Daily technical highlights – (MRCB, HSSEB)

kiasutrader

Publish date: Tue, 31 May 2022, 09:11 AM

Malaysian Resources Corporation Bhd (Trading Buy)

• MRCB’s share price could break out from a prevailing sideways trading pattern in view of the emergence of positive technical signals.

• An upward shift in the shares may be on the cards following the presence of a bullish stochastic divergence pattern (with the formation of two rising bottoms in an oversold zone as the price was drifting lower) while the RSI indicator is in the midst of reversing from an oversold position.

• This may then lift the stock to climb towards our resistance thresholds of RM0.40 (R1; 14% upside potential) and RM0.44 (R2; 26% upside potential).

• We have pegged our stop loss price level at RM0.30 (which represents a downside risk of 14%).

• Backed by its three main business activities, namely property development & investment, engineering, construction & environment and facilities management & parking, the group reported net profit of RM75.2m (+166% YoY) in 4QFY21, taking its full-year’s net profit to RM15.8m in FY December 2021 (from net loss of RM177.4m previously).

• Moving forward, consensus is projecting MRCB to post net earnings of RM34.5m for FY22 and RM59.5m for FY23. Based on its latest book value per share of RM1.01 as of end-December 2021, the stock is currently trading at Price/Book Value multiple of 0.35x (or at 1SD below its historical mean).

• In terms of news flows, according to a business weekly article, MRCB may undertake a restructuring exercise (by exploring either a merger or privatisation proposal) in the near future, which would be led by its major shareholder EPF under the latter’s initiative to consolidate its real estate assets. If this materialises, then trading interest in the shares is expected to pick up ahead.

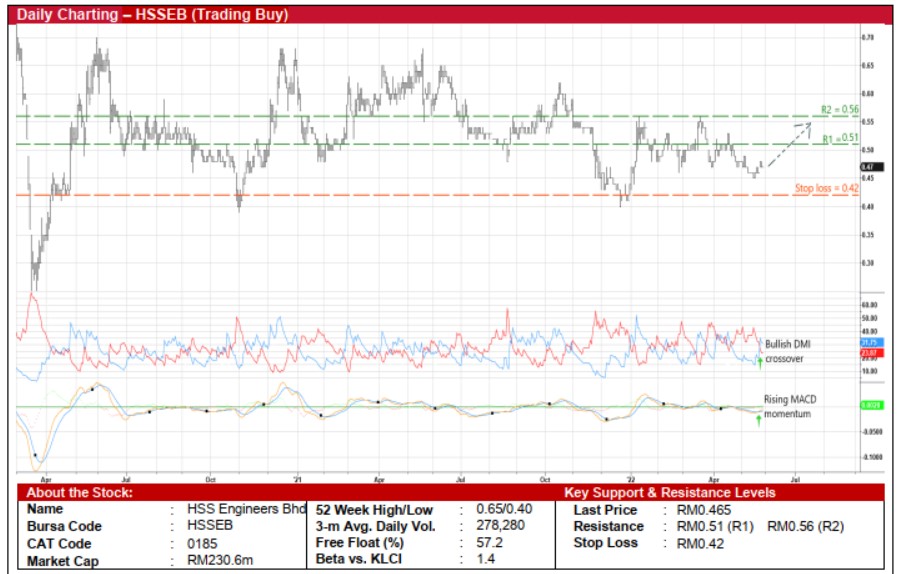

HSS Engineers Bhd (Trading Buy)

• After sliding from a recent high of RM0.56 in mid-March this year to as low as RM0.45 on 20 May amid diminishing trading volume, HSSEB shares may stage a technical rebound ahead.

• On the chart, the bullish crossover by the DMI Plus above the DMI Minus and the strengthening MACD momentum will likely lift the share price to higher levels.

• Riding on the upward trajectory, the stock could rise to challenge our resistance targets of RM0.51 (R1; 10% upside potential) and RM0.56 (R2; 20% upside potential).

• Our stop loss price level is set at RM0.42 (or a 10% downside risk from the last traded price of RM0.465).

• Earnings-wise, after posting net profit of RM3.0m (-72% YoY) in FY December 2021, HSSEB (an engineering consultancy group specialising in the provision of engineering and project management services) recently announced net earnings of RM2.6m (+29% YoY) in 1QFY22.

• Based on consensus estimates, the group is expected to register net earnings of RM13.8m for FY22 and RM17.7m for FY23, translating to forward PERs of 16.7x this year and 13.0x next year, respectively.

• Meanwhile, given its previous role as the independent consulting engineer for MRT Line 1 and Line 2, HSSEB is expected to be involved in the implementation of the Mass Rapid Transit Line 3 (MRT3), which is on track to be rolled out following last week’s media advertisement inviting tenders for various packages under the project. For a start, in April 2022, the group has been appointed by Mass Rapid Transit Corporation to undertake an independent peer review for the tender documentations on the upcoming MRT3.

Source: Kenanga Research - 31 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024