Daily technical highlights – (OPCOM, DELEUM)

kiasutrader

Publish date: Wed, 17 Aug 2022, 09:45 AM

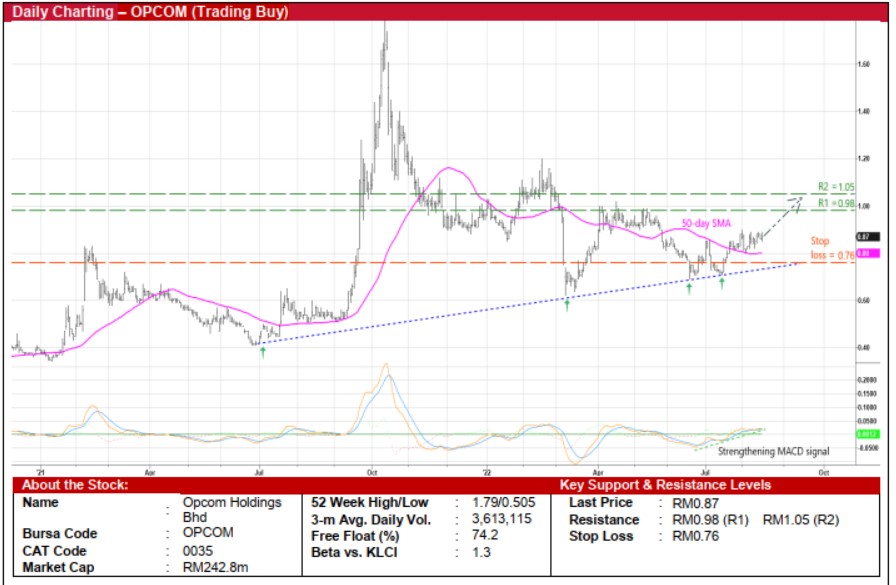

Opcom Holdings Bhd (Trading Buy)

• A recent bounce-off from a positive sloping trendline that stretches back to the beginning of July 2021 has set the stage for OPCOM’s share price – which closed at RM0.87 yesterday amid heavy trading interest – to extend its upward trajectory.

• On the chart, the shares will probably shift higher ahead in view of the recent price crossover above the 50-day SMA and the strengthening MACD signal.

• With that said, the stock could climb towards our resistance thresholds of RM0.98 (R1; 13% upside potential) and RM1.05 (R2; 21% upside potential).

• We have pegged our stop loss price level at RM0.76 (representing a downside risk of 13%).

• A manufacturer of fiber optic cables and cable-related products that are sold mainly to telecommunications network operators and electrical utility providers, OPCOM stands to benefit from an anticipated increase in demand for fibre optic cables in Malaysia to be driven by the implementation of JENDELA (the country’s national digital infrastructure plan to provide greater digital connectivity) and the 5G telecommunications network rollouts.

• Earnings-wise, the group logged net profit of RM3.9m (up 52% YoY) for FY March 2022.

• Its steady balance sheet is backed by net cash holdings of RM91.6m (translating to 32.8 sen per share or slightly more than one-third of the existing share price) as of end-March this year.

• Based on its book value per share of RM0.57 as of end-March 2022, the stock is presently trading at Price/Book Value multiple of 1.53x (or at 0.5 SD above its historical mean).

Deleum Bhd (Trading Buy)

• Currently hovering near an ascending trendline that stretches back to December last year, DELEUM’s share price is poised to pull away from yesterday’s closing price of RM0.58.

• With the price on the edge of overcoming the 50-day SMA and the stochastic %K line crossing over the %D line in the oversold area, an upward bias in the shares is now anticipated.

• Riding on the strengthening momentum, the stock is expected to reach our resistance targets of RM0.65 (R1; 12% upside potential) and RM0.70 (R2; 21% upside potential).

• Our stop loss price level is pegged at RM0.52 (or a 10% downside risk).

• DELEUM’s core business operations revolve around the upstream of the oil & gas industry, offering a diverse range of specialised products and support services under three segments: (i) Power and Machinery, (ii) Oilfield Services, and (iii) Integrated Corrosion Solution.

• After reporting net profit of RM17.1m (+130% YoY) in FY December 2021, the group saw its bottomline rising to RM8.1m (+45% YoY) in 1QFY22.

• Going forward, consensus is projecting the group would make net earnings of RM25.2m in FY22 and RM30.4m in FY23, translating to forward PERs of 9.2x this year and 7.7x next year, respectively (with its 1-year forward rolling PER presently hovering just marginally below its historical mean).

• With a healthy balance sheet, DELEUM’s financial standing is underpinned by net cash position of RM176.5m (or 44.0 sen per share which accounts for approximately three-quarter of the current share price) as of end-March 2022.

Source: Kenanga Research - 17 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024