Daily technical highlights – (DNEX, OPTIMAX)

kiasutrader

Publish date: Thu, 17 Feb 2022, 09:15 AM

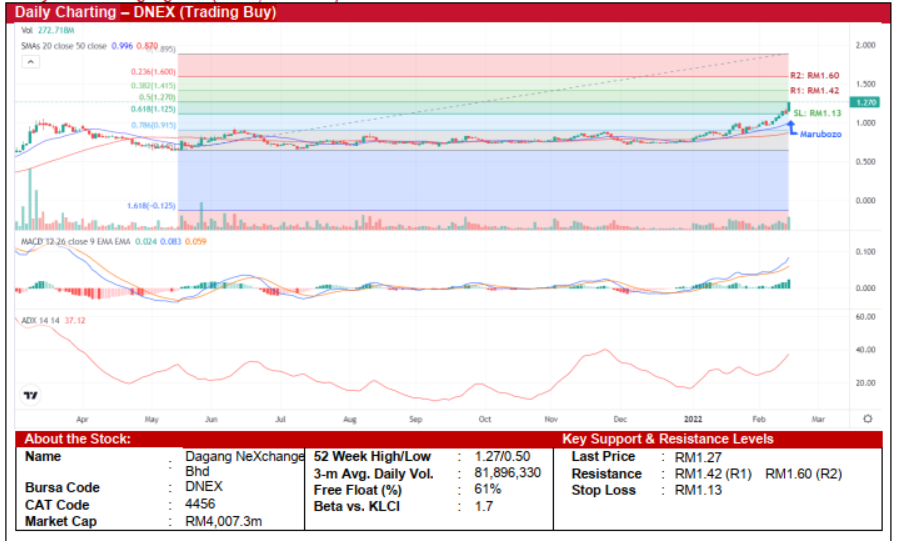

Dagang NeXchange Bhd (Trading Buy)

• Chart-wise, DNEX’s share price trended sideways from May 2021 until early February 2022 when it broke above the upper boundary of the rectangle pattern to stage an uptrend thereafter.

• The upward trajectory is likely to continue following the formation of a bullish Marubozo candlestick yesterday, which coupled with the stock trending above the key 20-day SMA and 50-day SMA, are indicating that the short-term uptrend is likely to carry on.

• With both the MACD histogram and ADX indicator also gaining momentum, the stock may continue to rise and challenge our resistance levels of RM1.42 (R1; 12% upside potential) and RM1.60 (R1; 26% upside potential).

• We have pegged our stop loss at RM1.13, which represents a downside risk of 11%.

• DNEX is an investment holding company with businesses in three segments, namely Information Technology, Energy and Technology.

• Earnings-wise, DNEX’s topline jumped by 490% QoQ to RM270.9m in 1QFY22 from RM45.9m in the immediate preceding quarter, thanks to the impact from the consolidation of Ping and SilTerra post their acquisitions. In line with the jump in topline, the group’s core net profit rose by 152% QoQ from RM116.7m to RM293.6m in 1QFY22.

Optimax Holdings Bhd (Trading Buy)

• Chart-wise, OPTIMAX’s share price – which has been treading in a sideways pattern since July 2021 - has recently bounced off the lower boundary of the sideways pattern, paving the way for a short-term upward bias.

• This comes as the stock has gapped up by 9% on 15 February 2022 following the announcement of a one-for-one bonus issue exercise.

• With the MACD indicator crossing over the signal line and given the bullish DMI crossover and rising Parabolic SAR indicator, the stock will likely climb to challenge our resistance levels of RM1.43 (R1; 13% upside potential) and RM1.53 (R1; 20% upside potential).

• On the downside, our stop loss has been set at RM1.15, which translates to a downside risk of 9%.

• Business-wise, OPTIMAX offers eye care services such as cataract surgery, lens exchange, glaucoma, diabetic eye disease and retinal detachment treatments.

• On the back of easing Covid-19 restrictions and the group’s participation in the PICK and MyMedic@Wilayah vaccination programmes in FY21, the group’s core net profit grew by 145% YoY from RM3.6m in 9MFY20 to RM8.7m in 9MFY21.

• Going forward, consensus is predicting the group to report a core net profit of RM12.0m in FY December 21 and RM15.8m in FY December 22, which translate to PERs of 28.2x and 21.9x, respectively.

Source: Kenanga Research - 17 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024