Daily technical highlights – (BAHVEST, ASTRO)

kiasutrader

Publish date: Tue, 17 Jan 2023, 09:22 AM

Bahvest Resources Bhd (Technical Buy)

• BAHVEST stands to benefit from rising gold prices (up 18.2% since early November last year to USD1,918 per oz currently orback to where it was in April 2022) via its gold mining business activity in an area of 317.7 hectares in Tawau, Sabah (with aleasehold period ending in 2048).

• Technically speaking, after swinging sideways since early June last year, its share price – which rose 3.2% to close atRM0.32 yesterday amid heavy trading interest – may stage an upward bias ahead driven by a reversal from the oversoldcondition by the stochastic indicator and the appearance of several bullish dragonfly doji candlesticks recently.

• Consequently, the stock could climb to reach our first resistance target of RM0.35 (R1; 9% upside potential). Following which,a breakout from the rectangle pattern will probably lift the shares to challenge our next resistance threshold of RM0.39 (R2;22% upside potential).

• We have placed our stop loss price level at RM0.29 (representing a downside risk of 9%).

• Earnings-wise, BAHVEST reported net profit of RM2.7m (-70% YoY) in 2QFY23, bringing 1HFY23 bottomline to RM5.7m (-53% YoY).

• In terms of Price / Book Value rating, the stock is presently trading at a multiple of 3.2x (or at 1SD below its historical mean)based on its book value per share of RM0.10 as of end-September 2022.

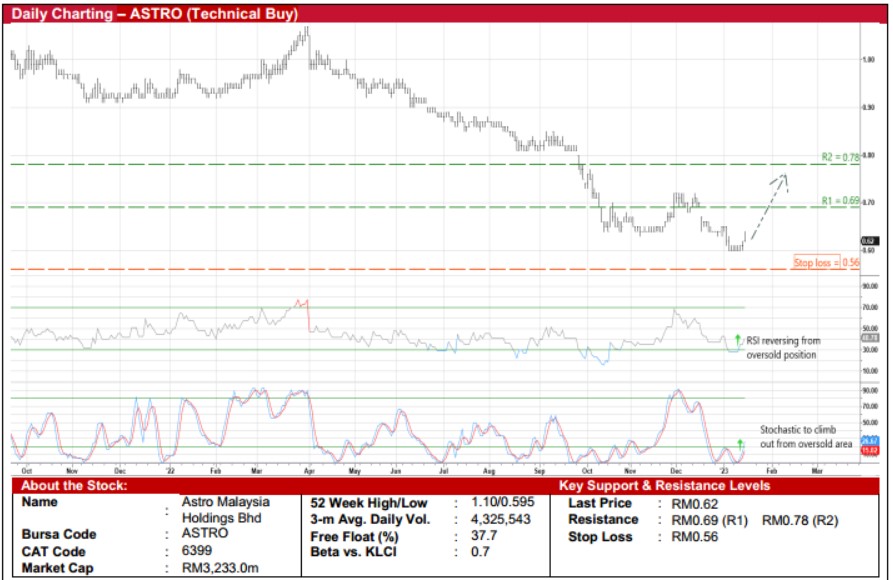

Astro Malaysia Holdings Bhd (Technical Buy)

• A price lift-off from its record low of RM0.595 last Thursday could pave the way for ASTRO shares (which gained 1.6% toclose at RM0.62 yesterday amid strong trading volume) to chart a technical rebound ahead.

• The upward trajectory is expected to persist as both the RSI and stochastic indicators are in the midst of climbing out from theoversold territory.

• Riding on the strengthening momentum, the stock could move to close the price gap that was left opened in mid-Decemberlast year, possibly advancing towards our resistance thresholds of RM0.69 (R1; 11% upside potential) and RM0.78 (R2; 26%upside potential).

• Our stop loss price level is set at RM0.56 (representing a downside risk of 10%).

• A leading content and entertainment group serving its customers across the TV, radio, digital and commerce platforms,ASTRO made net profit of RM5.8m (-95% YoY) in 3QFY23, which took 9MFY23 bottomline to RM204.3m (-39% YoY).

• According to consensus forecasts, the group would post net earnings of RM387.0m for FY January 2023 and RM434.1m forFY January 2024. This translates to forward PERs of 8.4x and 7.4x, respectively (with its 1-year rolling forward PER currentlyhovering at 2SD below its historical mean).

• In addition, the stock offers attractive forward dividend yield of 9.7% based on consensus DPS estimate of 6.0 sen for FYJanuary 2024.

• Meanwhile, ASTRO is expected to benefit from the strengthening RM vis-à-vis the USD (up 9.1% since early November lastyear to RM4.32 per USD currently), which will then reduce its USD-denominated content costs (hence translating to a betterearnings outlook).

Source: Kenanga Research - 17 Jan 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024