A Guide to Reading for Investors (Plus, What Prof. Sanjay Bakshi Reads) - safalniveshak

Tan KW

Publish date: Mon, 04 May 2015, 05:19 PM

“I do not take a single newspaper, nor read one a month, and I feel myself infinitely happier for it. The man who reads nothing at all is better informed than the man who reads nothing but newspapers.” ~ Thomas Jefferson

Long time readers of Safal Niveshak blog and attendees to my investing workshops know my dislike for reading newspapers. The dislike is so deep that I’ve not had a newspaper subscription at my home for the past six years now, and neither do I consume news via electronic media. This also holds true of business television which I watch very occasionally and only when I want to get a hearty laugh and there’s nothing else that’s as funny on television at that time.

Now, one big reason I do not read newspapers is because I have a big problem with the fact that they decide for us what we should pay attention to and what we should ignore. It isn’t just the text of a news story that can mislead us; it’s also the choice of which stories get covered at all, and where they’re placed in the paper.

I know a lot of people who really believe that if a story isn’t covered in the first three pages of a paper, it isn’t worth knowing about it. To see how silly an approach this is, you need to only read, say The Times of India or Economic Times (two most popular English newspapers in India) from, say, ten or twenty years ago and ask yourself whether the events that ultimately proved to be important in the long run were consistently receiving prominent coverage at that time.

Were there front-page articles in 1995 or 2005 on build-up of subsequent economic and financial crises, air pollution, weather changes, oil, rise/fall of industries, or the rise of the consumerist Indian middle class? Occasionally perhaps, but for the most part the coverage focused on stories of more momentary interest, just as it does today.

I am not blaming the newspapers here. That’s their job to inform us about the day-to-day events, to entertain us, to reflect the public moods and sentiments of the moment, to print stories that will interest us today, and that we will want to read.

But that’s exactly what creates problems for readers of news, who are often fooled by recency and availability biases that newspapers help create.

Nassim Taleb wrote in The Black Swan –

Public information can be useless, particularly to a businessman, since prices can already “include” all such information, and news shared with millions gives you no real advantage. Odds are that one or more of the hundreds of millions of other readers of such information will already have bought the security, thus pushing up the price. I then completely gave up reading newspapers and watching television, which freed up a considerable amount of time (say one hour or more per day, enough time to read more than a hundred additional books per year, which, after a couple of decades, starts mounting).

Then, Taleb wrote in Fooled by Randomness that minimal exposure to the media should be a guiding principle for someone involved in decision making under uncertainty — including all participants in financial markets.

His key argument is that what is reported in the media is noise rather than information, but most people do not realize that the media is paid to get your attention –

The problem with information is not that it is diverting and generally useless, but that it is toxic…If there is anything better than noise in the mass of “urgent” news pounding us, it would be like a needle in a haystack. People do not realize that the media is paid to get your attention. For a journalist, silence rarely surpassed any word.

It takes a huge investment in introspection to learn that the thirty or more hours spent “studying” the news last month neither had any predictive ability during your activities of that month nor did it impact your current knowledge of the world. This problem is similar to the weaknesses in our ability to correct for past errors: like a health club membership taken out to satisfy a New Year’s resolution, people often think that it will surely be the next match of news that will really make a difference to their understanding of things.

You see, newspapers are like soap operas – you can go without seeing them for a few days and months and come right back in without missing a beat.

Just as fantasy typically substitutes for reality, news typically substitutes for insight – in both cases by diverting attention.

Another problem with news is that you don’t have any clue about the credibility and competence of the person who has created the news. The only thing you can be sure about the news is that every attempt has been made to appeal to your emotions and target your lizard brain.

So, What to Read?

I have lost count of how many investors have told me over the years that they never read anything apart from newspapers. They’re too busy to read books or even long articles, they say. In fact, most people I’ve encountered read very little (despite the fact that, as per a study, an average Indian reads the most in the world, at around 90 minutes per day, as compared to 68 minutes of an average Chinese and 48 minutes of an average American).

Now, the art of investing is not about figuring out what has already happened (that newspapers write about), but about anticipating the future that others will read about in the newspapers. And anticipating what lies ahead, writes Joshua Rogers in Forbes –

…requires a mixture of certain habits of mind. You need to foster imagination, thoroughly understand the origins of past ideas, learn from others’ mistakes, talk to lots of people about ideas and test your hypotheses against people both alive and dead.

Creativity doesn’t come from glancing quickly at your Twitter feed. It comes from deep thought. It comes from voraciously reading books – long books that require focused attention.

Reading books is a way for you to communicate with and learn from the best thinkers that are writing today and that have ever lived. Reading is a time machine that allows you to acquire wisdom from the past and to analyze and imagine another person’s vision of the future. This is the fuel for the creativity engine. It helps a great investor anticipate, analyze and avoid missteps.

Anyways, when people ask me what they should read to improve their investment thinking and/or to stay informed on the stock market, businesses, etc., the first thing I ask them to do is to avoid reading newspapers (the law of inversion, you see, of what not do).

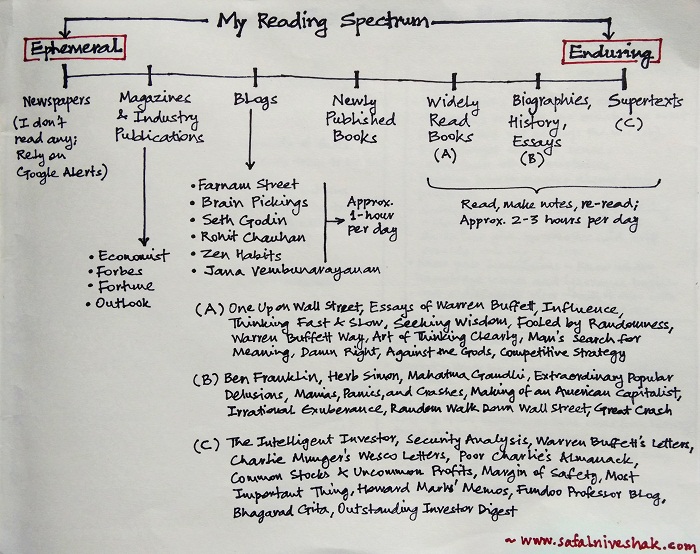

Then, if they are still interested, I tell them if they care less about signalling intelligence and connectedness, and more about understanding, then they should consider reading more and more things moving towards the Enduring side of my reading spectrum, instead of spending precious time on what’s Ephemeral –

[Click here to open a larger image]

Here, I am reminded of what Sherlock Holmes told his accomplice Watson in A Study in Scarlet –

I consider that a man’s brain originally is like a little empty attic, and you have to stock it with such furniture as you choose. A fool takes in all the lumber of every sort that he comes across, so that the knowledge which might be useful to him gets crowded out, or at best is jumbled up with a lot of other things so that he has a difficulty in laying his hands upon it.

Holmes added…

Now the skillful workman is very careful indeed as to what he takes into his brain-attic. he will have nothing but the tools which may help him in doing his work, but of these he has a large assortment, and all in the most perfect order. It is a mistake to think that that little room has elastic walls and can distend to any extent. Depend upon it there comes a time when for every addition of knowledge you forget something that you knew before. It is of the highest importance, therefore, not to have useless facts elbowing out the useful ones.

If you’ve been putting off reading books until after you’re wealthy and you have plenty of time, I think you’re getting it exactly wrong. Take the time you’ve been spending on newspapers, reality television and the Internet and dedicate that to reading a book. Expand your mind. You may find that snappy investment idea you’ve been dreaming of buried in its pages.

By the way, I posted a question to Prof. Sanjay Bakshi on what he reads and recommends. While you can see his book recommendations here, this is how he replied to my question.

Safal Niveshak: Prof. Bakshi, can you please outline what you read in terms of newspapers, magazines, blogs, books etc. and also what you recommend other investors to read to improve their investment thinking?

Prof. Sanjay Bakshi: I rank news beneath books. News stories often relate to things that are temporary and relatively unimportant whereas good books teach you about things that are long-term and important.

When some industry veteran writes a book on his industry and what he learnt by being a part of it for 50 years, he is unlikely to write about quarterly results.

So, nothing beats a good book on learning about the evolution of an industry. I have read and learnt from books on the history of denim, cotton, oil, organised retail, containers, banking, real estate, travel, the software industry, the airline industry, the steel industry and many others. (See the list of books at the end of this post)

One of the best sources for my learning is reading biographies and autobiographies of national leaders, scientists, entrepreneurs, and even germs. Yes, there’s a book for that!

Three books on Lee Kuan Yew I have read taught me more about management than perhaps any other book. (See the list of books at the end of this post)

As a student of Charlie Munger who advises developing a multi-disciplinary mind, I also love reading up books on subjects other than finance and business. Here’s one I am reading now. It’s a book on architecture and is titled “Structures: Or Why Things Don’t Fall Down.” The author writes –

A structure has been defined as ‘any assemblage of materials which is intended to sustain loads’, and the study of structures is one of the traditional branches of science. If an engineering structure breaks, people are likely to get killed, and so engineers do well to investigate the behaviour of structures with circumspection.

When we talk about structures we shall have to ask, not only why buildings and bridges fall down and why machinery and aeroplanes sometimes break, but also how worms came to be the shape they are and why a bat can fly into a rose-bush without tearing its wings.

Can engineers learn from natural structures? What can doctors and biologists and artists and archaeologists learn from engineers?

As I read these passages, questions come to mind. Questions like – “What can I learn about the business world from natural structures?” – and – “Is the connection between a strong architectural structure and a strong business model?” And as I think about these questions, I recall Warren Buffett’s words from his Columbia Talk “The Superinvestors of Graham-and-Doddsville” –

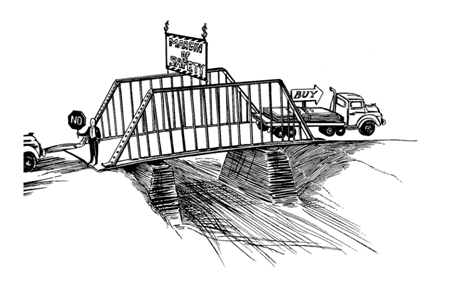

You also have to have the knowledge to enable you to make a very general estimate about the value of the underlying business. But you do not cut it close. That is what Ben Graham meant by having a margin of safety. You don’t try and buy businesses worth $83 million for $80 million. You leave yourself an enormous margin. When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000-pound trucks across it. And that same principle works in investing.

Aha! So there is a close connection between the idea of “margin of safety” in value investing and that idea in architecture. Even, the image above came from Buffett’s speech transcript.

And then I start thinking about what kinds of business models have inherent strength and I am immediately reminded of “strong capital structures.” That’s another aha moment.

It’s a lot of fun to do this — to find connections between seemingly unconnected ideas in different disciplines. I have found amazing connections relevant for understanding the world of business by reading up great books on other subjects. I cannot overemphasise the importance of this. I have learnt a lot about the world of business and investing by reading books on biology (especially evolutionary biology), psychology, physics (especially quantum physics), history, creativity, and even literary fiction.

Literary fiction?

Here’s a great book by a Harvard Business School professor who uses examples from literary fiction in his class. It’s called “Questions of Character: Illuminating the Heart of Leadership Through Literature.” He writes –

How does serious fiction help us understand leadership? The answer is simple but extraordinarily powerful: serious fiction gives us a unique, inside view of leadership. In real life, most people see the leaders of their organisations only occasionally and get only fleeting glimpses of what these leaders are thinking and feeling. Even interviews with executives have their limits. Executives say only so much, even when they want to be candid: sensitivities have to be observed, memory fades and sometimes distorts, and successes crowd out failures.

In contrast, serious literature offers a view from the inside. It opens doors to world rarely seen — except, on occasion, by leaders’ spouses and closest friends. It lets us watch leaders as they think, work, hope, hesitate, commit, exult, regret, and reflect. We see their characters tested, reshaped, strengthened, or weakened.

I think the author is quite correct on this point.

If you want to learn to empathise with an entrepreneur, read literary fiction. Most investors don’t do that and I think they miss something important. They form opinions about people who are out there creating wealth, sometimes in very difficult environment. They have no clue what it takes to get there. Reading literary fiction has helped me empathise with the people who run businesses. It has helped me understand that no one is perfect. People make mistakes and entrepreneurs are human beings and not machines programmed to “maximise shareholder value” for you all the time.

I also learnt to appreciate the wisdom of Ben Franklin’s advice on how to have a happy marriage –

“Keep your eyes wide open before marriage, half shut afterwards.”

Following that advice has helped me in dealing with situations where something is obviously wrong about a person but it’s not a big deal if you look at the overall situation. Indeed, some of my best performing investments have been made because the investment community took one little adverse thing about an entrepreneur and over-emphasised it. That created an opportunity for those who understand that no one is perfect and you should not look for perfection in business models and human beings who run them.

Here is another trick I accidentally discovered. It’s inspired by a Charlie Munger quote –

I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you.

So Charlie prescribes that you should go to bed a little wiser than you were when you got up that morning. That’s good advice. But what if you could go a step further? Can you become wiser between the time you sleep at night and wake up the next morning?

I found out that the answer is yes and the discovery is to do with the science of sleep. I found that if I read some random passage from a “super text” (e.g. some page from Poor Charlie’s Almanack, or some passage from the letters of Warren Buffett or Common Stocks and Uncommon Profits by Philip Fisher) just before I sleep, then while I slept what I had read does things inside my brain. When I wake up, I get fresh insights which I can use.

There is plenty of evidence which shows that sleep makes memories and associations stronger. And learning is about making the right associations. And we sleep roughly one-third of our lives. So why not use the time to become a bit wiser while we sleep?

So, books are my primary source of reading and learning from. But when it comes to news, I like to focus on corporate news not economic ones. I get that from multiple sources like Economic Times, Business Standard, Financial Express, Business Line etc. I never read the stock market pages or opinions on where a stock or the market is headed.

One source from where I don’t get my news is the TV. I don’t have one in my home or my office. I am so biased against TV that I agree with Andrew Ross who said that “the smallest bookstore still contains more ideas of worth than have been presented in the entire history of television.”

There are ways to create your own news. Investors should understand that the best news will almost certainly not be handed over to you on a platter. You are not likely to see headlines like “Prem Watsa Buys Into Thomas Cook India and Will Transform it Into a Value Creating Acquisition Machine.” Those type of news, or, rather insights come from reading stuff like transcripts of annual meetings, stock exchange announcements, annual reports and connecting the dots.

The idea of connecting the dots is, of course, a very powerful idea and is identical to Charlie Munger’s idea of maintaining a checklist of mental models. One of Charlie’s favourite authors is Herb Simon who gave him the idea of mental models. Simon wrote –

One can train a man so that he has at his disposal a list or repertoire of the possible actions that could be taken under the circumstances…A person who is new at the game does not have immediately at his disposal a set of possible actions to consider, but has to construct them on the spot – a time- consuming and difficult mental task.

The decision maker of experience has at his disposal a checklist of things to watch out for before finally accepting a decision. A large part of the difference between the experienced decision maker and the novice in these situations is not any particular intangible like “judgment” or “intuition.” If one could open the lid, so to speak, and see what was in the head of the experienced decision-maker, one would find that he had at his disposal repertoires of possible actions; that he had checklists of things to think about before he acted; and that he had mechanisms in his mind to evoke these, and bring these to his conscious attention when the situations for decisions arose.

Most of what we do is to get people ready to act in situations of encounter consists of drilling in these lists into them sufficiently deeply so that they will be evoked quickly at the time of the decision.

Simon is very right on that. Over time, I think one can train oneself to connect the dots, to recognize patterns that matter. The process is a lot like what you wrote in your recent excellent blog post on Sherlock Holmes using Peter Bevelin’s wonderful book as your guide. Bevelin writes –

When an event differs from what Holmes expect, it draws his attention — What is out of the ordinary or atypical?

The absence of something we expect to see or happen is information and a clue in itself.

“Is there any point to which you would wish to draw my attention?”

“To the curious incident of the dog in the night-time.”

“The dog did nothing in the night-time.”

“That was the curious incident,” remarked Sherlock Holmes.

How can we use this example? Let me tell you how. Imagine that there is a commodity industry whose profitability is highly volatile because the price of the raw material it consumes is quite volatile. When the raw material price rises, the profitability of the industry falls dramatically because the industry has little pricing power. But then you notice that there is this one business in that very industry who is like Sherlock’s dog who doesn’t bark – it’s profitability is not impacted at all. Now, isn’t that amazing? Isn’t that worth investigating? I think it is.

So you put on your detective hat and ask why is this business different? And if you keep doing this, once in a while you’ll find a pattern that’s different for one or more very good reasons which you understand and which you think are sustainable.

This is how you stumble upon treasures. You are, in a way, like a treasure hunter or a detective who is really looking for unusual patterns that kind of stand out and that would make someone like Sherlock Holmes stop and think. And in world of stock picking, there are all kinds of unusual patterns that are worth investigating but trust me, you are not likely to find them reported to you in a newspaper. You have to do your own digging and thinking and that’s why I think Peter Bevelin’s book is a must read for investors.

Instead of reading newspapers a lot, I create Google Alerts on businesses I track so a lot of the stuff comes automatically. I glance through the links and open them only if I think they might contain some useful information relating to long term prospects of the business.

I love reading interviews of entrepreneurs and CEOs about their businesses and their own journeys. The more detailed the better. For example take a look at the quality of management interviews Donald is publishing on ValuePickr. They are astonishingly detailed and excellent in my view. Sometimes, there are business magazines like Forbes India, Business India, Outlook Business which also contain excellent interviews.

Amongst international publications I subscribe to Financial Times, Economist, Wall Street Journal but I have to confess I don’t get to read them every day. There is too much content in them and if books have to take priority, then one has to make compromises.

Another form of “news” comes from reading annual reports of portfolio and non-portfolio companies. Just reading through the letters of the CEO and the Management Discussion and Analysis section of the annual report and then relating what is being said in those sections to the underlying fundamental performance of the business tells me a lot more than newspaper stories typically do. This is an incredible source of knowledge.

My friend Ravi Purohit not only reads up the reports of portfolio companies but if they happen to be subsidiaries of a MNC, he would read up the parent company reports too and even get on analyst conference calls with senior management of the parent and ask questions about their India plans.

I illustrate this as an example to tell your readers that no one is going to hand the really important “news” to you on a platter. You have to go out and get it on your own, ethically and there are many ways to do that and I just cited one. Another one is to use government databases such as ones maintained by Ministry of Corporate Affairs. You can learn a lot about the economics of a business by downloading the filings made by competitors even if they are privately owned corporations.

My ex-student and colleague Ankur Jain is one helluva detective who has filed RTI applications to get valuable information to help him think about a business. Anyone can do that. But most people don’t.

I also read a lot of blogs on high quality businesses including blogs on businesses which are outside India like Andy Berger’s Punch Card Investing, Rohit Chauhan’s blog, and Amit Arora’s blog called Long Term Equities. This gives me exposure to business models which don’t exist in India or in some cases are behind India (for example Amit often writes about businesses in frontier markets). I also love the Farnam Street blog for developing wisdom. I think everyone should read that blog.

I also get mails and comments from my blog followers, followers on twitters, fans, ex-students and peers in the value investing world. Sometimes I get a mail or a comment that offers a very different perspective than my own with sources quotes so I go and read up those too. It’s very important to read views that oppose your own views and have been well argued. When I find someone who disagrees with me and presents good arguments, I want to connect with him or her and take the dialogue forward in a respectful manner.

Twitter followers also sometimes send links to stuff I would never have gotten access to and which give me new perspectives.

Safal Niveshak: Wonderful, Prof. Bakshi! Thanks for your recommendations on what to read.

Prof. Sanjay Bakshi: My pleasure, Vishal!

Anyways, here is what Prof. Bakshi shared with me – a note from Rolf Dobelli on why you must avoid news.

“News is to the mind what sugar is to the body,” Dobelli writes.

I have nothing to add.

http://www.safalniveshak.com/guide-to-reading-for-investors/

More articles on Good Articles to Share

Created by Tan KW | Aug 26, 2024

Created by Tan KW | Aug 26, 2024

Created by Tan KW | Aug 26, 2024

Created by Tan KW | Aug 26, 2024

Created by Tan KW | Aug 26, 2024

Created by Tan KW | Aug 26, 2024

.png)

bgoon99

add one more to the list -- Annual Reports

2015-05-04 18:30