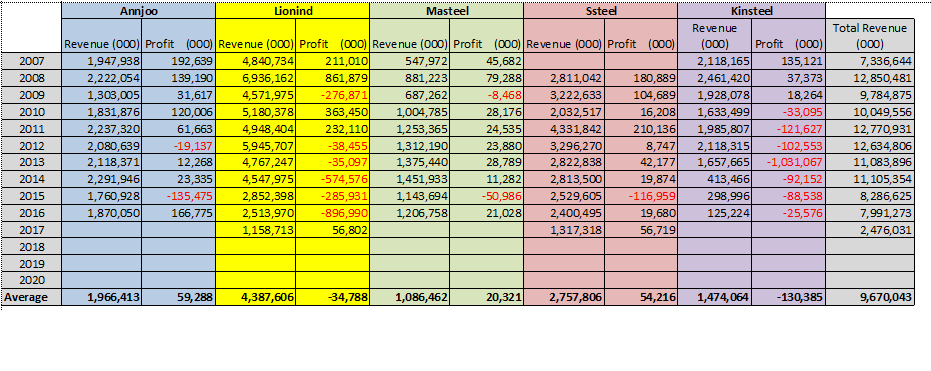

以最近两年来说,2015和2016

大马本地长钢商的市场销售大约是80亿。

以最简单的算法,今年可以有10%的净利。

80亿就是净利8亿,给4家主要长钢商分吧!

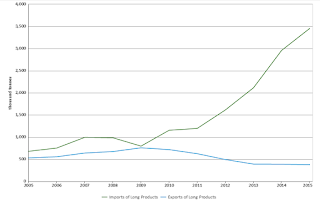

以2014年来说,大约35%的长钢是进口的。

2015是灾难的一年,比例高于2014。

出口长钢少得可怜!

2016年改善了一些。

2017年也就是今年,随着保护税正式执行3年,

长钢进口会被压制到最低的程度。

所以,这些需求将会被本地厂商的产量给补上。

产量增,通常生产成本除以单位下跌,所以盈利就会上。

加上,保护税使得长钢成为卖家市场。

所以,会有双重的盈利出现!

由于2016年的统计还未出炉,

我们以2015年的长钢进口量来计算。

大约进口3500千吨的长钢。

假设2017年把进口压低至1500千吨进口,

而2000千吨跟大马本地购买。

以平均RM2100 每吨来计算,

那会是42亿的额外销售。

以近两年的RM80亿本地厂商销售,

加上RM42亿,

那2017,2018,2019,

大约本地长钢销售会上升到120亿左右。

以10%净利来计算,就是12亿吧。

2017年,4家长钢商分享。

2018之后,多了一家联钢分享。

总体来说,足够喂饱饱这5家本地长钢商了。

cooling

there is an upcoming dividend of 9 cents in May for Annjoo...and dividend will grow significantly this year with govt protection....Buy!

Ann Joo reported 2016 revenue of RM1.9b and core net profit of RM154.1m. Fullyear dividend is 15 sen, which implies a 45% dividend payout ratio. For 2017, we expect Ann Joo to deliver better results, primarily on higher ASP (arising from higher local demand and absence of cheap imports) and favourable raw materials prices. Maintain BUY with a higher target price of RM3.15.

https://klse.i3investor.com/servlets/staticfile/297992.jsp

2017-04-14 07:08