Daily technical highlights – (DIALOG, SAM)

kiasutrader

Publish date: Wed, 21 Dec 2022, 09:19 AM

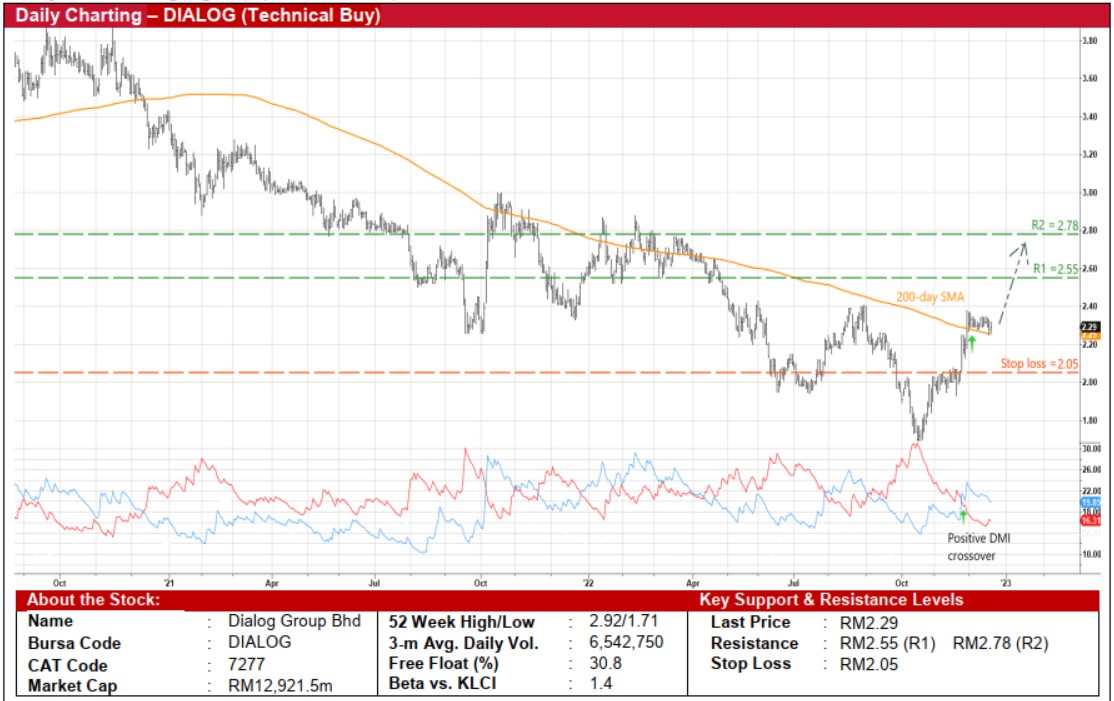

Dialog Group Bhd (Technical Buy)

• Following a recent rebound from its trough of RM1.71 in mid-October this year, DIALOG’s share price (which ended at RM2.29 yesterday) is set to ride on the prevailing upward momentum.

• From a technical standpoint, an extended upward shift is anticipated in view of the price crossover above the key 200-day SMA while the DMI Plus has cut above the DMI Minus.

• Hence, the stock could advance towards our resistance thresholds of RM2.55 (R1) and RM2.78 (R2), translating to upside potentials of 11% and 21%, respectively.

• Our stop loss price level is placed at RM2.05 (or a downside risk of 10%).

• An integrated technical service provider to the upstream, mid-stream and downstream segments in the oil & gas and petrochemical industry, DIALOG reported net profit of RM508.0m (-6% YoY) in FY June 2022 that was followed by quarterly net earnings of RM125.8m (-2% YoY) in 1QFY23.

• Based on consensus estimates, the group is projected to log net profit of RM586.4m in FY23 and RM636.1m in FY24, implying forward PERs of 22.0x and 20.3x, respectively with its 1-year rolling forward PER currently hovering just below the minus 1 SD level from its historical mean.

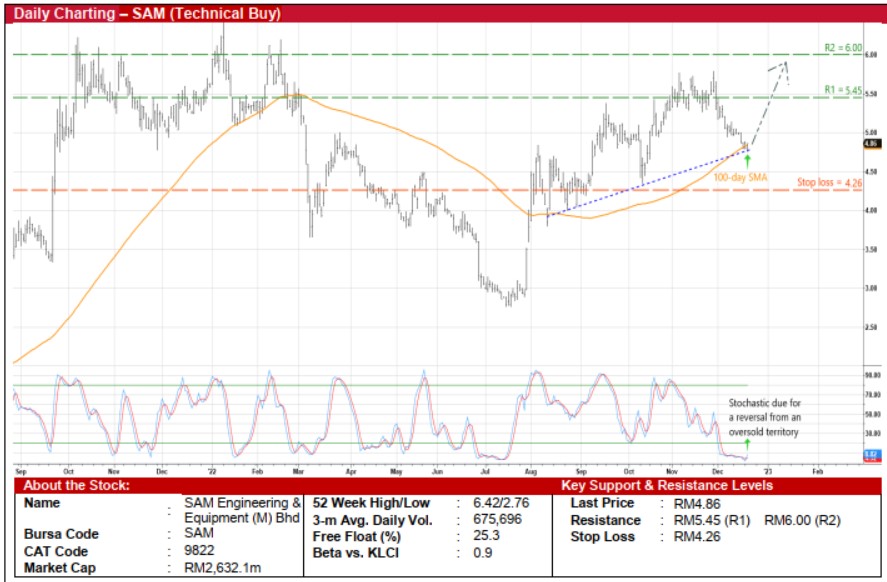

SAM Engineering & Equipment (M) Bhd (Technical Buy)

• Following a retracement from its recent high of RM5.79 in end-November to RM4.86 currently, which is near where it was in mid-October this year, a technical rebound may be in store for SAM shares.

• On the chart, the share price may find support at an ascending trendline (that dates back to early August this year), probably pulling away from the key 100-day SMA as the stochastic indicator is due for a reversal from the oversold territory.

• Riding on the momentum pick-up, the stock could resume its upward trajectory to challenge our resistance targets of RM5.45 (R1; 12% upside potential) and RM6.00 (R2; 23% upside potential).

• We have set our stop loss price level at RM4.26 (representing a downside risk of 12%).

• Backed by two business segments namely aerospace (involving the manufacturing and assembly of aircraft equipment, spares, components & precision engineering parts etc) and equipment (catering to the semiconductor and data storage industries), SAM posted net profit of RM26.9m (+63% YoY) in 2QFY23, bringing 1HFY23 bottomline to RM50.5m (+77% YoY).

• Moving forward, consensus is forecasting the group would show net earnings of RM85.6m in FY March 2023 and RM105.0m in FY March 2024, which translate to forward PERs of 30.7x and 25.1x, respectively (with its 1-year rolling forward PER presently treading at 1 SD above its historical mean).

Source: Kenanga Research - 21 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

DIALOG2024-11-22

DIALOG2024-11-22

DIALOG2024-11-22

SAM2024-11-21

DIALOG2024-11-21

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

SAM2024-11-19

DIALOG2024-11-19

SAM2024-11-18

DIALOG2024-11-18

SAM2024-11-15

SAMMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024