Daily technical highlights – (KSL, SUNCON)

kiasutrader

Publish date: Thu, 17 Mar 2022, 08:45 AM

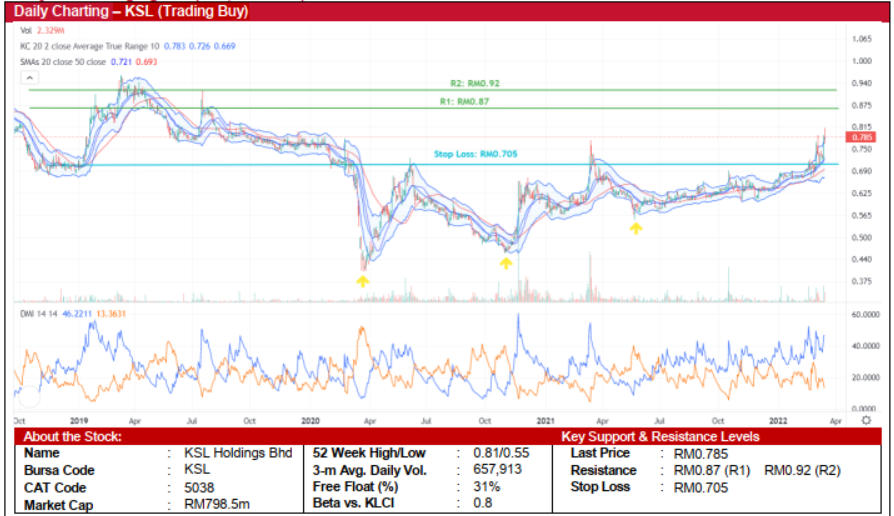

KSL Holdings Bhd (Trading Buy)

• Chart-wise, following a steep plunge in March 2020 to RM0.405 – down by 42% from the start of that month - KSL’s share price has since been on an upward trajectory as marked by the formation of higher lows.

• We believe the upward momentum is likely to continue as: (i) the stock is currently hovering around the upper boundary of the Keltner Channel, (ii) the gap between the DMI Plus and DMI Minus has widened, and (iii) the 20 day-SMA is treading above the 50-day SMA while providing support to the share price.

• Thus, the stock could rise to challenge our resistance levels of RM0.87 (R1; 11% upside potential) and RM0.92 (R2; 17% upside potential).

• We have pegged our stop loss at RM0.705, which represents a downside risk of 10%.

• KSL is engaged in real estate services with four business segments, namely; (i) property development, which contributes c.85% to the group’s revenue, (ii) property investment, (iii) investment holding, and (iv) car park operation.

• According to the Real Estate and Housing Developers’ Association, housing prices are expected to rise due to higher construction costs arising from the increase in building materials prices, wages and financing costs which may affect property developers’ profit margins going forward.

• Still, the group – which reported a turnaround in net profit to RM109.7m in FY21 from a net loss of RM63.5m in FY20 – could be relatively less affected given its established track record and economies of scale on account of multiple development projects in strategic locations.

Sunway Construction Group Bhd (Trading Buy)

• The formation of a long bullish candlestick with no lower wick yesterday showed a strong buying interest in SUNCON shares as the bulls pushed the price up by 8% from RM1.54 the day before.

• Thanks to the bullish candlestick uptick, the stock closed above a descending price channel that began in April 2021.

• With the Parabolic SAR indicator trending higher and coupled with the bullish MACD signal, we believe the stock will likely rise further and challenge our resistance levels of RM1.85 (R1; 11% upside potential) and RM1.93 (R2; 16% upside potential).

• On the downside, our stop loss has been set at RM1.51, which translates to a downside risk of 9%.

• Business-wise, the construction group operates in Malaysia, Singapore, the Middle East and India whereby it derives the majority of its revenue from the home country.

• Thanks to the less stringent lockdowns last year, the group reported a core net profit of RM127.2m in FY21, up from RM82.8m in FY20 (+54%).

• As economic activities continue to pick up, consensus is projecting SUNCON to make a core net profit of RM132.5m and RM145.3m in FY22 and FY23, which translate to forward PERs of 16.1x and 14.7x, respectively.

• And given its reputation as an established contractor with a proven track record, SUNCON is a potential beneficiary of MRT3 construction jobs with the government planning to call for tenders for this mega infrastructure project as early as May this year.

Source: Kenanga Research - 17 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

SUNCON2024-11-22

SUNCON2024-11-22

SUNCON2024-11-22

SUNCON2024-11-22

SUNCON2024-11-22

SUNCON2024-11-22

SUNCON2024-11-22

SUNCON2024-11-22

SUNCON2024-11-21

SUNCON2024-11-21

SUNCON2024-11-20

SUNCON2024-11-20

SUNCON2024-11-19

SUNCON2024-11-19

SUNCON2024-11-19

SUNCON2024-11-19

SUNCON2024-11-18

SUNCON2024-11-18

SUNCON2024-11-15

SUNCON2024-11-15

SUNCON2024-11-14

SUNCON2024-11-14

SUNCON2024-11-13

SUNCON2024-11-13

SUNCON2024-11-12

KSL2024-11-12

SUNCON2024-11-12

SUNCONMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024