Daily technical highlights – (SIME, SLVEST)

kiasutrader

Publish date: Mon, 07 Aug 2023, 09:10 AM

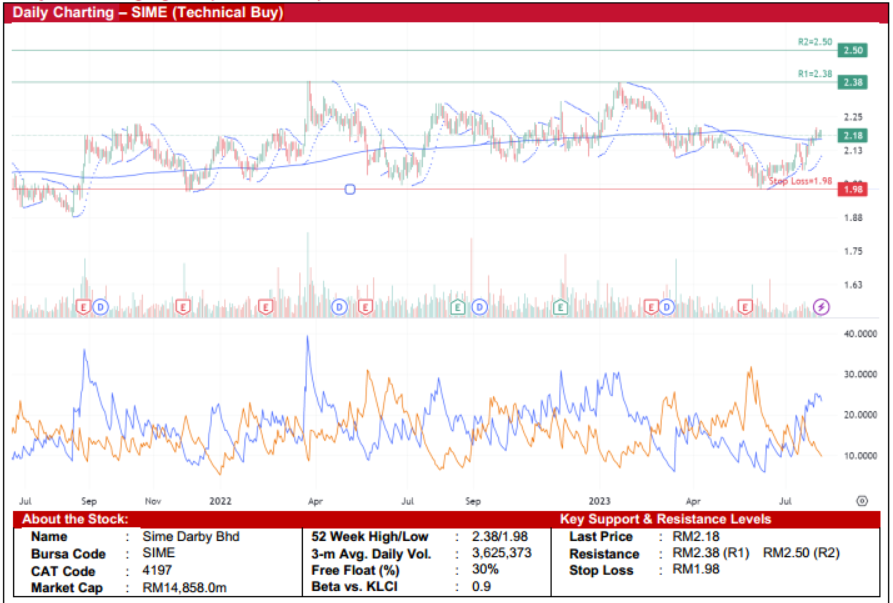

Sime Darby Berhad (Technical Buy)

• From a low of RM1.31 in March 2020, SIME’s share price has been riding on an uptrend since the COVID pandemic andreaching a high of RM2.38 in January 2023, showing an increment of 82%. The stock closed at RM2.18 last Friday andalready rebounded from the major support level of RM2.00.

• A technical rebound could be on the horizon in view of the positive technical signals as suggested by the Parabolic SARremains in a n uptrend as well as the DMI Plus being higher than the DMI Minus.

• The stock will likely climb towards our resistance thresholds of RM2.38 (R1; 9% upside potential) and RM2.50 (R2: 15%upside potential).

• Our stop-loss level is pegged at RM1.98 (representing a 9% downside risk).

• From the fundamental point of view, SIME’s primary operations are centred around the industrial, motors and logisticssectors, in addition to its presence in the healthcare and insurance segments.

• Earnings-wise, the group reported a profit of RM240m in 3QFY23 compared with a profit of RM244m in 3QFY22 primarily dueto lower profits from its motor segment in China coupled with higher finance costs.

• Based on consensus forecasts, SIME’s net earnings are projected to come in at RM1.1b in FY June 2023 and RM1.2b in FYJune 2024, which translate to forward PERs of 13.5x and 12.4x, respectively.

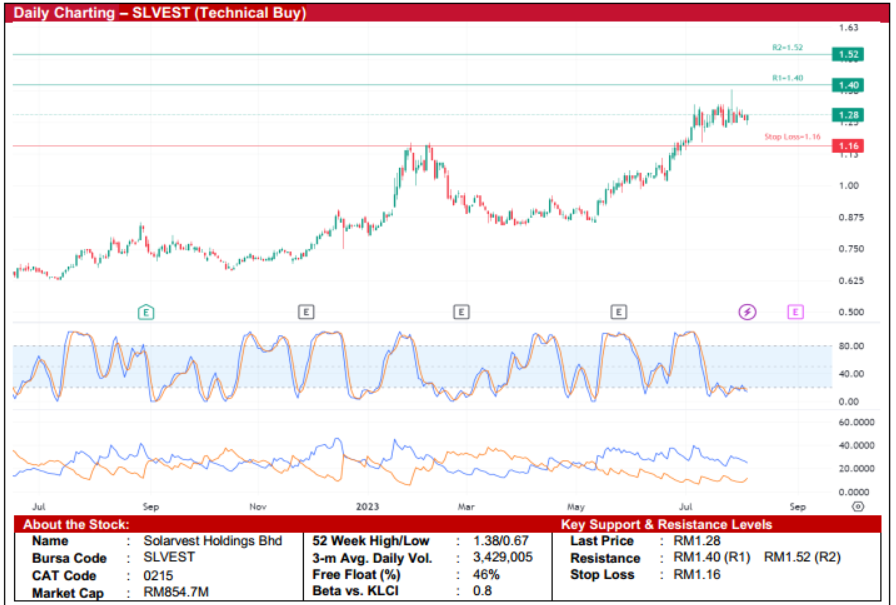

Solarvest Holdings Berhad (Technical Buy)

• Hitting a low of RM0.60 in March 2022, SLVEST’s share price rose steadily and closed at RM1.38 last Friday, showing anincrement of 130%. We expect the rise in price to continue due to the announcement of NETR Phase 2 at the end of August.

• A continuation of the uptrend is anticipated due to the DMI Plus still hovering above the DMI Minus as well as the stochasticRSI indicator set to climb from the oversold area.

• The stock will likely head towards our resistance thresholds of RM1.40 (R1; 9% upside potential) and RM1.52 (R2: 19%upside potential).

• Our stop-loss level is pegged at RM1.16 (representing a 9% downside risk).

• SLVEST is a provider of solar farms and solar panels with its expertise in the solar PV system engineering, procurement,construction, and commissioning (EPCC).

• Fundamentally speaking, YoY, the group reported a profit of RM5.2m in 4QFY23 compared with a profit of RM3.7m in4QFY22 primarily due to a strong order book stemming from securing government projects i.e. the LSS4.

• Based on consensus forecasts, SLVEST’s net earnings are projected to come in at RM28.7m in FY March 2024 andRM33.8m in FY March 2025, which translate to forward PERs of 29.8x and 25.3x, respectively.

Source: Kenanga Research - 7 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

SLVEST2024-11-22

SIME2024-11-22

SLVEST2024-11-21

SIME2024-11-21

SLVEST2024-11-20

SIME2024-11-20

SIME2024-11-20

SIME2024-11-20

SLVEST2024-11-19

SIME2024-11-19

SIME2024-11-19

SLVEST2024-11-18

SIME2024-11-18

SIME2024-11-18

SIME2024-11-18

SIME2024-11-18

SLVEST2024-11-14

SIME2024-11-14

SIME2024-11-13

SIME2024-11-13

SIME2024-11-13

SLVEST2024-11-13

SLVEST2024-11-13

SLVEST2024-11-12

SIME2024-11-12

SIMEMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024