Daily technical highlights – (FM, YTLPOWR)

kiasutrader

Publish date: Wed, 09 Nov 2022, 10:26 AM

FM Global Logistics Holdings Bhd (Technical Buy)

• Following a plunge from its peak of RM1.15 in mid-October 2021 to a trough of RM0.475 in mid-July this year, FM’s share price – which has since rebounded to RM0.535 currently – might have hit a bottom already.

• On the chart, an upward reversal may be underway in view of the golden cross by the 50-day SMA above the 100-day SMA and the positive MACD signal.

• Riding on the strengthening momentum, the stock is poised to challenge our resistance targets of RM0.60 (R1; 12% upside potential) and RM0.67 (R2; 25% upside potential).

• Our stop loss price level is pegged at RM0.48 (representing a 10% downside risk).

• An international freight services provider that cover sea freight, air freight and land freight (including cross-border trucking services, warehousing & distribution and supporting services), FM registered net profit of RM12.6m (+46% YoY) in 4QFY22, lifting full-year FY June 2022 bottomline to RM45.6m (+69% YoY).

• The steady earnings profile is expected to sustain according to consensus expectations with the group’s net profit projected to come in at RM44.3m for FY23 and RM46.4m for FY24.

• In terms of valuation, this implies undemanding prospective PERs of 6.7x and 6.4x, respectively with its 1-year rolling forward PER presently hovering near the minus 1.5 SD level from its historical mean.

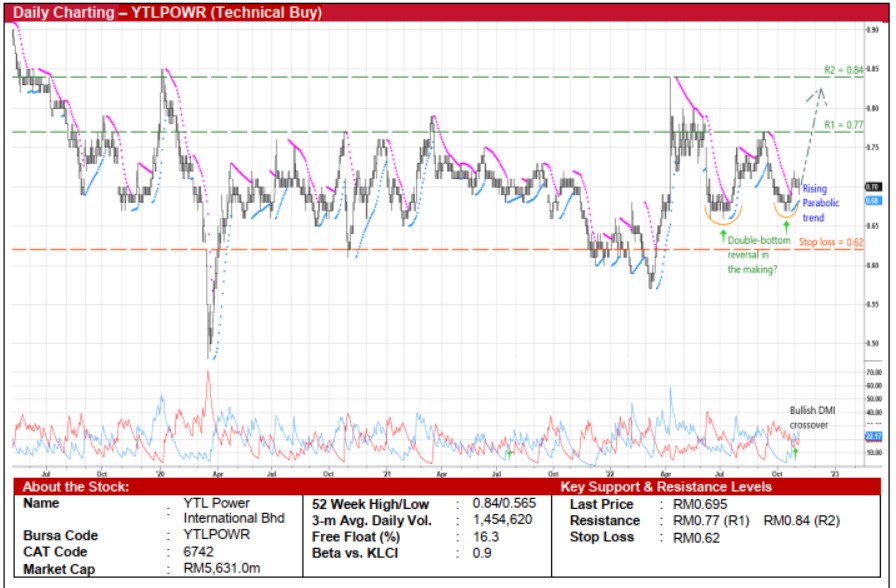

YTL Power International Bhd (Technical Buy)

• A probable double-bottom reversal pattern may be in the making for YTLPOWR shares after bouncing up twice from the RM0.66 support line in the first half of July 2022 and mid-October 2022.

• The rising momentum is expected to persist as the DMI Plus has just crossed over the DMI Minus while the Parabolic SAR is still signalling an upward trajectory.

• Backed by these bullish technical indicators, the stock could advance towards our resistance thresholds of RM0.77 (R1; 11% upside potential) and RM0.84 (R2; 21% upside potential).

• We have placed our stop loss price level at RM0.62 (or an 11% downside risk from yesterday’s close of RM0.695).

• An international multi-utility group with diversified businesses in power generation, water & sewerage and telecommunications spread across Malaysia, Singapore, the United Kingdom, Indonesia, Jordan and the Netherlands, YTLPOWR reported net profit of RM193.2m in 4QFY22 (versus 4QFY21’s net loss of RM490.2m), taking full-year FY June 2022 bottomline to RM1.21b (reversing from net loss of RM146.5m previously).

• According to consensus estimates, the group is forecasted to make net earnings of RM340.0m for FY June 2023 and RM418.8m for FY June 2024, which translate to forward PERs of 16.6x and 13.4x, respectively (with its 1-year rolling forward PER current treading just below its historical mean).

• And based on consensus DPS projections of 4.6 sen in FY23 and 4.4 sen and in FY24, the stock offers prospective dividend yields of 6.6% and 6.3%, respectively.

Source: Kenanga Research - 9 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024