Daily technical highlights – (DUFU, UEMS)

kiasutrader

Publish date: Thu, 10 Nov 2022, 09:15 AM

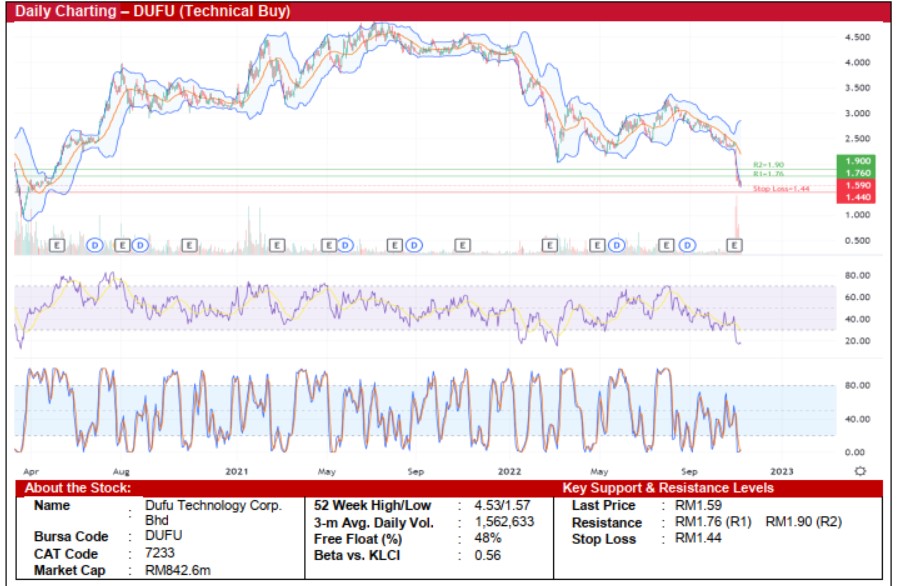

Dufu Technology Corp. Bhd (Technical Buy)

• From a high of RM4.82 in early July 2021, DUFU’s share price has subsequently fallen 67% to close at RM1.59 yesterday. With the share price likely to find support near its 52-week low of RM1.57, a technical rebound could be anticipated.

• Chart-wise, an upward shift is expected as both the RSI and stochastic indicators are set to climb out from the oversold area while the stock price has crossed back above the lower Bollinger Band yesterday.

• Hence, we believe that DUFU’s share price will rise to challenge our resistance levels of RM1.76 (R1; 11% upside potential) and RM1.90 (R2; 19% upside potential).

• Conversely, our stop loss price has been identified at RM1.44 (representing a 9% downside risk).

• Business-wise, DUFU specialises in the designing, development and manufacturing of precision machining parts and components.

• The group reported a net profit of RM16.4m in 3QFY22 compared with a net profit of RM20.3m in 3QFY21, lifting 9MFY22’s bottomline to RM64m (versus a net profit of RM55.7m previously).

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 2.5x (or approximately 2 SD below its historical mean) based on a book value per share of RM0.64 as of end-September 2022.

UEM Sunrise Bhd (Technical Buy)

• UEMS’ share price has been trending down since May 2013 from a peak of RM3.66 to hit a 52-week low of RM0.185 in October this year before moving sideways since then.

• On the chart, the share price – which closed at RM0.21 yesterday – is expected to stage a technical rebound in view of the rising RSI indicator and the 12-day moving average still hovering above the 26-day moving average following the MACD golden cross in late October.

• As such, we believe the stock could climb towards our resistance thresholds of RM0.24 (R1; 14% upside potential) and RM0.26 (R2; 24% upside potential).

• On the downside, our stop loss level is pegged at RM0.18 (representing a 14% downside risk).

• Fundamentally speaking, UEMS is a property developer which is involved in a diverse range of projects including industrial, commercial, residential, healthcare, mixed-used properties, government offices and universities.

• Earnings-wise, the group reported a net profit of RM20.7m in 2QFY22, reversing from a net loss of RM7.4m in 2QFY21. This took 1HFY22 bottomline to RM39.7m (versus net loss of RM11.7m previously), lifted mainly by land sale gains amounting to RM43.5m and forex gain of RM3.1m.

• Based on consensus forecasts, UEMS’ net earnings are projected to come in at RM37.3m in FY December 2022 and RM68.6m in FY December 2023, which translate to forward PERs of 28.5x this year and 15.5x next year, respectively.

Source: Kenanga Research - 10 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024