Daily technical highlights – (SKPRES, KUB)

kiasutrader

Publish date: Tue, 11 Apr 2023, 09:48 AM

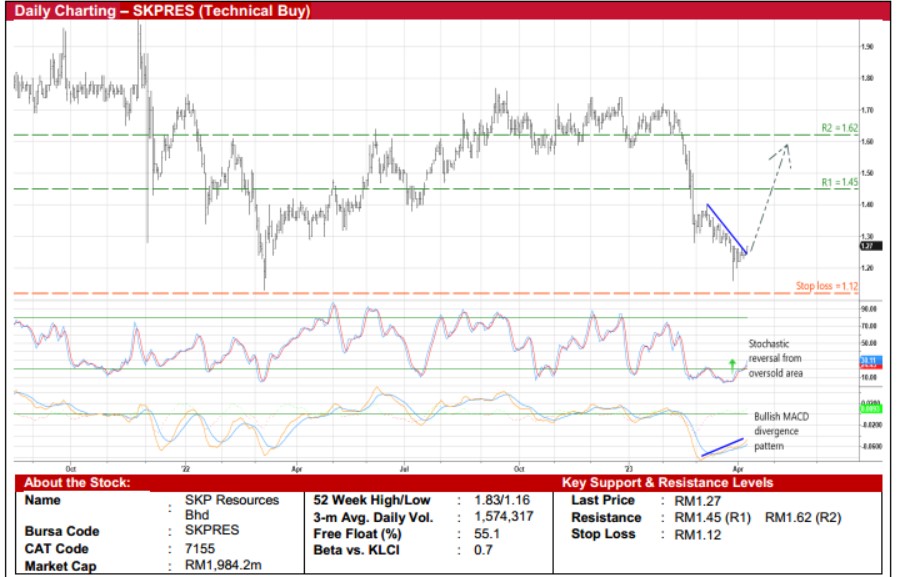

SKP Resources Bhd (Technical Buy)

• A technical rebound could be in the offing for SKPRES’ share price following its recent pullback from a high of RM1.72 in early February this year to as low as RM1.16 end-March. The shares closed at RM1.27 yesterday.

• On the chart, a price run-up is anticipated in view of the existence of a bullish MACD divergence pattern (which saw the indicator rising in the oversold area as the share price was weakening) while the stochastic indicator is in the midst of climbing out from the oversold territory.

• With that said, the stock could advance towards our resistance targets of RM1.45 (R1; 14% upside potential) and RM1.62(R2; 28% upside potential).

• Our stop loss price level is pegged at RM1.12 (representing a downside risk of 12%).

• SKPRES – an electronics manufacturing services (EMS) provider which is principally involved in the manufacturing of plastic products and fabrication of moulds – made net profit of RM40.7m (-12% YoY) in 3QFY23, bringing 9MFY23 bottom line toRM124.4m (+5% YoY).

• According to consensus estimates, the group is forecasted to make net earnings of RM155.5m in FY March 2023, RM154.0min FY24 and RM193.1m in FY25.

• This translates to prospective PERs of 12.9x and 10.3x on FY24-FY25 consensus earnings, respectively (with its 1-year rolling forward PER presently trading at 1SD below its historical mean).

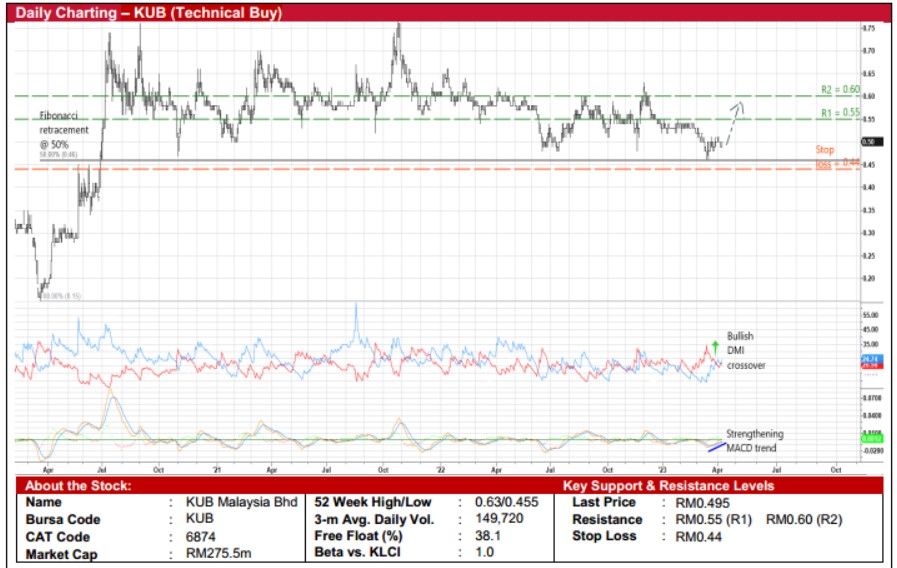

KUB Malaysia Bhd (Technical Buy)

• After bouncing off from a 33-month low of RM0.455 in mid-March this year, which coincided with the Fibonacci retracement line of 50%, KUB shares will likely climb further from yesterday’s closing price of RM0.495.

• With the DMI Plus crossing over the DMI Minus recently and the MACD indicator showing a strengthening trend, the stock is expected to chart an upward trajectory ahead.

• On the way up, the share price could challenge our resistance targets of RM0.55 (R1; 11% upside potential) and RM0.60 (R2;21% upside potential).

• We have placed our stop loss price level at RM0.44 (translating to a downside risk of 11%).

• Fundamental-wise, KUB’s business segments are segregated into: (i) importation, bottling, marketing and distribution of Liquified Petroleum Gas (LPG), (ii) oil palm plantation, and (iii) others (which includes infrastructure solutions, supply, maintenance and ancillary services in ICT, engineering civil works in the power sector and property management services).

• The group posted net profit of RM11.5m (+87% YoY) in 2QFY23, which took 1HFY23 bottomline to RM15.3m (+44% YoY).

• Its balance sheet is backed by net cash holdings and short-term investments of RM310.0m (or RM0.56 per share which is more than its existing share price) as of end-December 2022.

• In terms of Price / Book Value rating, the stock is currently hovering at a multiple of 0.55x (or at slightly below the minus 1SDlevel from its historical mean) based on its book value per share of RM0.90 as of end-December 2022.

Source: Kenanga Research - 11 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024