Daily technical highlights – (DELEUM, OPCOM)

kiasutrader

Publish date: Thu, 12 May 2022, 09:04 AM

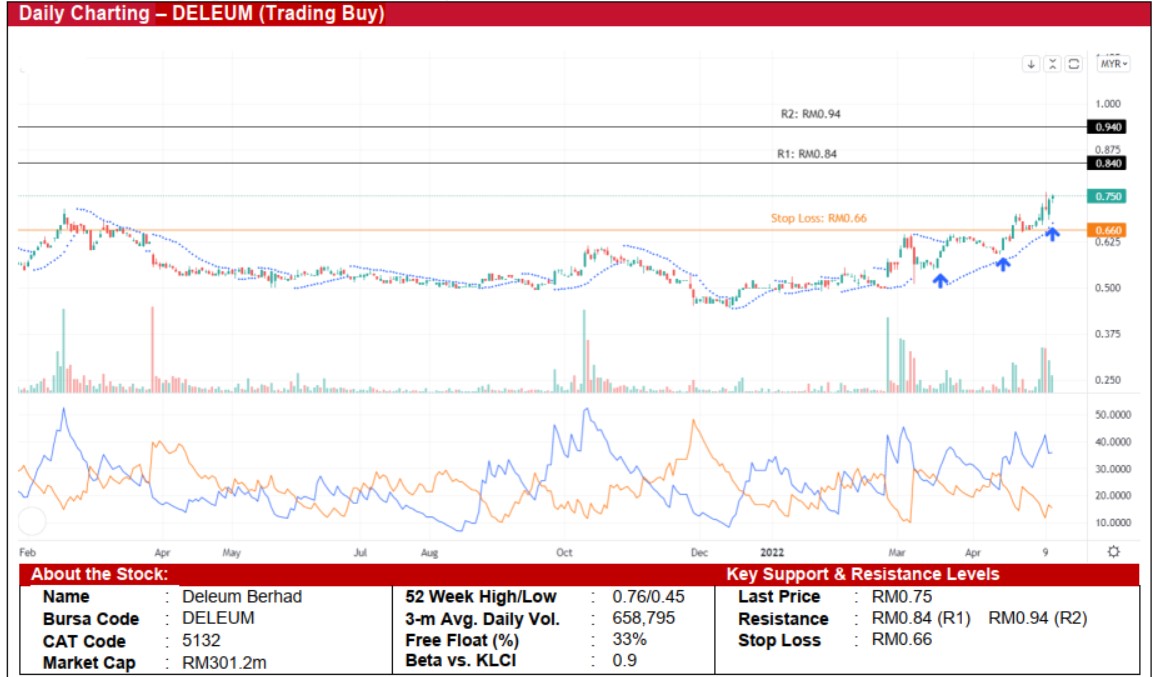

Deleum Bhd (Trading Buy)

• After a recent sideways trend, DELEUM’s share price broke away to form a sequence of higher highs and higher lows, possibly signaling that an uptrend is already underway.

• With the Parabolic SAR indicator still rising and coupled with the DMI Plus hovering above the DMI Minus, we anticipate that the stock will continue to trend higher.

• Thus, we believe that DELEUM’s share price could climb towards our resistance thresholds of RM0.84 (R1) and RM0.94 (R2), which represent upside potentials of 12% and 25%, respectively.

• Our stop loss price level is set at RM0.66 (or a downside risk of 12%).

• Business-wise, DELEUM is involved in the provision of support services and related products to the oil and gas industry, mainly in the exploration and production segment.

• The group reported a net profit of RM10.6m in 4QFY21 (vs 3QFY21’s net loss of RM0.7m), taking its full-year FY December 21 bottomline to RM17.1m (+130% YoY), mainly lifted by higher contribution from the Power and Machinery division.

• Based on consensus forecasts, DELEUM is expected to record a net profit of RM30.0m in FY December 2022 and RM33.4m in FY December 2023, translating to forward PERs of 10.0x and 9.0x, respectively.

Opcom Holdings Bhd (Trading Buy)

• OPCOM’s share price was sold down by 32% to a low of RM0.64 in early-March 2022 that was followed by a subsequent rebound before forming a consolidation pattern.

• Looking ahead, the stock will likely break out from the sideways pattern on the back of the stochastic indicator’s reversal from an oversold area and the DMI Plus hovering above the DMI Minus.

• With that, the stock could rise to challenge our resistance levels of RM1.08 (R1; 12% upside potential) and RM1.16 (R2; 20% upside potential).

• We have pegged our stop loss at RM0.85, which represents a downside risk of 12%.

• OPCOM is engaged in the manufacturing and supply of fiber optic cables and engineering services.

• Earnings-wise, the group reported net profit of RM0.2m (-91.7% QoQ) in 3QFY21, which led to 9MFY21’s bottomline of RM5.4m (vs. 9MFY20’s net loss of RM1.5m), as overall performance was affected mainly by lower sales.

• Nonetheless, OPCOM’s financial standing remains steady, backed by net cash holdings of RM76.7m (translating to 30.0 sen per share or almost one-third of the current share price) as of end-December 2021.

Source: Kenanga Research - 12 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024