AWC Berhad is an investment holding company specialising in quality engineering services. AWC provides total asset management services such as integrated facilities management and engineering services to building owners[1]. AWC is involved in 4 major industries, namely facilities, engineering, environment and investment holding. Let's understand the business model of AWC before we go into more in depth details of it.

AWC is the only company who provides solution for Integrated Facilities Management (IFM) in Malaysia. Some examples for IFM, the autopay for parking at the entrance, cleaning housekeeping (pest control), Computerized Maintenance Management System (CMMS), energy and utilities, etc. Basically all new buildings will need the service of IFM in new projects. And AWC is the premier provider of total asset management and provides "one stop" integrated facilities management services. Next, AWC provides integration of key facility systems that manage electrical distribution, lighting, air conditioning and security. Basically, they supply the engineering section for the buildings, for example, civil structural, control systems, heating ventilating and air conditioning system (HVAC), building automation system (BAS), utilities, mechanical and electrical for the building.

|

|

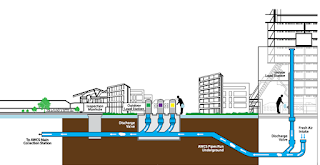

STREAM AWCS (Automated Waste Collection System) |

Next, the environment sector. AWC also provides design, engineering and supply of STREAM Automated Waste Collection System (AWCS) to transport municipal solid waste via pipes to a central waste handling facility where it is collected and compacted into sealed containers that are then removed periodically. Basically this STREAM AWCS had resolved 2 major problems about wastes, which are irregular collection schedules of wastes and spillage of wastes from garbage trucks. The AWCS is widely used in a few countries and their projects. Just to name a few projects, In Malaysia (M-Suites Ampang, Lakeville Residence, Iskandar Residence, NU Sentral, KL Sentral, KLIA 2 Integrated Complex) Singapore (Changi General Hospital, Changi Airport Terminal 3 & 4, Resort World Sentosa) United Arab Emirates, Qatar, China and Hong Kong[2].

In short, AWC provides a dragon-full-set facilities to the buildings. From the engineering of air conditioner, to the facilities of CCTV security, to the waste management system, AWC integrated all of the facilities, engineering and environmental issues in IFM (Integrated Facilities Management). They are also pioneering into energy conversation. They provides pro-environment solutions, or another word, green environment, which is aligned to the Governments requirement. Even in the first page of their website amazes me, the slogan, TOWARDS SUSTAINABLE GROWTH... Going to Preferred Heights... such ambitious and charismatic slogan...

|

|

Summary of AWC Business Model[1] |

1) Fundamental Analysis:

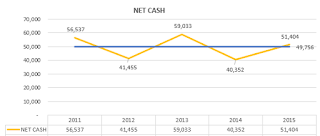

AWC is a net cash company, with net cash per share of around 0.22. Nothing much to be highlighted on the fundamental of the company. Revenue and net profit are both increasing, since suffering a 28% and 61% decrease in revenue and net profit respectively. The book value for AWC for the past 3 years ranges from 0.42 to 0.52, which might prompt the price to go up again, to its supposed value.

In their Annual Report 2015 which had just being released last few weeks, a few key highlights can be monitored. The Environmental Division (63%) contributed the most to AWC's profit, followed by Engineering Division (23%) and Facility Division (14%)[3]. There is a good write-up from Sherlock, you can refer to my source number [5]. In the Facilities Division, the current interim agreement had expired on 31 August 2015 and they were expected to sign new interim agreement after they obtained the approval from the Government for the maintenance of all the buildings covered under the Concession from 1 Sept 2015 till 31 Dec 2015[3]. And i am quite sure that they had managed to secure the contract.

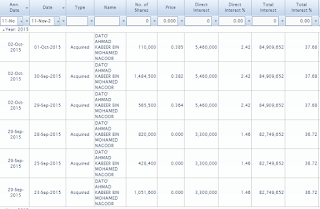

By looking at the announcement, their managing director Dato Ahmad Kabeer had been accumulating AWC from September 2015 to October 2015, exactly after the contract expired on 31 August 2015. He had

acquired 4,461,000 shares with the average price of around 0.380. Mr Tan Siew Kheng and Mdm Soo Chow Mei also disposed their shares, but not to worry as the number of shares are not much. Another possible reason Dato Ahmad Kabeer is collecting might be because of the

acquisition of Qudotech SB (plumbing industry) and DD Techniche SB for the

Engineering Division.

Qudotech had been a premium plumber in the construction industry whereby it had undertaken many plumbing jobs for the high rise buildings. As for DDT, it is one of the four players involved in the selling and distributing of Rainwater Harvesting Components and Products (RHCP). When we mention there are only 4 players, meaning to say the competition is lessor. DDT designs, sells and installs the RHCPs for the buildings. The Federal Government had gazetted a law requiring the incorporation of Rainwater Harvesting Systems in all the relevant buildings. 6 states in Malaysia had incorporated the requirements of RHCP under the local council laws. DDT is well poised to take advantage of the increased implementation of these laws[3]. Lets assume another few states will be implementing on this, AWC will definitely benefit from there. Both Qudotech and DDT will provide a collective profit guarantee of RM3.9 million per annum for 2 financial years ending 30 June 2017. So roughly in FY2016 and 2017, we will notice the additional RM1.8 million for each years. In April 2015, AWC undertook the Xiamen University Project in Dengkil, Selangor for all the air conditioning works and recently they accepted the award for air conditioning for Capital 21 project in Johor and will commence in the last quarter of 2015.

The biggest contribution coming from the Environment Division. AWC secured several projects locally and internationally (Singapore, Hong Kong, Middle East) with their STREAM AWCS system. A thing to note here is, they had diversified their income base to recurring income by securing the Operations and Maintenance for the majority of their projects. AWC needed to ensure their systems continue to run efficiently and cost effectively well into the future, and i think that since they are the only company doing that business, the clients will not hesitate to have them as their maintenance contractor.

To calculate the possible Target Price for AWC in 2016, by considering the RM1.8 million from the new subsidiaries:

a) Net Profit for 2016: Average of 3 years 2013, 2014 and 2015 = RM6,500k + RM1,800k = RM8,300k.

b) The number of shares remain the same (following the 2015 Annual Report) = 225,352k shares

c) Average PE for 3 years: 12, lets take a range from 12 to 15

d) Target Price = PE (12 - 15) x EPS (8,300k / 225,352k) = ranging from 0.44 to 0.52

So our Target Price will be around 0.44 to 0.52, hmm, seems achievable. (Just a rough guide with plenty assumptions made).

2) Technical Analysis:

As for chart wise, there is a double bottom breakout at 0.38. I also notice there is a cup with handle at around 0.38 and 0.39. The chart is moving just nice, today even though the market is dropping, same goes to AWC. But it rebounded once it touch the middle band 0.395. With Dato Kabeer expecting good results

Summary:

AWC definitely had a lot of good looking prospects as they secure more contracts and because of their business model. I believe AWC deserves an awakening call due to:

- A complete integration for new buildings, from engineering to waste, through integration between facilities.

- Net cash company which will settle the wear and tear of the buildings.

- Completed a few big projects locally and internationally, aiming for the recurring income from Operations and Maintenance.

- Environment Division will continue to excel with the STREAM AWCS technology and acquisition of 2 new subsidiaries Qudotech and DDT to boost up the Engineering Division by RM1.8Mil FY 2016 and 2017.

- Heavy acquisition by AWC MD in September to October, coincidently after the 31 August 2015, which might be the secure of Concession Contract for the Facilities Division.

- The estimated Target Price of fundamental and technical ranges from 0.43 to 0.50, which is achievable provided the market sentiment is normal.

- Q1 of 2016 to be announced in this month, signs of advance movement had been spotted.

AWC's an AWaCkening call? Your call...

Gainvestor short term TP: 0.48

Let's Ride the Wind and Gainvest

Gainvestor 10sai

11 November 2015

10.55pm

Sources:

[1]: http://www.awc.com.my/index.php/about

[2]: http://www.stream-environment.com/

[3]: Annual Report 2015

[4]: Q4 2015 Report

[5]: http://klse.i3investor.com/blogs/sherlock/85809.jsp

yctee

Thanks. very informative

2015-11-12 08:52