Daily technical highlights – (ECOMATE, PWROOT)

kiasutrader

Publish date: Fri, 23 Dec 2022, 06:48 PM

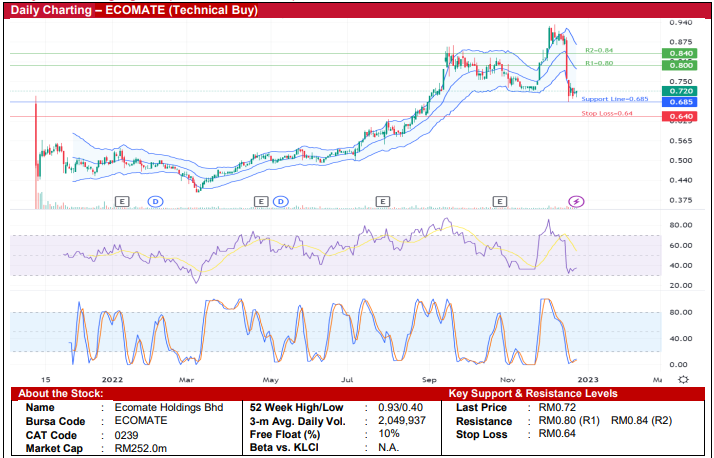

Ecomate Holdings Bhd (Technical Buy)

• Listed in November 2021, ECOMATE’s share price has fallen 23% since early December this year from its 52-week high of RM0.93 to close at RM0.72 yesterday. With the share price currently fluctuating near its support line at RM0.685, a level that was previously tested on 16 December, a technical rebound could be anticipated.

• Chart-wise, we believe the share price will shift upwards given the following technical signals: (i) the strengthening RSI indicator, (ii) the stochastic indicator is on the verge of climbing out from the oversold territory, and (iii) the stock price has crossed back above the lower Keltner Channel.

• Hence, we expect the stock to rise and test our resistance thresholds of RM0.80 (R1; 11% upside potential) and RM0.84 (R2; 17% upside potential).

• Conversely, our stop loss price has been identified at RM0.64 (representing a 11% downside risk).

• Business-wise, ECOMATE is involved in the manufacturing of ready-to-assemble furniture products, focusing on export markets mainly in Asia and North America.

• Earnings-wise, the group has turned around with a net profit of RM1.6m in 2QFY23 (from a net loss of RM1.8m in 2QFY22), lifted mainly by higher revenue contributions from the domestic market, Europe and Australia. This took 1HFY22 bottomline to RM3.6m (versus net profit of RM0.6m previously).

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 7.2x (or approximately at 1SD above its historical mean) based on its book value per share of RM0.10 as of end-Aug 2022.

Power Root Bhd (Technical Buy)

• The share price of PWROOT has tumbled to a 52-week low of RM1.23 in early March this year before subsequently bouncing off from the trough to plot an ascending price channel.

• On the chart, the share price – currently hovering near the lower end of the price channel – is expected to continue its upward trajectory in tandem with the strengthening RSI indicator as the stochastic indicator is set to reverse from an oversold area.

• A resumption of the uptrend could lift the stock to challenge our resistance levels of RM2.34 (R1; 11% upside potential) and RM2.45 (R2; 16% upside potential).

• Our stop loss level is pegged at RM1.90 (representing a 10% downside risk).

• Fundamentally speaking, PWROOT is a manufacturer and distributor of beverage products specialising in staple drinks (such as coffee, tea, chocolate malt drinks and herbal energy drinks).

• Earnings-wise, the group reported a net profit of RM15.6m in 2QFY23 (compared with a net profit of RM5.6m in 2QFY22), driven by robust sales growth in the domestic (+51%) and export (+64%) markets. This took 1HFY22 bottomline to RM30.9m (versus net profit of RM7.6m previously).

• Based on consensus forecasts, PWROOT’s net earnings are projected to come in at RM54.1m in FY March 2023 and RM56.9m in FY March 2024, which translate to forward PERs of 16.5x this year and 15.7x next year, respectively.

Source: Kenanga Research - 23 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024