Kinergy Advancement Bhd (0193) - On the cusp of a multi-year, multi-bagger re-rating cycle

Axcapital

Publish date: Wed, 21 Aug 2024, 11:14 AM

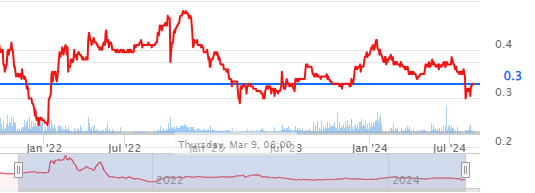

KAB is a familiar small-cap name - this sustainable energy solutions (SES) company evokes strong emotions among investors. The stock has been on a roller-coaster ride in the past two years, oscillating between 25 and 48 sen.

Back in 2022, irrational exuberance in the green energy space drove KAB’s price to 48 sen, valuing it at 342x FY22 P/E! This was clearly unsustainable as KAB had only just embarked on its transformational path from engineering services to the SES space. Investors lost money, and many never forgot that episode.

Fast forward 2-years, some investors still hold a pessimistic view on the stock. However, KAB has grown leaps and bounds, executing its growth strategies quietly. Core net profit has exploded from RM2.8m in FY22 to RM4.1m in FY23 and RM10.5m in 1HFY24 (implying full year FY24 net profit of at least RM20m). From a valuation standpoint, its historical P/E has therefore dropped massively from 342x in FY22 to 84x in FY23 and FY33x in FY24F. The solar sector (Solarvest, Samaiden and Sunview) currently trades at an average P/E of 33-36x. So KAB is no longer expensive as it is trading in line with its sector peers.

Outlook

KAB’s 2QFY24 press release paints a very rosy and bullish outlook by management. With 1HFY24 revenue and net profit surging 256% and 78% yoy respectively, driven by new projects in the SES segment, management shared that “it expects a continued upward trajectory in its financial performance that could double in FY24 vs FY23”. KAB further expects “a substantial uplift in profits for FY25”

While KAB did not reveal the quantum of growth for FY25, we can surmise that the 2023 award win of RM230m by Petronas Gas for the 52MW gas-fired power plant in Sabah will be the main driver of profits. From its Bursa announcement dated 3 Jan 2023, the contract runs from 2Q2023 – 1Q2026. Based on Axcapital’s experience as a contruction analyst, we can therefore expect peak revenue and profit recognition in FY25.

Assuming net profit growth of 50-100% in FY25, KAB could report anywhere between RM30-40m in FY25. Pegging a solar sector average P/E of 33x, this would imply a fair value of between 50-66 sen (potential share price upside of 50-100%).

Catalysts

What catalysts could realise this upside potential?

1. In Axcapital’s experience, as KAB’s quarterly net profit trend continues delivering consistently, it will attract analysts’ attention in the sector. KAB currently has zero analyst coverage. Any signs of interest in the analyst community could spark a massive share price re-rating, especially given the still-pessimistic sentiment on the stock.

2. Favourable government policy in the green energy space. As Malaysia embarks on its National Energy Transition Roadmoap, Budget 2025 on 18 Oct 2024 could see government incentives for the sector. This will boost investor sentiment in the space and KAB could be a huge beneficiary of this newsflow.

3. Short squeeze. KAB attracts some Intraday Short-selling interest among day traders. However, if the factors above come into-play in KAB’s favour, these short sellers could be squeezed to cover or at least cease to short sell KAB stock. After all, shorting companies that are growing 50-100% annually is a dangerous trading proposition!

Just to share some parting wisdom - what stood out in 2QFY24 press release to Axcapital was management’s extremely bullish outlook going forward. This is a rarity in our experience as most company’s management teams are always at-best cautiously optimistic in nature. This implies tremendous upside in its profit potential not-yet expected by the market. If we justapose this against market sentiment that appears to still negatively appraise the company’s prospects, any slightest positive perception change (which we believe will happen eventually) could spark a major rally in KAB’s stock. As Warren Buffet likes to say, “Be greedy when others are fearful”.

Happy investing.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Axcapital's investment blog

Created by Axcapital | Oct 17, 2021

Created by Axcapital | Sep 25, 2021

.png)

.png)

Dkk08

Long waited article from AC.. hope to read more of your articles.. TQ

4 hours ago