Article in The Star, one snippet:

"Hibiscus should not only be applauded for being the first SPAC, but also a successful one."

I have been rather sceptical in the past about SPACs in general and Hibuscus was no exception.

Below is the share graph since inception, it shows a rather wildly fluctuating price, from initial RM 0.59 to RM 2.68 crashing down to RM 0.16 and up to its current price of RM 0.98. A rather bumpy ride for a stock that was perceived to be rather speculative.

If we dive into the latest quarterly financials then we notice the following:

In other words, despite being listed for almost seven years and having received more than seven hundred million of shareholders capital, the company still has not shown a profit overall. That does not seem to be impressive, simply putting the money in a Fixed Deposit would have yielded something like RM 200 Million in interest payments.

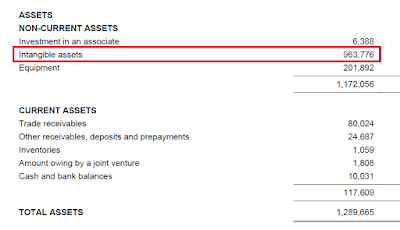

One should also take note that three quarters of its assets consists of intangible assets. An investor should deep dive in the nature of these intangible assets to check if any of them should be revalued.

So is Hibiscus indeed a successful SPAC, as The Star wants us to believe? Looking at the results delivered so far the answer has to be negative.

.png)

supersaiyan3

Fair enough!!

2018-02-26 10:50