Daily technical highlights – (VS, SUNWAY)

kiasutrader

Publish date: Tue, 28 Jun 2022, 09:21 AM

V.S. Industry Bhd (Trading Buy)

• Following a tumble from a high of RM1.73 in late September 2021 to as low as RM0.825 in early March this year, a recent run-up from the trough has probably paved the way for VS shares to chart a trend reversal going forward.

• With the share price set to pull away from the 50-day SMA (which is seen as the resistance-turned-support line currently), an anticipated technical breakout from an ascending triangle could propel the stock to plot higher highs ahead.

• Riding on the upward trajectory, the shares will likely climb towards our resistance thresholds of RM1.11 (R1; 12% upside potential) and RM1.18 (R2; 19% upside potential).

• We have pegged our stop loss price level at RM0.88 (representing a 12% downside risk from yesterday’s close of RM0.995).

• A leading integrated Electronics Manufacturing Services (EMS) provider in the region offering one-stop manufacturing solutions to global brand names for office and household electrical and electronic products, VS’ financial performance has been affected by a lower delivery of orders to key customers mainly due to labour shortage and protracted disruption in the supply of components.

• Reflecting this, the group reported weaker net profit of RM51.3m (-30% YoY) in 3QFY22, bringing 9MFY22’s bottomline to RM135.2m (-34% YoY).

• Nonetheless, the worst may be in the past already as consensus is presently projecting VS (which is a beneficiary of the strengthening USD versus the Ringgit) to log rising net earnings of RM189.5m for FY July 2022 and RM298.6m for FY July 2023, which translate to forward PERs of 20.1x and 12.8x, respectively. Its 1-year forward rolling PER currently stands slightly below its historical average.

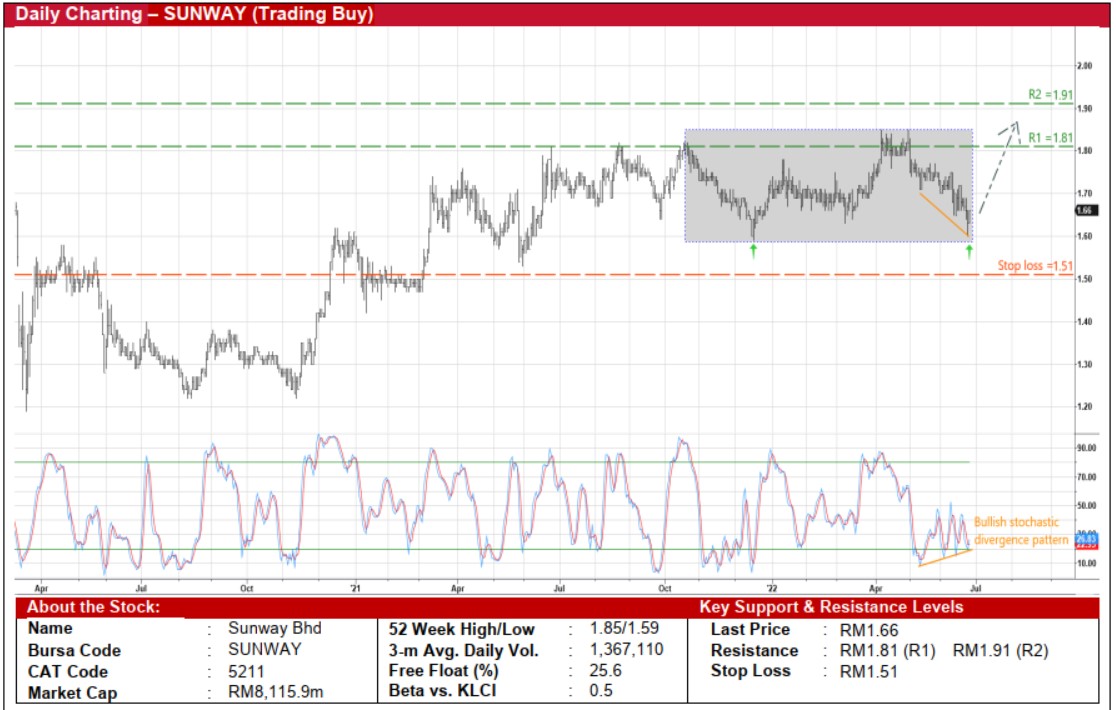

Sunway Bhd (Trading Buy)

• Presently hovering near the bottom of a rectangle formation, SUNWAY shares – which ended at RM1.66 yesterday – are poised to shift higher going forward.

• An upward bias in the share price is now anticipated following the appearance of a bullish stochastic divergence pattern as illustrated by a sequence of rising bottoms in the oversold area while the stock was drifting lower.

• Therefore, the shares could be on the way to challenge our resistance targets of RM1.81 (R1; 9% upside potential) and RM1.91 (R2; 15% upside potential).

• Our stop loss price level is set at RM1.51 (which represents a 9% downside risk).

• A leading conglomerate with core business interests across key industries, namely property development, property investment & REIT, leisure, hospitality, construction, healthcare, education, trading & manufacturing, quarry and building materials, SUNWAY offers diversified and resilient income streams.

• After announcing net profit (from continuing operations) of RM140.1m (+214% YoY) in 1QFY22, consensus is projecting the group to make net earnings of RM483.9m in FY December 2022 and RM576.3m in FY December 2023.

• This translates to forward PERs of 16.8x this year and 14.1x next year, respectively with its 1-year forward rolling PER currently treading at 0.5 SD above its historical mean.

Source: Kenanga Research - 28 Jun 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

VS2024-11-22

VS2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

VS2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-18

SUNWAY2024-11-18

SUNWAY2024-11-15

SUNWAY2024-11-15

SUNWAY2024-11-14

SUNWAY2024-11-14

SUNWAY2024-11-13

SUNWAY2024-11-13

SUNWAY2024-11-13

VS2024-11-13

VS2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

VSMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024