Daily technical highlights – (TECHBND, SENHENG)

kiasutrader

Publish date: Wed, 19 Apr 2023, 09:40 AM

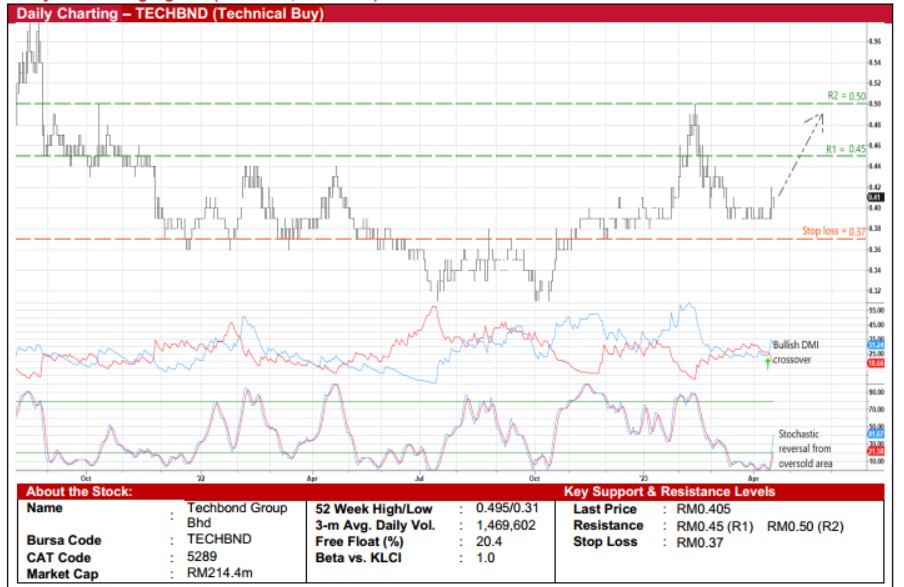

Techbond Group Bhd (Technical Buy)

• After retreating from its peak of RM0.495 in mid-February this year, a recent lift-off from the low of RM0.385 last week couldset the stage for TECHBND shares – which ended at RM0.405 yesterday – to chart an upward trajectory.

• Backed by the positive crossover by the DMI Plus above the DMI Minus and the stochastic indicator’s ongoing reversal fromthe oversold position, the share price is expected to climb further ahead.

• Chart-wise, the stock is anticipated to advance towards our resistance thresholds of RM0.45 (R1; 11% upside potential) andRM0.50 (R2; 23% upside potential).

• We have placed our stop loss price level at RM0.37 (representing a downside risk of 9%).

• Business-wise, TECHBND is a manufacturer of industrial adhesives (comprising water-based and hot melt adhesives whichare mainly used for woodworking, paper & packaging and automotive applications) and industrial sealants (for building andconstruction applications).

• The group posted net loss of RM1.7m in 2QFY23 (mainly due to an unrealised foreign exchange loss of RM2.9m) (versus2QFY22’s net profit of RM2.6m), taking 1HFY23’s bottomline to RM2.8m (-28% YoY).

• Going forward, Kenanga Research’s fundamental research team has projected TECHBND to register stronger net earnings ofRM10.1m for FY June 2023 and RM20.0m for FY June 2024, which translate to forward PERs of 21.2x and 10.7x,respectively.

• An added positive is its healthy balance sheet that is backed by cash holdings of RM42.7m (or 8.1 sen per share) as of endDecember 2022.

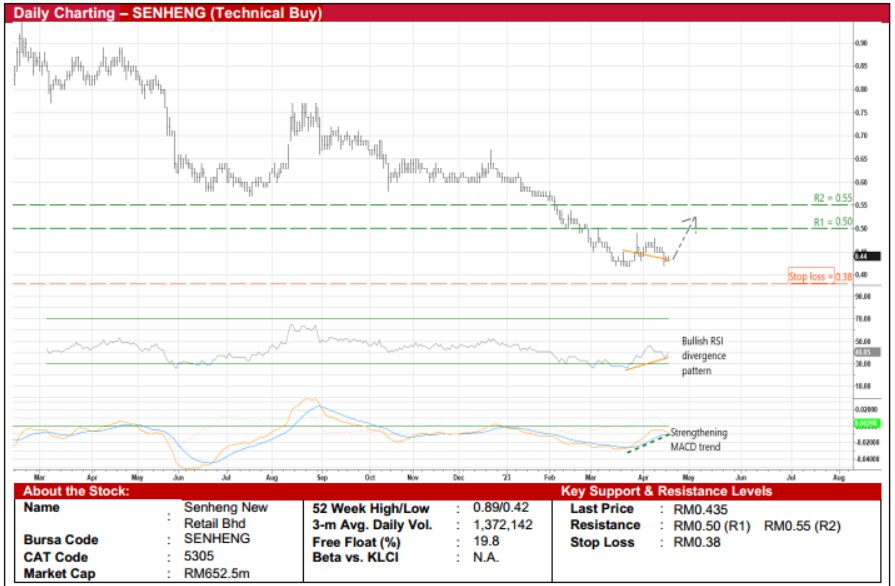

Senheng New Retail Bhd (Technical Buy)

• Following a slide from its peak of RM1.04 in January last year to as low as RM0.42 last Friday, a technical rebound may beon the horizon for SENHENG’s share price.

• From a charting perspective, the existence of a bullish RSI divergence pattern (which saw the indicator plotting higher lowswhile the price was drifting sideways) and the strengthening MACD signal will probably push the shares to shift higher ahead.

• Riding on the positive momentum, the stock could climb to challenge our resistance thresholds of RM0.50 (R1; 15% upsidepotential) and RM0.55 (R2; 26% upside potential).

• Our stop loss price level is set at RM0.38 (or a downside risk of 13% from its last traded price of RM0.435).

• A retailer of consumer electrical and electronics with over 100 retail stores nationwide, SENHENG (which was listed in lateJanuary 2022) registered net profit of RM21.0m (-33% YoY) in 4QFY22, bringing FY December 2022’s bottomline toRM60.6m (-7% YoY).

• Based on its book value per share of RM0.35 as of end-December 2022, the stock is currently trading at a Price / Book Valuemultiple of 1.24x.

Source: Kenanga Research - 19 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024