Daily technical highlights – (UZMA, HSPLANT)

kiasutrader

Publish date: Tue, 23 Aug 2022, 09:17 AM

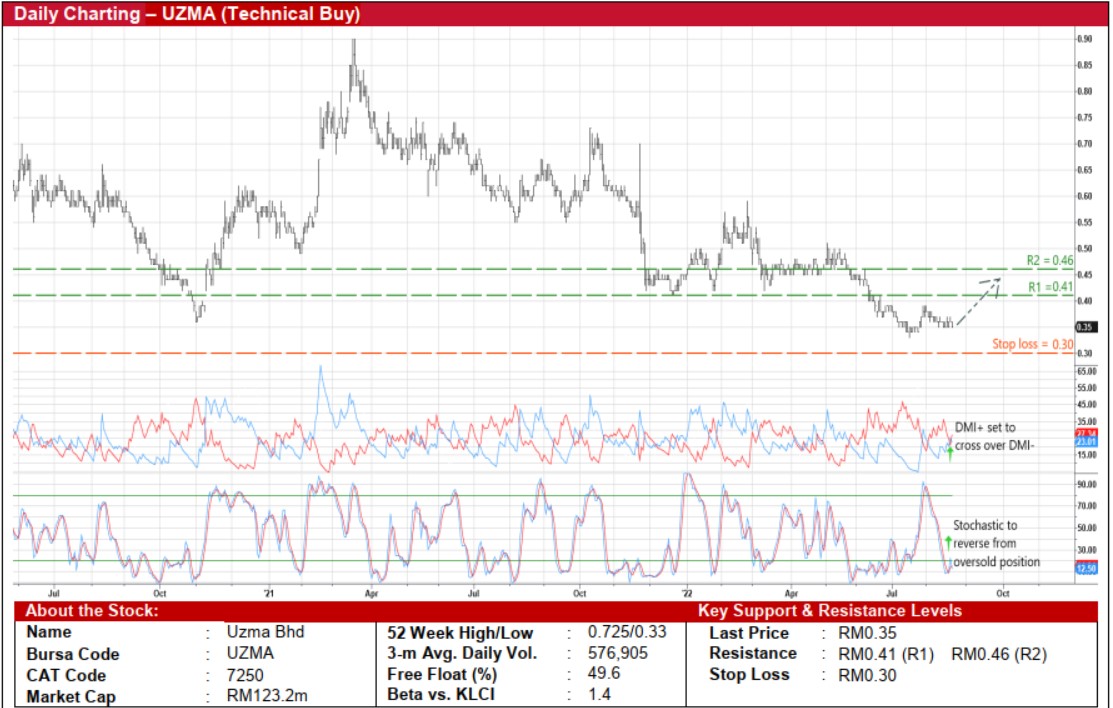

Uzma Bhd (Technical Buy)

• Following a slide from its peak of RM0.895 in mid-March last year to as low as RM0.33 in the middle of last month, UZMA‘s share price (which has since bounced up slightly to close at RM0.35 yesterday) will likely shift higher ahead.

• On the chart, a technical rebound is now anticipated as the DMI Plus is set to cross over the DMI Minus while the stochastic indicator is in the midst of reversing from an oversold area.

• With that said, the stock could be on its way to challenge our resistance targets of RM0.41 (R1; 17% upside potential) and RM0.46 (R2; 31% upside potential).

• Our stop loss price level is pegged at RM0.30 (representing a 14% downside risk).

• An oil & gas service and equipment group offering the provision of integrated well solutions, production solutions, subsurface solutions and other upstream services as well as other specialized services, UZMA reported net profit of RM1.2m (-84% YoY) in 3QFY22, taking its 9MFY22 bottomline to RM1.6m (-90% YoY).

• Consensus is currently projecting the group (which is scheduled to announce its final quarter results tomorrow) to make net earnings of RM7.6m in FY June 2022 before increasing to RM17.0m in FY23 and RM23.2m in FY24.

• This translates to forward PERs of 7.2x and 5.3x in the subsequent two financial years with its 1-year forward rolling PER presently hovering at 1.5SD below its historical mean.

• Meanwhile, UZMA may be an ESG play in the making as the group has set a target to achieve revenue of RM1.5b by 2025, of which c.40% is expected to be derived from non-oil & gas ventures (via its diversification strategy into the solar energy space).

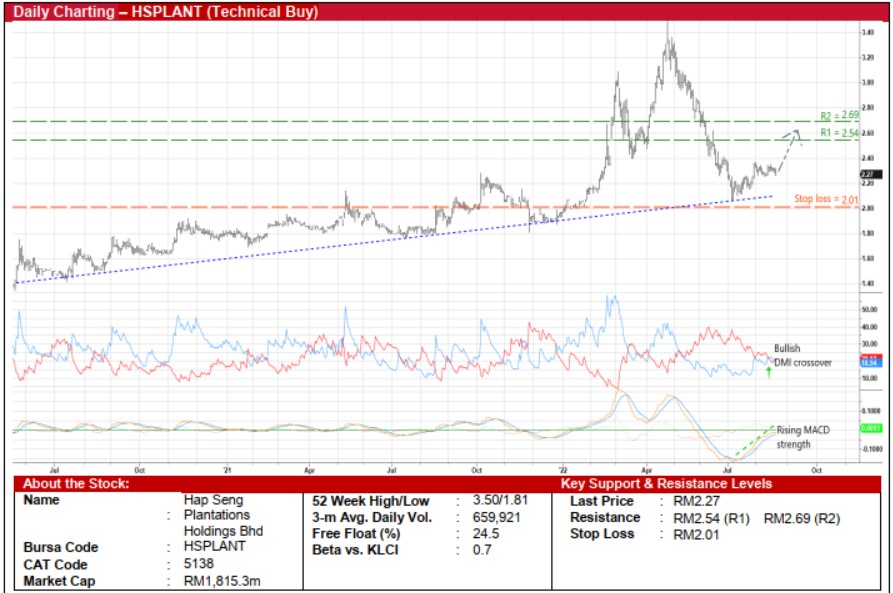

Hap Seng Plantations Holdings Bhd (Technical Buy)

• After a recent lift-off from an ascending trendline that stretches back to end-May 2020, HSPLANT shares will probably extend its upward trajectory ahead.

• This follows the positive technical signals triggered by the bullish crossover by the DMI Plus above the DMI Minus and the strengthening momentum in the MACD indicator (which is also on the edge of overcoming the zero-line).

• An upward shift in the share price could then push the stock towards our resistance thresholds of RM2.54 (R1; 12% upside potential) and RM2.69 (R2; 19% upside potential).

• We have placed our stop loss price level at RM2.01 (a downside risk of 11% from its last traded price).

• An oil palm plantation group, HSPLANT saw its net profit jumped 246% YoY to RM101.7m in 1QFY22 as the group benefited from higher average CPO selling prices and stronger sales volumes.

• Going forward, based on consensus expectations, the group is forecasted to log net earnings of RM273.2m in FY December 2022 and RM188.1m in FY December 2023.

• Valuation-wise, the stock is currently trading at forward PERs of 6.6x this year and 9.7x next year, respectively with its 1-year forward rolling PER standing near the minus 1.5SD threshold from its historical mean.

Source: Kenanga Research - 23 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024