Daily technical highlights – (CSCENIC, FFB)

kiasutrader

Publish date: Wed, 26 Apr 2023, 09:29 AM

Classic Scenic Bhd (Technical Buy)

• CSCENIC’s share price is poised to stage a technical rebound after sliding from its peak of RM1.44 in mid-November last year to as low as RM0.795 last Wednesday (or back to where it was in early August last year). The shares closed at RM0.81 yesterday.

• A rising price action is currently anticipated following: (a) the stochastic indicator’s unwinding from an oversold condition, (b) the existence of a bullish RSI bottom failure swing (which saw the indicator plotting higher lows in the oversold area as the price was drifting listlessly), and (iii) the appearance of several dragonfly doji candlesticks.

• On the chart, the stock could be making its way to challenge our resistance targets of RM0.91 (R1; 12% upside potential) and RM1.03 (R2; 27% upside potential).

• Our stop loss price level is placed at RM0.74 (representing a downside risk of 9%).

• A manufacturer and exporter of wooden picture frame mouldings, CSCENIC reported net profit of RM4.2m (+23% YoY) in 4QFY22, which brought FY December 2022’s bottomline to RM19.0m (+196% YoY).

• Valuation-wise, the shares are currently trading at a Price / Book Value multiple of 1.25x (or at 0.5SD below its historical mean) based on its book value per share of RM0.65 as of end-December 2022.

• An added investment merit is its debt-free balance sheet that is backed by a cash position of RM24.1m (or 9.5 sen per share) as of end-December 2022.

• In terms of corporate development, CSCENIC is currently undertaking a 1-for-2 bonus issue exercise with the ex-entitlement date set on 10 May 2023.

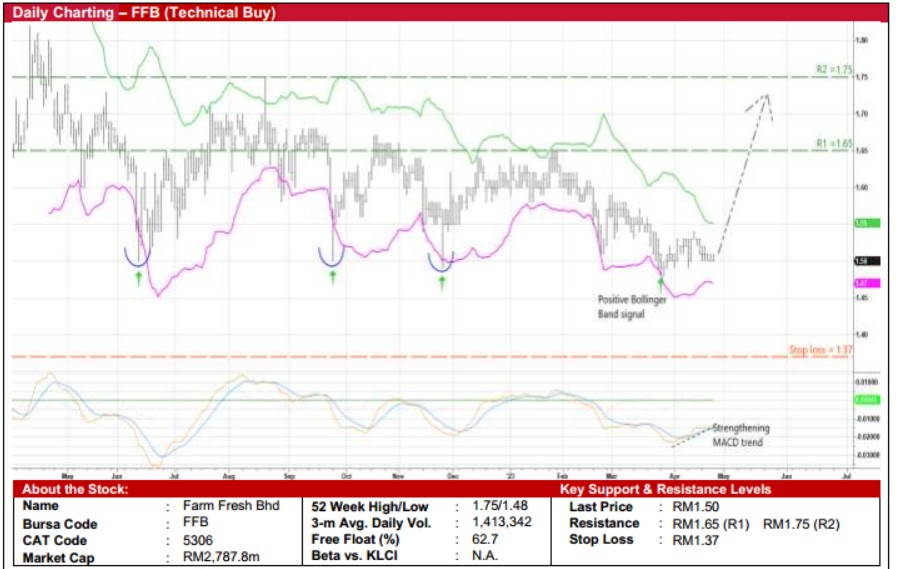

Farm Fresh Bhd (Technical Buy)

• At yesterday’s close of RM1.50, FFB’s share price is presently hovering near its recent lows that had previously preceded subsequent rebounds thrice (in mid-June 2022, late September 2022 and late November 2022).

• A repeat of the lift-off may be on the cards as the shares have moved back above the lower Bollinger Band while the MACD is signalling a strengthening trend.

• Riding on the upward trajectory, the stock could advance towards our resistance thresholds of RM1.65 (R1; 10% upside potential) and RM1.75 (R2; 17% upside potential).

• We have set our stop loss price level at RM1.37 (or a downside risk of 9%).

• Listed in March last year, FFB is Malaysia’s largest integrated producer of dairy products made from fresh raw milk, operating six dairy farms and three processing facilities across Malaysia and Australia.

• The group made net profit of RM18.8m (+64% YoY) in 3QFY23, taking its 9MFY23’s bottomline to RM45.2m (-27% YoY).

• According to consensus forecasts, FFB is expected to show rising net profit trend of RM68.0m in FY March 2023, RM100.4m in FY March 2024 and RM121.8m in FY March 2025.

• Valuation-wise, FFB is currently trading at prospective PERs of 41.0x, 27.8x and 22.9x, respectively (with its 1-year rolling forward PER currently hovering at 2SD below its historical mean).

Source: Kenanga Research - 26 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024