Daily technical highlights – (CBIP, SDS)

kiasutrader

Publish date: Fri, 15 Apr 2022, 08:41 AM

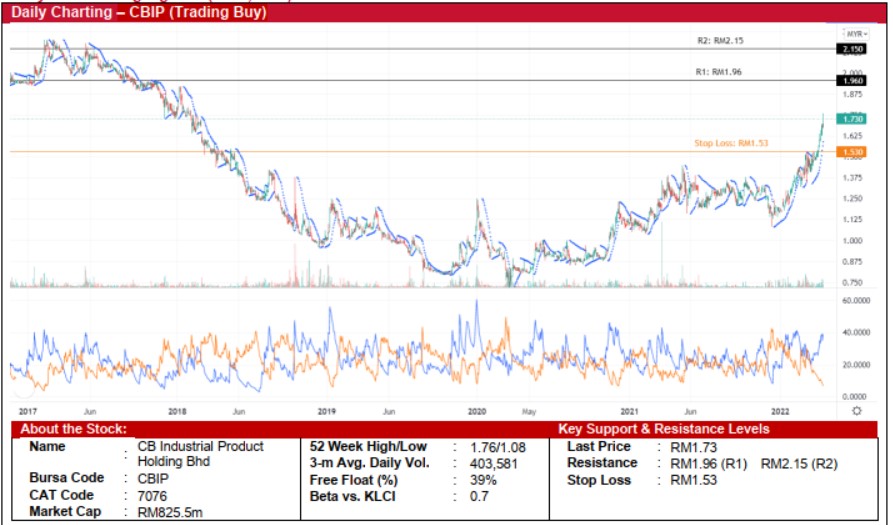

CB Industrial Product Holding Bhd (Trading Buy)

• After a sharp sell-off that led to a low of RM1.08 in mid-Dec 2021, CBIP shares rebounded subsequently to form an ascending price channel. And more recently, the share price has plotted long bullish candlesticks, which indicate extended strong buying interest.

• With the Parabolic SAR indicator trending higher and coupled with the DMI Plus on the rise to widen its gap from the DMI Minus, we anticipate that the stock will continue to trend upwards.

• Thus, we believe that CBIP’s share price could climb towards our resistance thresholds of RM1.96 (R1; 13% upside potential) and RM2.15 (R2; 24% upside potential).

• Our stop loss price level is set at RM1.53 (or a downside risk of 12%).

• Business-wise, CBIP is engaged in the manufacturing of palm oil mills processing equipment and replacement parts.

• Earnings-wise, the group reported revenue of RM217.6m in 4QFY21 (+59% QoQ), which brought the whole year’s topline to RM614.3m (+14% YoY), lifted mainly by: (i) higher job billings on the back of project implementation by the palm oil equipment and engineering segment, and (ii) stronger contribution from the refinery and palm oil plantation segment. Consequently, its net profit rose 129% QoQ to RM37.1m in 4QFY21 and 60% YoY to RM87.3m in FY21.

• Based on consensus forecasts, CBIP is expected to record a net profit of RM96m in FY December 2022 and RM91m in FY December 2023, translating to forward PERs of 8.6x and 9.0x, respectively.

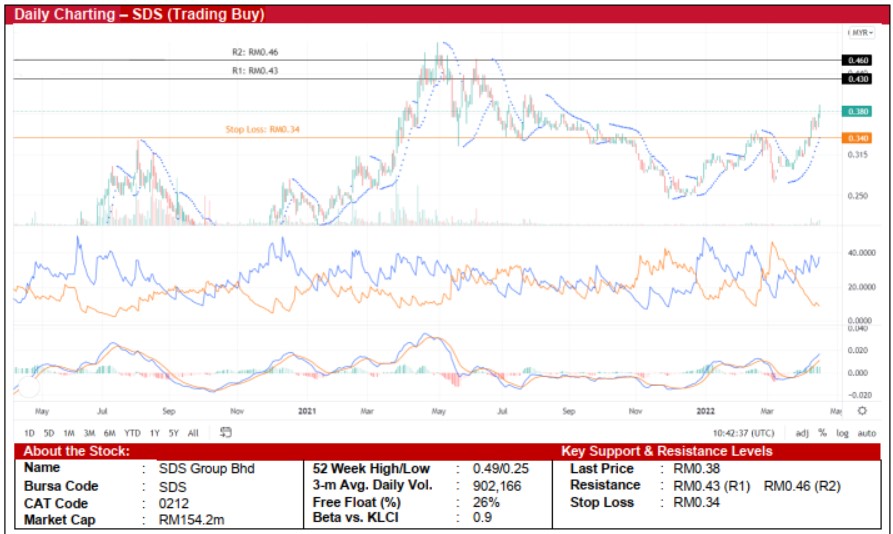

SDS Group Bhd (Trading Buy)

• Chart-wise, after hitting a peak of RM0.485 in May 2021, SDS shares plunged to a low of RM0.245 in Dec 2021, down by 50%. Following a subsequent rebound, the share price saw another fall to RM0.275 in Dec 2021 before plotting an upward reversal thereafter.

• Technically speaking, we believe the stock will likely strengthen further on the back of: (i) the rising Parabolic SAR indicator, (ii) the bullish MACD signal backed by substantial histogram volume, and (iii) the DMI Plus crossing above the DMI Minus.

• Thus, the stock is expected to trend towards our resistance thresholds of RM0.43 (R1; 13% upside potential) and RM0.46 (R2; 21% upside potential).

• We have set our stop loss price level at RM0.34 (or an 11% downside risk).

• Business-wise, SDS is involved in the manufacturing and distribution of bakery products through its retail and wholesale networks.

• Earnings-wise, the group reported a net profit of RM4.7m in 3QFY21 (vs. RM0.6m in 2QFY21), which brought 9MFY21 net profit to RM4.8m (vs. 9MFY20’s net profit of RM6.4m).

Source: Kenanga Research - 15 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024