Daily technical highlights – (BAUTO, PWROOT)

kiasutrader

Publish date: Wed, 09 Mar 2022, 09:01 AM

Bermaz Auto Bhd (Trading Buy)

• A test of resilience awaits BAUTO as the stock approaches an ascending trendline following its ongoing price weakness in tandem with the market slide.

• Still, with both the stochastic and RSI indicators entering their oversold territories, a technical rebound could be forthcoming.

• On the way up, the share price will probably rise towards our resistance thresholds of RM1.83 (R1; 12% upside potential) and RM1.93 (R2; 18% upside potential).

• Our stop loss price level is set at RM1.45 (representing a 12% downside risk from yesterday’s close of RM1.64).

• From a valuation standpoint, downside risk for the stock may be cushioned by dividend yields of 4.0% in FY April 2022 and 5.3% in FY April 2023 based on consensus DPS estimates of 6.6 sen and 8.7 sen, respectively.

• A distributor of Mazda vehicles in Malaysia and the Philippines, BAUTO reported net profit of RM26.0m (+5% YoY) in 2QFY22, which lifted 1HFY22’s bottomline to RM36.3m (+7% YoY).

• Following which, consensus is projecting the group to make net earnings of RM132.5m in FY22 and RM170.7m in FY23. This translates to forward PERs of 14.4x and 11.2x, respectively.

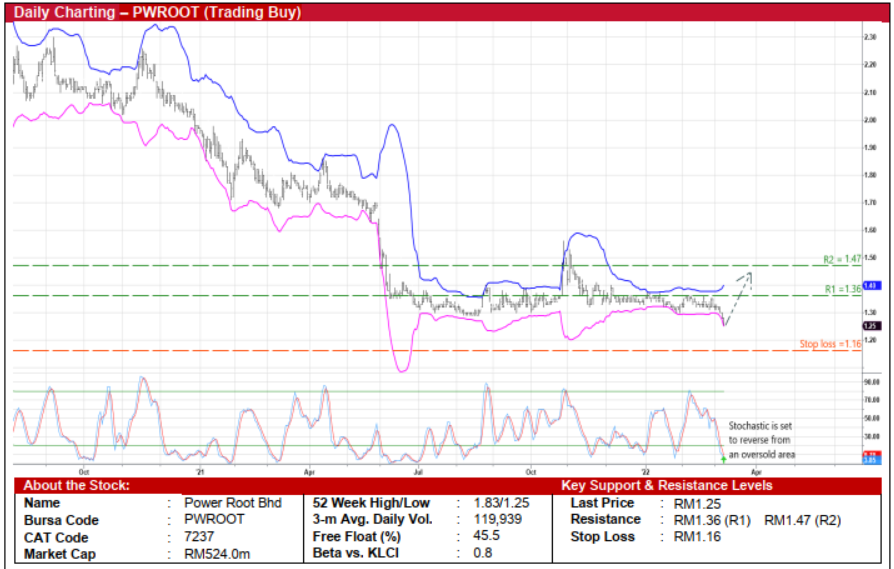

Power Root Bhd (Trading Buy)

• After sliding from a recent high of RM1.55 in end-October last year to close at a 2¾-year low of RM1.25 yesterday, PWROOT shares are in a position to stage a technical rebound ahead.

• On the chart, an ensuing bounce-up is anticipated as the stock may shift higher in tandem with the share price crossing back above the lower Bollinger Band and the stochastic indicator’s reversal from an oversold position.

• That said, the share price could then climb to challenge our resistance thresholds of RM1.36 (R1; 9% upside potential) and RM1.47 (R2; 18% upside potential).

• We have placed our stop loss price level at RM1.16 (or a 7% downside risk).

• Earnings-wise, PWROOT – a manufacturer and distributor of beverages specialising in staple drinks (such as coffee, tea, chocolate malt drinks and herbal energy drinks) – announced net profit of RM6.0m (-14% YoY) in 3QFY22, taking its 9MFY22 bottomline to RM13.6m (-48% YoY).

• Moving forward, according to consensus, the group is projected to see a rebound in net earnings from RM18.8m in FY March 2022 to RM30.4m in FY March 2023, which translate to forward PERs of 27.9x and 17.2x, respectively.

• In addition, with a balance sheet that is backed by net cash holdings of RM82.1m (or 19.5 sen per share) as of end December 2021, PWROOT is expected to reward its shareholders with consensus DPS estimates of 4.0 sen for FY22 and 6.6 sen for FY23. This implies dividend yields of 3.2% and 5.3%, respectively.

Source: Kenanga Research - 9 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024