Weekly Technical Highlights – FBM KLCI

kiasutrader

Publish date: Mon, 15 Jan 2024, 10:50 AM

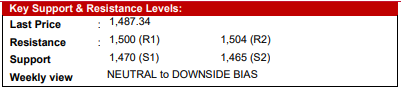

FBM KLCI (NEUTRAL to DOWNSIDE BIAS)

• The FBM KLCI started the week on a positive trajectory, surpassing the significant 1,500 level and peaking at 1,503.94, aligning with its 200-week SMA, on Tuesday. Despite this early surge, the momentum failed to maintain due to profit-taking and a resurgence in foreign funds selling, leading the index to a slight week-on-week dip, closing at 1,487.34 (-0.02%).

• The upcoming week is anticipated to be heavily influenced by key economic events, with the Davos World Economic Forum taking center stage. Additionally, the U.S. Beige Book report is scheduled for release on Thursday, while Malaysia's advanced 4Q GDP estimate is expected on Friday. Any negative data or comments emerging from these events could significantly impact the current optimistic market outlook.

• Technically, the FBM KLCI retreated from its recent peak of 1,503, forming a 'Doji' pattern in its weekly chart last Friday, which reflects uncertainty of its future trajectory. The index's inability to surpass the significant 1,504 resistance level, which corresponds with its 200-week SMA, combined with an overbought stochastic indicator, suggests a high probability of continued pullback in the coming week.

• The index is expected to fluctuate between 1,465 and 1,500 this week, with a tendency towards the downside. Key resistance levels are identified at 1,500 and then 1,504. On the lower end, a breach below the critical 1,470 support level, aligning with its previous high, could trigger a further drop to around 1,465, consistent with its 5-week SMA.

Source: Kenanga Research - 15 Jan 2024