Actionable Technical Highlights – (FRONTKN)

kiasutrader

Publish date: Fri, 22 Sep 2023, 09:14 AM

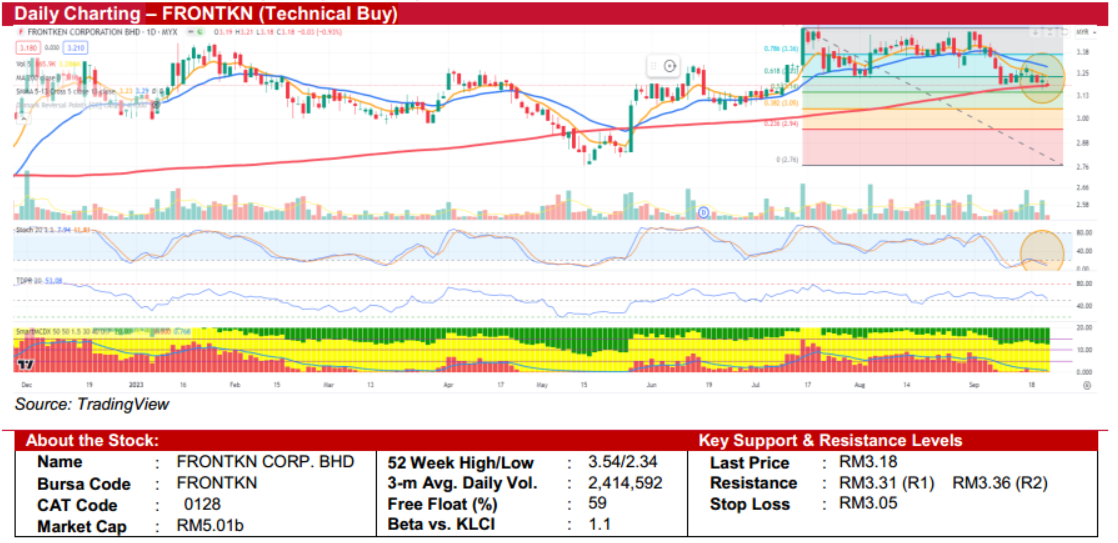

FRONTKN CORPORATION BERHAD (Technical Buy)

• Following nine-day stabilization period, FRONTKN displayed an inverted hammer chart pattern in yesterday, hinting of a possible departure from its recent downward path.

• From a technical standpoint, despite the stochastic oscillator lingering in the oversold region, there is a potential for a trend reversal, which could initiate an upward trajectory if it successfully crosses above the 20-threshold level with determination.

• Moreover, the stock is positioned near the 200-day SMA line, suggesting that it has established a firm support base. This optimistic outlook is further substantiated by the Tom DeMark Pressure Ratio (TDPR), illustrating sustained buying interest.

• Looking ahead, we foresee FRONTKN approaching its immediate resistance at RM3.31 in the forthcoming period. A decisive overcoming of this key resistance could potentially lead to challenging higher levels at RM3.36 and eventually RM3.52.

• We propose an entry point for the stock at RM3.18, near the 200-day SMA line, targeting an initial price goal of RM3.31, offering a prospective upside of approximately 4.1%. In tandem, we recommend instituting a stop-loss limit at RM3.05 to mitigate a potential downside risk of 4.0%.

Source: Kenanga Research - 22 Sept 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024