Kenanga Research & Investment

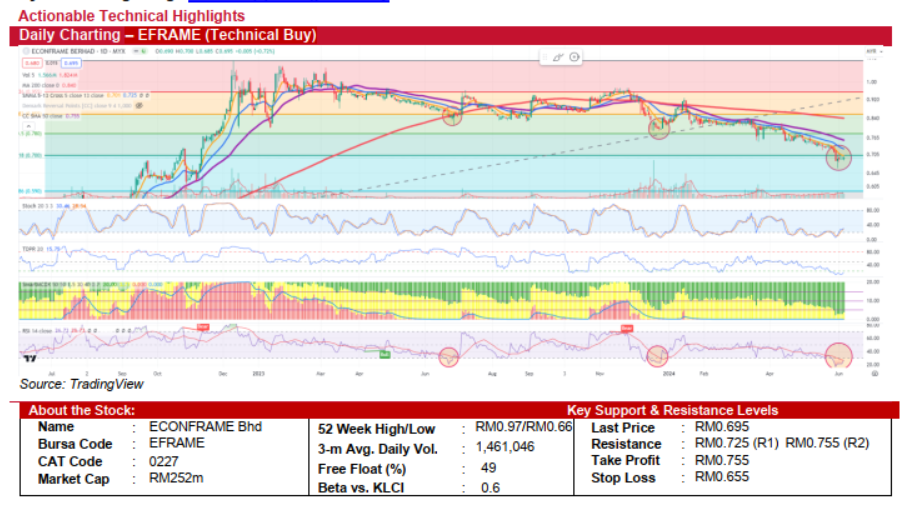

Daily Charting - EFRAME (Technical Buy)

kiasutrader

Publish date: Mon, 10 Jun 2024, 11:06 AM

ECONFRAME BERHAD (Technical Buy)

- Econframe Bhd (EFRAME) closed at RM0.695 last Friday after consolidating and stabilizing around the RM0.68 zone over the past few trading days. The recent session featured a ‘Doji’ candlestick pattern, indicating indecisiveness and a possible trend reversal. The weekly chart mirrors this pattern, suggesting a potential bullish shift ahead.

- From a technical perspective, the Tom Demark Pressure Ratio (TDRP) at 15.75 suggests diminishing selling pressure. The daily RSI, in the oversold zone at 26.73, reinforces the likelihood of a bullish turn-around based on historical trends. The weekly chart also displays similar indicators, further supporting a potential bullish shift.

- A sustained move above the immediate resistance level of RM0.70 could signal a bullish trend, leading the stock to test higher resistance levels at RM0.725 and RM0.755. Conversely, a decline below the RM0.680 support level may indicate a continuation of the downtrend towards the next major support at RM0.66. The "Doji" pattern suggests market indecision, which, if followed by a bullish candle, could confirm a trend reversal.

- We recommend considering an entry position around the RM0.69 to RM0.70 range. Setting a take-profit target at RM0.755 provides an estimated upside potential of approximately 9.4%. For risk management, placing a stop-loss at RM0.655 limits potential downside to around 5.1%. This strategy offers a balanced risk-to-reward ratio, making it a viable trade setup for investors.

Source: Kenanga Research - 10 Jun 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Jan 20, 2025

Renewable Energy - Big News, Another 2GW LSS Incoming (OVERWEIGHT)

Created by kiasutrader | Jan 20, 2025

Bond Market Weekly Outlook - Domestic yields set to rise ahead of Trump’s inauguration

Created by kiasutrader | Jan 17, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments