Benjamin Graham formula - OTB Formula 1

Tan KW

Publish date: Mon, 26 Aug 2013, 01:26 PM

The Benjamin Graham formula is an intrinsic value formula proposed by investor and professor, Benjamin Graham, often referred to as the "father of value investing". Published in his book, The Intelligent Investor, Graham devised the formula for investors to be able to quickly determine how rationally priced their stocks were. As with any valuation formula, the final number is not designed to give a true value of a stock, but only to approximate its range of possible values.

Note that Graham never intended this formula to be used to evaluate stocks.

Formula calculation

In The Intelligent Investor, Benjamin Graham describes a formula he used to value stocks. He disregarded complicated calculations and kept his formula simple. In his words: "Our study of the various methods has led us to suggest a foreshortened and quite simple formula for the evaluation of growth stocks, which is intended to produce figures fairly close to those resulting from the more refined mathematical calculations."

The formula as described by Graham in the 1962 edition of Security Analysis, is as follows:

V = Intrinsic Value

EPS = Trailing Twelve Months Earnings Per Share

8.5 = P/E base for a no-growth company

g = reasonably expected 7 to 10 year growth rate

Where the expected annual growth rate "should be that expected over the next seven to ten years." Graham’s formula took no account of prevailing interest rates.

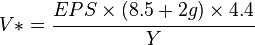

Revised formula

He revised his formula in 1974 (Benjamin Graham, "The Decade 1965-1974: Its significance for Financial Analysts," The Renaissance of Value) as follows:

Graham suggested a straight forward practical tool for evaluating a stock's intrinsic value. His model represents a down-to-earth valuation approach that focuses on the key market-related and company-specific variables.

The Graham formula proposes to calculate a company’s intrinsic value V* as:

V: Intrinsic Value

EPS: the company’s last 12-month earnings per share

8.5: the constant represents the appropriate P-E ratio for a no-growth company as proposed by Graham

g: the company’s long-term (five years) earnings growth estimate

4.4: the average yield of high-grade corporate bonds in 1962, when this model was introduced

Y: the current yield on AAA corporate bonds

Application

To apply this approach to a buy-sell decision, each company’s relative Graham value (RGV) can be determined by dividing the stock’s intrinsic value V* by its current price P:

An RGV of less than one indicates an overvalued stock and should not be bought, while an RGV of greater than one indicates an undervalued stock and should be bought.

Because of the measures it uses, difficulties may be encountered in evaluating both new and small company stocks using this model as well as any stock with inconsistent EPS growth. On one hand, it is efficient because of its simplicity but on the other, it is limited by its simplicity because the model does not work well for every stock.

Thus, the calculation is subjective when considered on its own. It should never be used in isolation; the investor must take into account other factors such as:

- Net Current Asset Value in order to determine the financial viability of the firm in question

- Current Asset Value in order to determine short-term financial viability of the firm

- Debt to equity ratio

- Quality of the Current Assets.

http://en.wikipedia.org/wiki/Benjamin_Graham_formula

Posted by kcchongnz > Jul 7, 2013 03:52 PM

Ooi, hope you don't mind I explain here.

IV=(EPS*(8.5+1.5g)*4.4)/Y is the Graham growth model to estimate the intrinsic value of a stock.

IV is the intrinsic value

EPS is earnings per share. Use normalized EPS as much as possible.

8.5 is the PE ratio Graham willing to pay for a stock without growth.

1.5g is the weightage given to a growth company. Graham used 2.0 in his original form.

At that time, the long-term bond yield was 4.4%. so to adjust the formula to the present long-term bond rate, Y%, a factor 4.4/Y is used. So one can see the rationale of the formula.

One thing I realized now is this formula should not be relied too much on to get the intrinsic value of a stock because too much weigh is given to the growth g of a company. Also Graham did not include any risk premium in the formula as modern financial theory would tell you that investing in equity has a higher risk than bond.

Imagine a company earns 10 sen per share but with an expected growth rate of 15%, and using Y as 5% would have an IV of 3.40 compared with no growth of just 75 sen. Would you want to pay so such for this "expected" growth?

But I think the formula would be useful to check whether the share price is too high, or too much expectation is built on the company.

For example TSH EPS is 7.6 sen last year. Its share price is 2.39 now. Using Graham's growth formula, Y=5, iteration of the formula to get the intrinsic value equals to its share price will yield a g of 18.5%. So do you think TSH's earnings can grow at 18.5% a year for the next 5-7 years? If so, the the share price of TSH may be reasonable.

For me, to grow at 18.5% for the next 5-7 years is not an easy feat. So I think the market is paying too much for TSH's expected growth.

More articles on Good Articles to Share

Created by Tan KW | Nov 02, 2024

Created by Tan KW | Nov 02, 2024

Created by Tan KW | Nov 02, 2024

Discussions

Any one can forward me the Cresbid IV calculator? My email is at kelvinongbk@hotmail.com

2013-08-26 15:32

I have said many times. Finance and investment is not that complicated. What TanKW has been posting are all about the fundamentals of finance and investment, academic as well as practical. They are really not that difficult to digest most of it if one takes the trouble and effort to do it.

2013-08-26 17:34

Tan KW, you have done a great job posting the stock picks by OBT and Kcchongnz .

Since I joined i3 and started reading the threads slightly more than 3 months ago, I find that you and the 2 sifus are real generous and very gracious in your sharing of time and effort.

I did make money from The info posted by the 3 of you.

Thanks again

2013-08-30 20:02

I also want to add that the strong exchange of words at times does provide some humour .to an otherwise sterile environment of figures and charts.

2013-08-30 20:08

TAN KW, OTB, KCCHONGNZ are the ones that I pay most attention to, thanks all along for all the valuable contributions. Like what someone said before, I say it again here, real gold is not afraid of fire, you are not afraid of fire, because you are the real gold

2013-08-30 20:19

kcchongnz

Tan KW has posted so many useful articles in i3. This is one of them. Not only that, he also incorporate other comments which are relevant. Just wonder (again) anybody read them or not. If a person trying to learn something about investment here but not reading articles posted by Tan KW, he would have missed heaps.

2013-08-26 13:37