Daily technical highlights – (3A, WPRTS)

kiasutrader

Publish date: Wed, 25 May 2022, 09:40 AM

Three-A Resources Bhd (Trading Buy)

• A price gap-up on Monday – which lifted 3A shares to an intra-day high of RM0.96 amid strong trading interest – could pave the way for the stock to chart an ascending trajectory ahead.

• An upward shift in the share price is now anticipated in view of the positive technical signals arising from: (i) an uptick in the Parabolic SAR indicator, (ii) the bullish crossover by the DMI Plus above the DMI Minus, and (iii) the reversal by the stochastic indicator from an oversold position.

• Riding on the strengthening momentum, the stock is expected to advance towards our resistance thresholds of RM0.98 (R1; 11% upside potential) and RM1.08 (R2; 22% upside potential).

• Our stop loss price level is pegged at RM0.80 (representing a downside risk of 10% from yesterday’s close of RM0.885).

• Fundamental-wise, 3A – a leading manufacturer of food and beverage ingredients (such as caramel, vinegar, glucose syrup, soya protein sauce, soya sauce etc) – offers exposure to the resilient prospects of the food & beverage industry.

• In spite of the challenging economic landscape, the group reported a jump in bottomline to RM46.5m (+54% YoY) in FY December 2021, which was followed by last Friday’s announcement of a net profit of RM12.8m (-4% YoY) in 1QFY22.

• This translates to a trailing PER of 9.3x (based on its latest historical full-year earnings) and a forward PER of 8.5x (on its 1QFY22 annualised earnings).

• An added positive is 3A’s steady balance sheet that is backed by net cash holdings of RM15.9m (or 3.2 sen per share) as of end-March 2022.

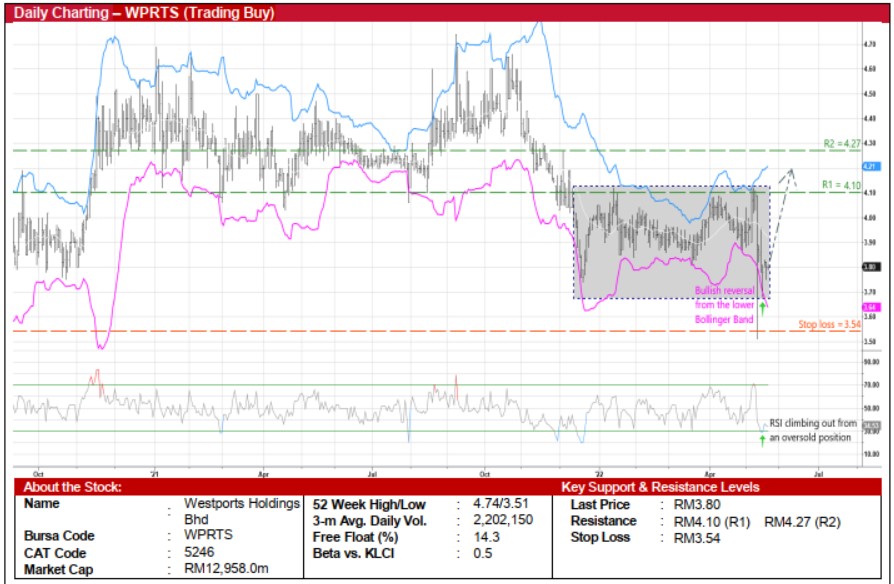

Westports Holdings Bhd (Trading Buy)

• After encountering an abrupt sell-off to as low as RM3.51 two Fridays ago, WPRTS shares saw a subsequent recovery before closing at RM3.80 yesterday, an indication of steady buying support for the stock.

• With the share price crossing back above the lower Bollinger Band and the RSI indicator reversing from an oversold territory, the upward momentum will likely persist as the shares bounce up from the bottom of a rectangle pattern.

• This could then push the stock to challenge our resistance levels of RM4.10 (R1; 8% upside potential) and RM4.27 (R2; 12% upside potential).

• We have placed our stop loss price level at RM3.54 (or a 7% downside risk).

• WPRTS – which is the largest listed port operator in Malaysia focussing on container and conventional cargo handling as well as the provision of a wide range of port services – recently reported net profit of RM151.9m (-27% YoY) in 1QFY22 (mainly dragged down by the one-off prosperity tax). For FY December 2021, its net earnings came in at RM808.2m (+23% YoY).

• Going forward, consensus is projecting the group to post net profit of RM662.5m for FY22 and RM759.5m for FY23, which translate to forward PERs of 19.6x this year and 17.1x next year, respectively.

• Meanwhile, WPRTS shares – which would be omitted from the MSCI Malaysia Index after market close on 31 May (next Tuesday) – could on the other hand gain from a potential inclusion as a constituent stock in the benchmark FBMKLCI when the outcome of semi-annual review exercise is announced on 2 June (next Thursday).

Source: Kenanga Research - 25 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

WPRTS2024-11-22

WPRTS2024-11-22

WPRTS2024-11-22

WPRTS2024-11-22

WPRTS2024-11-21

3A2024-11-21

WPRTS2024-11-21

WPRTS2024-11-21

WPRTS2024-11-21

WPRTS2024-11-21

WPRTS2024-11-20

WPRTS2024-11-20

WPRTS2024-11-20

WPRTS2024-11-20

WPRTS2024-11-19

WPRTS2024-11-19

WPRTS2024-11-19

WPRTS2024-11-19

WPRTS2024-11-18

WPRTS2024-11-18

WPRTS2024-11-18

WPRTS2024-11-18

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-15

WPRTS2024-11-14

WPRTS2024-11-14

WPRTS2024-11-14

WPRTS2024-11-14

WPRTS2024-11-13

WPRTS2024-11-13

WPRTS2024-11-13

WPRTS2024-11-13

WPRTS2024-11-12

WPRTS2024-11-12

WPRTS2024-11-12

WPRTSMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024