and challenge our immediate resistance threshold of RM3.36 (R1; 11% upside potential). An ensuing breakout from the rectangle pattern could then lift the stock towards our next resistance hurdle of RM3.65 (R2; 20% upside potential).

• We have set our stop loss price level at RM2.76 (or a 9% downside risk).

• With businesses in the automotive, equipment (for the industrial, heavy, marine & power industries) and manufacturing & engineering (of automotive parts and lubricants) segments, UMW made net profit of RM28.3m (-43% YoY) in 9MFY21.

• Based on consensus estimates, the group is projected to register net earnings of RM171.9m in FY December 2021, RM292.8m in FY December 2022 and RM333.4m in FY December 2023. This translates to forward PERs of 12.1x this year and 10.6x next year, respectively.

Source: Kenanga Research - 15 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024