Daily Technical Highlights - (AXIATA, GCB)

kiasutrader

Publish date: Tue, 13 Jun 2023, 10:02 AM

Axiata Group Bhd (Technical Buy)

• A technical rebound could be around the corner for AXIATA shares following a retracement from the recent high of RM3.10 inmid-May this year to close at RM2.67 yesterday (or back to where it was in October last year).

• Backed by the occurrence of a bottom failure swing by the RSI indicator (which has formed rising bottoms in the oversoldzone while the stock price was drifting lower) and the ongoing reversal by the stochastic indicator from an oversold position,the stock is anticipated to shift upwards ahead.

• Chart-wise, the share price will probably be making its way towards our resistance targets of RM2.98 (R1; 12% upsidepotential) and RM3.18 (R2; 19% upside potential).

• We have placed our stop loss price level at RM2.37 (representing a downside risk of 11%).

• A diversified telecommunications and digital conglomerate focusing on digital telcos, digital businesses and infrastructure inASEAN and South Asia, AXIATA reported net loss (from continuing operations) of RM5.12b in FY December 2022 (versusnet loss of RM136.9m previously), mainly impacted by impairment of goodwill of mobile operations in Nepal, Indonesia andSri Lanka amounting to RM4.15b that was followed by quarterly net earnings of RM73.8m in 1QFY23 (versus 1QFY22’s netloss of RM43.0m).

• According to consensus estimates, the group’s bottomline is forecasted to come in at RM881.3m for FY23 and RM1.12b forFY24.

• In terms of valuation, this translates to forward PERs of 27.8x this year and 21.7x next year, respectively with its 1-yearrolling forward PER presently hovering around 0.5SD below its historical mean.

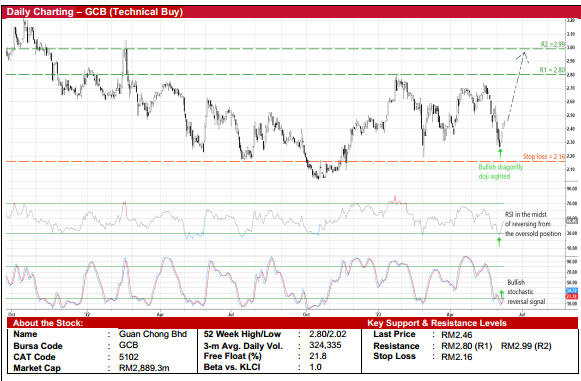

Guan Chong Bhd (Technical Buy)

• After bouncing off from a low of RM2.26 last Tuesday, GCB’s share price is poised to stage a technical rebound and extendits upward trajectory ahead.

• On the chart, an upward shift in the shares is anticipated in view of the appearance of a bullish dragonfly doji candlestickwhile both the stochastic and RSI indicators are in the midst of climbing out from the oversold territory.

• With that said, the stock could rise to challenge our resistance thresholds of RM2.80 (R1; 14% upside potential) and RM2.99(R2; 22% upside potential).

• Our stop loss price level is seen at RM2.16 (representing a downside risk of 12% from its last traded price of RM2.46).

• Fundamentally speaking, after reporting net profit of RM149.0m (-3.8% YoY) in FY December 2022, GCB (a manufacturer ofcocoa-derived food ingredients namely cocoa mass, cocoa butter, cocoa cake and cocoa powder) saw its bottomline comingin at RM23.8m (-55% YoY) in 1QFY23.

• Going forward, consensus is projecting the group to register rising net earnings of RM200.3m for FY23 and RM223.7m forFY24.

• Valuation-wise, this translates to forward PERs of 14.4x this year and 12.9x next year, respectively with its 1-year rollingforward PER presently hovering just marginally below its historical mean.

Source: Kenanga Research - 13 Jun 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024