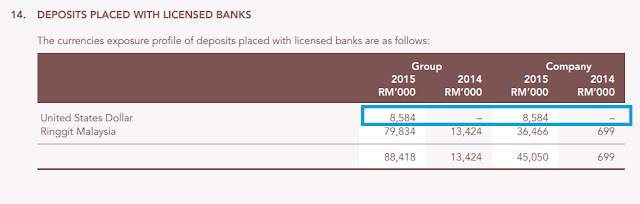

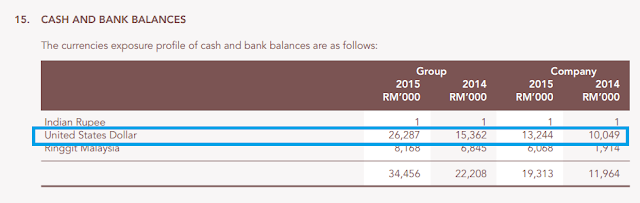

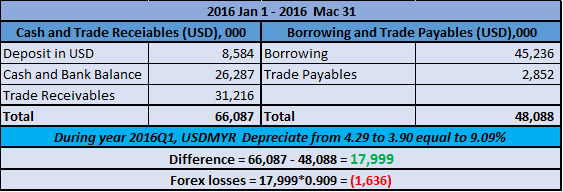

因为公司的盈利大爆发,所以HEVEA在2015年的美金现金从15.362 mil进步到26.287 mil。

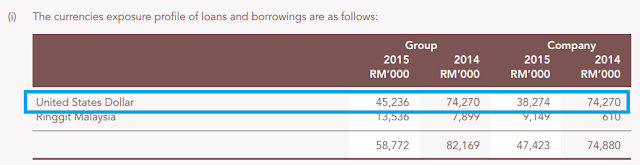

而美金债务从2014年的74.27 mil减低到45.236 mil, 总债务也价绍了接近24 mil。因此公司也从负债股变成了Net cash company。

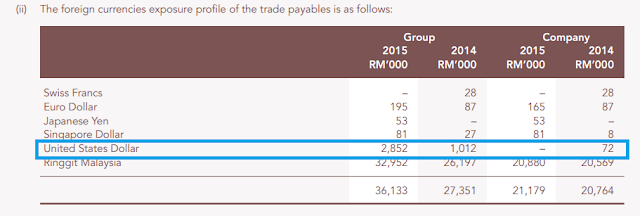

公司的Trade payable其实很少,只有2.852 mil。所以公司大部分的成本都是来自马币,也就是赚美金还马币的意思。

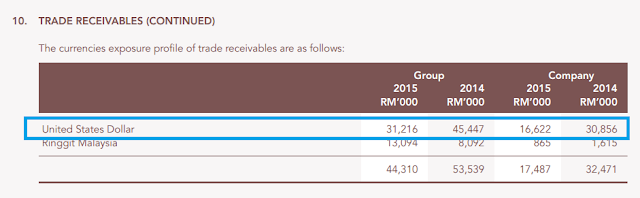

而Trade Receivables有31.216 mil是以美金结算,2015年收回了不少账目。Trade receivables介绍了9 mil左右。

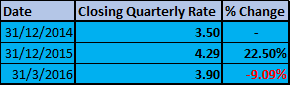

上图是美金兑换马币在2014年底,2015年底以及2016年3月31日的汇率。2015年马币上涨22.5%,2016年3个月里下跌了9.09%左右。

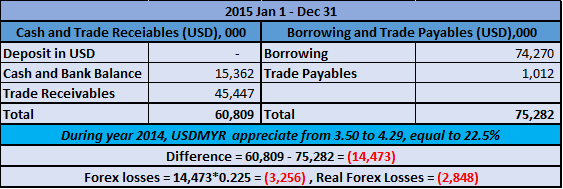

为了方便大家阅读,我把2015年以及2016年3个月里的美金现金+债务的数据放进了以下两个图表。

在2015年1月1日,公司拥有60.809 mil的USD现金+ Trade Receivables(别人欠公司的钱), 美金借贷高达74.27 mil,美金Trade Payable(欠别人的钱) 只有1.012 mil。

在笔者计算外汇盈利/亏损之前,大家要明白:

- 当公司拥有大笔美金现金的时候,美元上涨代表转换成马币会增加,所以造 成Forex Translation Gain。反之,如果美金下跌,公司拥有大笔美金资产以及现金,那么就会蒙受Foreign Currency Translation Loss, 最佳例子: FLBHD.

- 而当公司有大笔美金债务,美金上涨代表unrealized forex losses增加,反之unrealized forex gain增加。

来到了2016年,笔者以为美金下跌,HEVEA应该会受益了吧。但是仔细算了之后,发现HEVEA还是【可能】会蒙受外汇亏损。

原因是因为HEVEA赚了很多钱,所以美金现金增加了不少,过后2014年又减少接近29 mil的美金债务。所以2015年12月31,HEVEA的USD现金 多过美金债务。

大家看看上图,美金在1 - 3月下跌了9.09%,扣除了美金借贷以及美金Trade Receivables,HEVEA还多出了17.999 mil美金资产。结果美金今年下跌,所以又再度蒙受外汇亏损。

所以笔者预测HEVEA【可能】会蒙受1.5 mil - 2mil的Forex losses。不过以HEVEA上个季度高达25 mil的盈利,1.5 - 2mil的外汇亏损是可以接受的。假设笔者算错就更好,HEVEA如果有外汇盈利当然是好事,但是看来机率不大。

上个季度HEVEA在美金巅峰的Net Profit是25 mil,这次美金下跌以及少许的外汇亏损。所以几个mil的外汇亏损应该不会把盈利拉低太多。

如果笔者的【估算+预测】是正确的,那么HEVEA也够可怜的。不过美金起获跌都亏钱,但是还好亏不多。共勉之。

以上纯属分享,买卖自负。

Harryt30

moneySIFU

有头咸鱼在那里游泳,吓得所有的人都不敢下场,哈哈

2016-05-24 16:20