Daily technical highlights – (UZMA, MRCB)

kiasutrader

Publish date: Wed, 05 Oct 2022, 09:44 AM

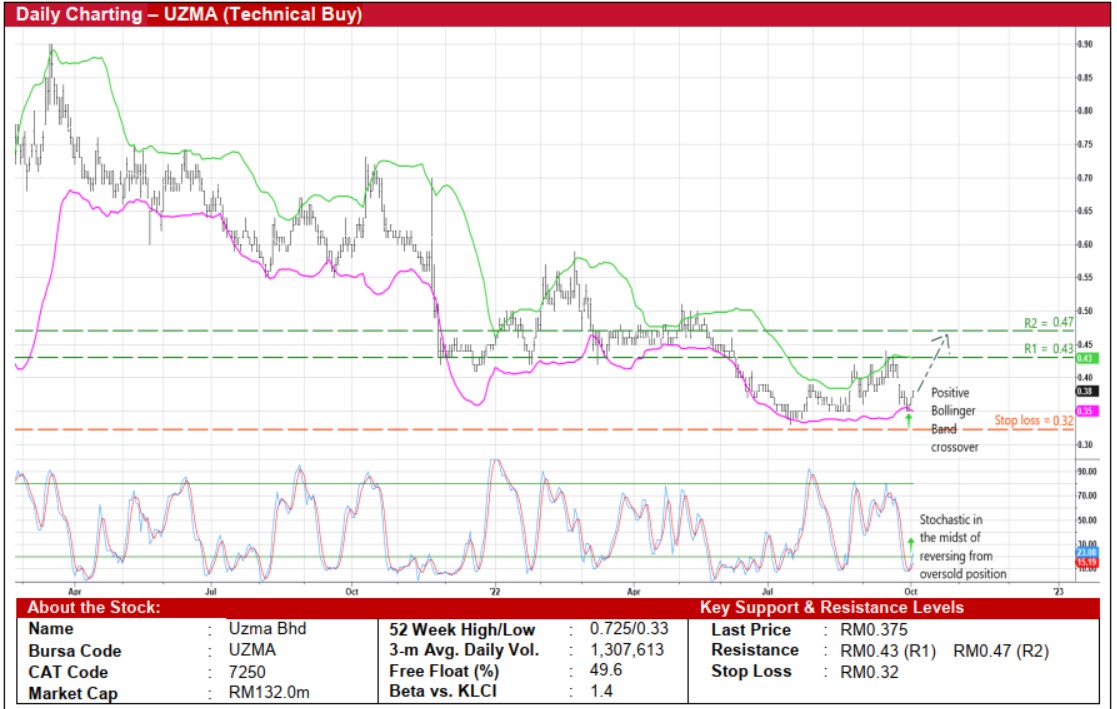

Uzma Bhd (Technical Buy)

• The recent share price weakness in UZMA – which has pulled back from a high of RM0.435 in mid-September to as low as RM0.345 last Thursday – presents a timely buying opportunity for investors.

• On the chart, the shares will probably shift higher ahead as the price has crossed back above the lower Bollinger Band while the stochastic indicator is in the midst of climbing out from the oversold territory.

• With that said, the stock is expected to close the price gap that emerged last Monday and advance towards our resistance thresholds of RM0.43 (R1) and RM0.47 (R2), translating to upside potentials of 15% and 25%, respectively.

• We have set our stop loss price level at RM0.32 (or a 15% downside risk from its last traded price of RM0.375).

• Business-wise, as an oil & gas service and equipment group, UZMA is involved in the provision of integrated well solutions, production solutions, subsurface solutions and other upstream services (including the provision of geoscience and reservoir engineering, drilling, project and operations services) as well as other specialized services.

• The group reported adjusted core net profit of RM8.2m (+74% YoY) in 4QFY22, bringing its full-year FY22 core bottomline to RM13.3m (-46% YoY).

• Going forward, consensus is forecasting UZMA to post higher net earnings of RM16.2m for FY June 2023 and RM21.1m for FY June 2024. This translates to forward PERs of 8.1x and 6.3x, respectively with its 1-year rolling forward PER presently hovering around 1SD below its historical mean.

Malaysian Resources Corporation Bhd (Technical Buy)

• Amid heavier-than-usual trading volume, MRCB shares climbed from RM0.295 on Monday (its lowest level since March 2020) to close at RM0.31 yesterday, paving the way for the price to stage a technical rebound ahead.

• The positive trajectory will likely persist in view of the existence of a bullish stochastic divergence pattern (following the formation of two rising bottoms in the oversold zone as the price was moving lower) and the RSI indicator’s ongoing reversal from an oversold position.

• Riding on the strengthening momentum, the stock could rise towards our resistance thresholds of RM0.36 (R1; 16% upside potential) and RM0.40 (R2; 29% upside potential).

• Our stop loss price level is pegged at RM0.27 (representing a 13% downside risk).

• MRCB – which is involved in three main business activities, namely property development & investment, engineering, construction & environment and facilities management & parking – reported net profit of RM14.1m in 2QFY22 (from 2QFY21’s net loss of RM32.4m). This took its 1HFY22 performance to RM28.1m (versus net loss of RM27.2m previously).

• According to consensus estimates, the group is projected to log net earnings of RM53.2m for FY December 2022 and RM66.8m for FY December 2023.

• Valuation-wise, based on its latest book value per share of RM1.01 as of end-June 2022, the stock is currently trading at Price/Book Value multiple of 0.31x or at 1.5SD below its historical mean.

• In terms of recent news flows, according to a business weekly article, MRCB – which is undertaking the LRT3 infrastructure project – may get a boost as the federal government is contemplating to reinstate five more train stations (which could then add to the overall project value).

Source: Kenanga Research - 5 Oct 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024