Daily technical highlights – (GDEX, POS)

kiasutrader

Publish date: Wed, 03 May 2023, 10:15 AM

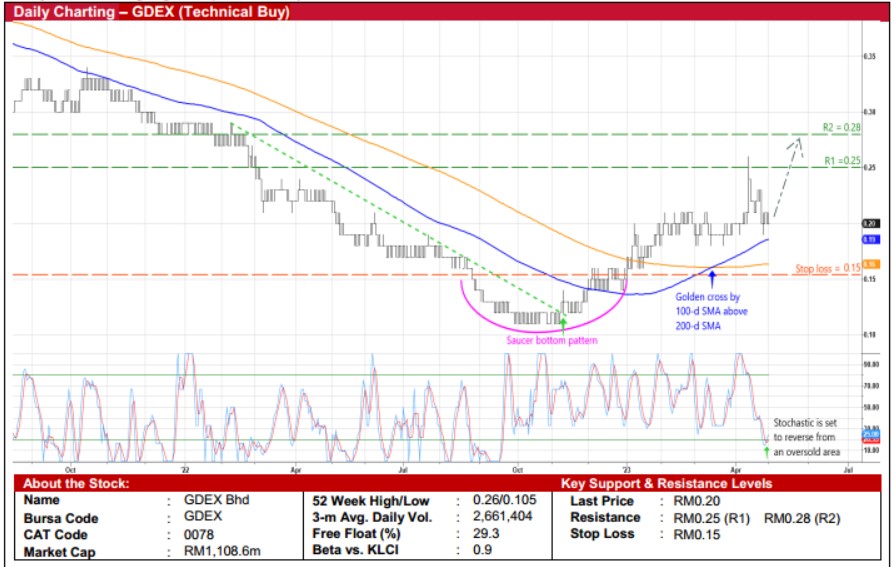

GDEX Bhd (Technical Buy)

• After climbing from a 10-year low of RM0.105 in late October last year to close at RM0.20 yesterday, forming a rounding bottom pattern and overcoming a descending trendline (that dates back to February 2022) along the way, a price reversal forGDEX shares could be underway.

• With the stochastic indicator in the midst of unwinding from an oversold condition and following the golden cross by the 100-day SMA above the 200-day SMA, an extended run-up is on the horizon.

• Riding on the positive momentum, the stock is expected to advance towards our resistance thresholds of RM0.25 (R1; 25%upside potential) and RM0.28 (R2; 40% upside potential). Our stop loss price level is placed at RM0.15 (or a downside risk of25%).

• A provider of express delivery and logistics services, GDEX logged net loss of RM6.0m in 4QFY22 (versus 4QFY21’s net earnings of RM5.9m), bringing FY22’s net loss to RM18.0m (from net profit of RM27.4m previously). The loss-making performance was chiefly attributable to stiff competition from aggressive pricing practices, weak market sentiment and low demand conditions.

• Yet, according to one media report, the extremely competitive operating environment may change as the government plans to undertake a review of practices in the last-mile logistics sector and introduce new regulations (such as the implementation ofa floor price) for fairer and healthy competition with an announcement likely to be made by end-2Q 2023. A more equitable playing field, in turn, could translate to improved margins for industry players like GDEX.

• Also, its balance sheet is backed by net cash holdings & short-term funds of RM116.9m (or 2.1 sen / share) as of end December 2022.

• Valuation-wise, based on its book value per share of RM0.09 as of end-December 2022, the stock is currently trading at Price/ Book Value multiple of 2.22x (or at 1 SD below its historical mean).

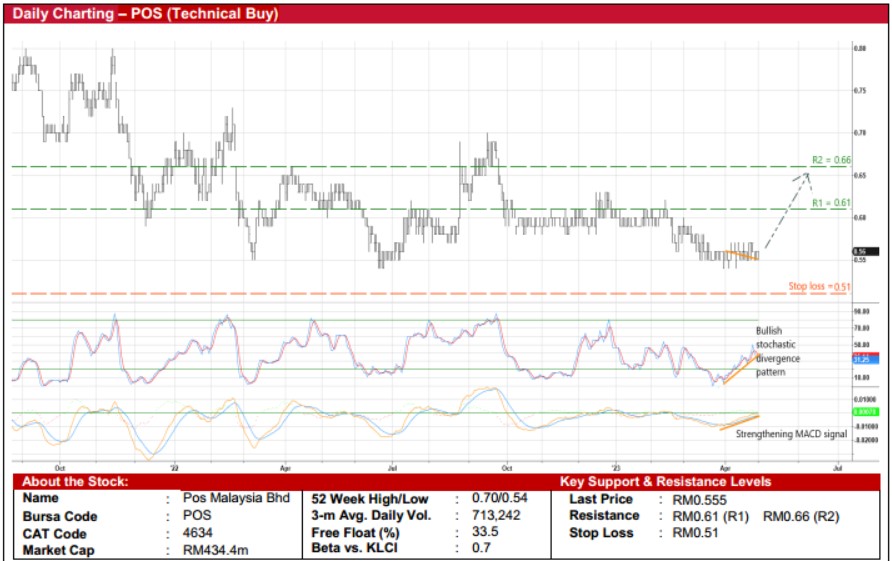

Pos Malaysia Bhd (Technical Buy)

• After hitting a recent trough of RM0.54 in the first half of April 2023 (matching its previous low in June last year), POS’ shareprice – which ended at RM0.555 yesterday – is poised to stage a technical rebound ahead.

• On the chart, an upward shift in the shares is anticipated following the existence of a bullish stochastic divergence pattern(which saw the indicator plotting rising bottoms while the price was treading listlessly) and the strengthening MACD signal.

• With that said, the stock could be making its way to challenge our resistance targets of RM0.61 (R1; 10% upside potential)and RM0.66 (R2; 19% upside potential).

• We have pegged our stop loss price level at RM0.51 (or a downside risk of 8%).

• POS – which is the national postal and parcel service provider and sole licensee for universal postal services in the country –made net loss of RM98.4m in 4QFY22 (less than 4QFY21’s net loss of RM123.2m), taking FY22’s bottom-line to RM167.7m(or nearly halved the previous year’s net loss of RM335.7m).

• Going forward, consensus is projecting the group to narrow its net loss further to RM65.5m in FY December 2023 and RM3.1m in FY December 2024.

• In terms of valuation, based on its book value per share of RM0.83 as of end-December 2022, the stock is currently trading at Price / Book Value multiple of 0.67x (or at 1 SD above its historical mean).

Source: Kenanga Research - 3 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024