Daily technical highlights – (AEON, BSTEAD)

kiasutrader

Publish date: Fri, 25 Mar 2022, 08:46 AM

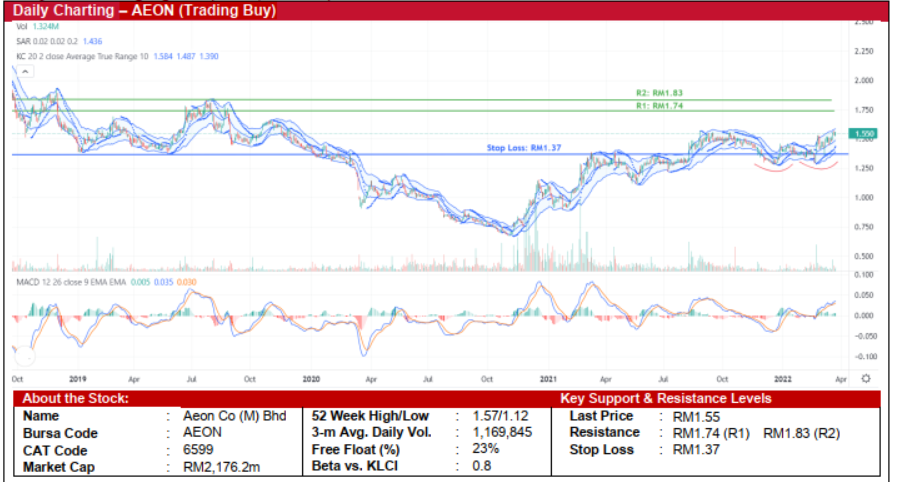

Aeon Co. (M) Bhd (Trading Buy)

• Chart-wise, following a dip in price to RM0.672 in November 2020, AEON shares climbed to a high of RM1.54 in September 2021 before sliding again to form a double-bottom reversal pattern.

• Post the double-bottom formation, the stock has been trending upwards with the bullish momentum likely to continue on the back of the rising Parabolic SAR along with the share price treading around the upper boundary of the Keltner Channel.

• Moreover, with the MACD line bouncing off the signal line – indicating a continuation of the positive momentum – the stock could rise to challenge our resistance levels of RM1.74 (R1; 12% upside potential) and RM1.83 (R2; 18% upside potential).

• We have pegged our stop loss at RM1.37, which represents a downside risk of 12%.

• AEON is predominately engaged in retailing and property management services with c.85% of the group’s revenue coming from the retailing segment. In addition to its core general merchandise stores, the group also operates superstores, pharmacy and flat-price shops and owns an e-commerce business (via www.shoppu.com.my).

• For FY21, the group’s top-line was dragged down by 10% from RM4.1b in FY20 to RM3.63b in FY21 due to the prolonged closure of stores (retailing) and a revamp of rental structures. Despite the lower revenue, the group’s net profit rose by >100% to RM85.3m mainly on account of lower effective tax rate and lower finance costs.

• Following the reopening of the economy, AEON’s outlook is poised to improve with consensus projecting the group to register a core net profit of RM109.2m and RM126.8m in FY22 and FY23, which translate to forward PERs of 19.9x and 17.4x, respectively.

Boustead Holdings Bhd (Trading Buy)

• BSTEAD’s share price has recently bounced off the lower boundary of an ascending channel following the formation of a long bullish candlestick on 22 March 2022, making its way towards the upper boundary currently.

• A recent golden crossover is observed as the 50-day SMA crossed above the 100-day SMA with both moving averages still trending upwards, which suggest the upward momentum will likely persist.

• That said, along with the MACD line crossing above the signal line, the stock will likely rise further and challenge our resistance levels of RM0.700 (R1; 10% upside potential) and RM0.735 (R2; 16% upside potential).

• On the downside, our stop loss price has been set at RM0.57, which translates to a downside risk of 10%.

• Business-wise, the Malaysian-based conglomerate has operations in 5 segments, namely: (i) plantation, (ii) property and industrial, (iii) heavy industries, (iv) pharmaceutical, and (v) trading finance and investment.

• Earnings-wise, the group achieved a revenue of RM11.3b in FY21, up from RM7.8b in FY20 (+43%) thanks to stronger performance across the majority of the segments. Its bottom-line rose by >100% from a net loss of RM550.9m in FY20 to a net profit of RM170.1m in FY21, mainly thanks to one-off gains arising from the disposal of properties and lower impairments of assets recognised in FY21.

• Meanwhile, as part of the group’s ongoing transformation initiative, BSTEAD has recently partnered with Proficient to drive technological changes across the group’s divisions to improve transparency and minimize human errors.

Source: Kenanga Research - 25 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024