TEE's FAMILY LOSING GRIP

kokokai1993

Publish date: Tue, 15 Jan 2019, 12:33 PM

BPURI - TEE's FAMILY LOSING GRIP

With the recent headwinds of Bina Puri unable to carry forward its special resolution due to failure of obtaining the 75% voting for the special resolution, we can suspect there is something fishy going on in the board.

Firstly, Bina Puri announced the proposal on 28 August 2018 which contains “Proposed Acquisition” and “Proposed Amendments”.

The proposal mainly sums up to tell us that Bina Puri is in consideration of purchasing 54.50% equity interest of Ideal Heights Properties Sdn Bhd (IHP) by issuing ordinary shares and new redeemable preference shares at an issue price of RM0.2498.

To let you readers to understand better on this proposal, I have done some summaries on the acquisition proposal.

1) In order to purchase 54.50% of IHP, Bina Puri has to acquire 2,477,108 ordinary shares of IHP

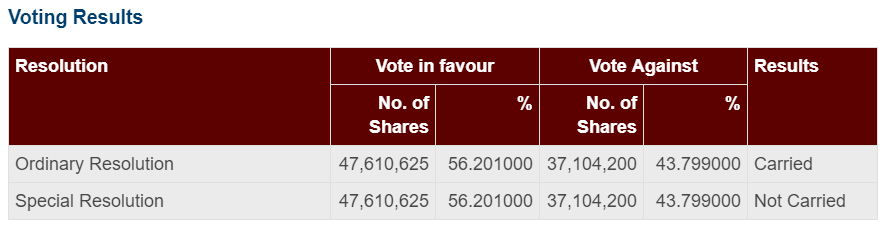

Ordinary Resolution - Proposed Acquisition – Required majority vote of 50% (passed)

Total Cost - RM 42,682,343

2) How to get their funding?

Special resolution - Proposed Amendments – Required majority votes of 75% (failed)

I) Issuance of new Bina Puri shares @ 95,112,573 shares which could help Bina Puri to gather a sum of RM23,759,121

AND

II) Consideration RPS at an issue price of RM0.2498 – a sum of RM10,110,565 (in details please refer to Bursa)

III) Retention RPS at an issue price of RM0.2498 – a sum of RM8,812,657 (in details please refer to Bursa)

TOTAL – RM 42,682,343

Take note that without both proposals approved, this acquisition would not be succeeded.

3) What’s the outcome of EGM?

The outcome of the meeting was unexpected, as the special resolution was failed to go through.

Below is the results of the EGM:

Well, this is something worth looking into it.

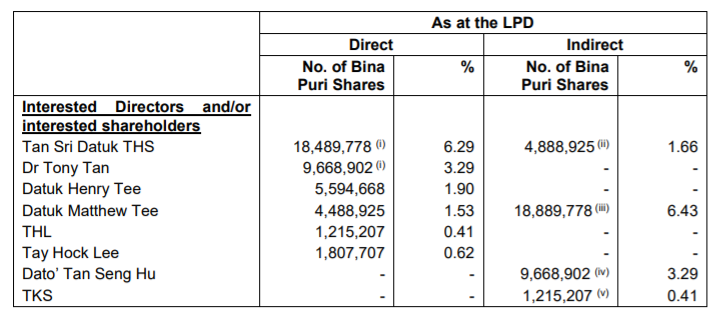

Let us go through the board ownership in the Company first….

If you calculate the directors and controlling shareholders ownership, based on the picture above, it will total up to 15.7%. Obviously, this indicates us that the Management do not have sufficient ownership to pass the resolutions themselves and they need other shareholders’ support.

Looking at a bigger picture, we believe that the controlling shareholders would have considered the success rate. Retail investors would have mostly thought that the acquisition will go through as they assume discussion had held within the board with the votes they had in hand for a win.

Unfortunately, the outcome was out of expectation. As the result, the special resolution for the company to obtain funding to activate the acquisition was not approved.

So what happened?

There were a few possibilities.

- Retail shareholders did not agree to this acquisition:

This possibility is quite unrealistic as normal shareholders are hoping for wealth maximization. Moreover, we can see that this acquisition is a growth driver for Bina Puri– which is a good thing isn’t it?

Besides that, looking into the votes casted in the EGM, it didn’t seem like retail investors were rejecting the resolution. Retail investors normally do not attend general meeting, and now they are against both resolutions. Another point to take note, the 37million shares against the resolutions is close to 10% of total outstanding shares.

- There is civil war happening right now in the board:

Why do I say so?

Well, looking at the votes involved in the EGM, there were about 85million of shares (22% of the total outstanding shares) being casted in the EGM.

Wow, the Management owns 15.7% shares and 10% of the total outstanding shares were against the resolutions. What does this mean?

We believe that there is a board tussle in Bina Puri right now! It looks like another party with substantial shareholding is emerging.

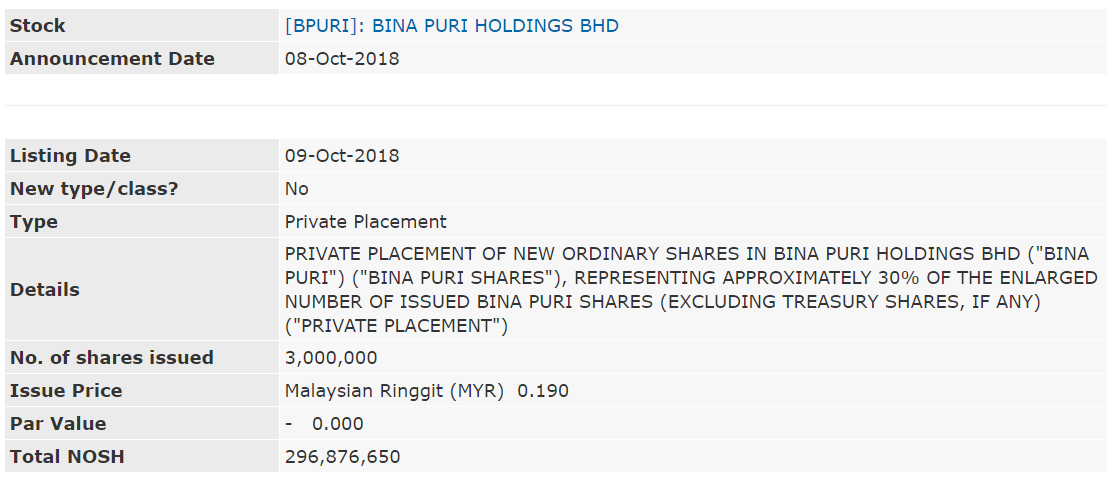

Tracing back to one to two months earlier, there were private placements which actually caught our attention. In this case, we see the placements could actually be related to the failed resolution.

There were total 3 tranches of private placements:

1st Tranche

2nd Tranche

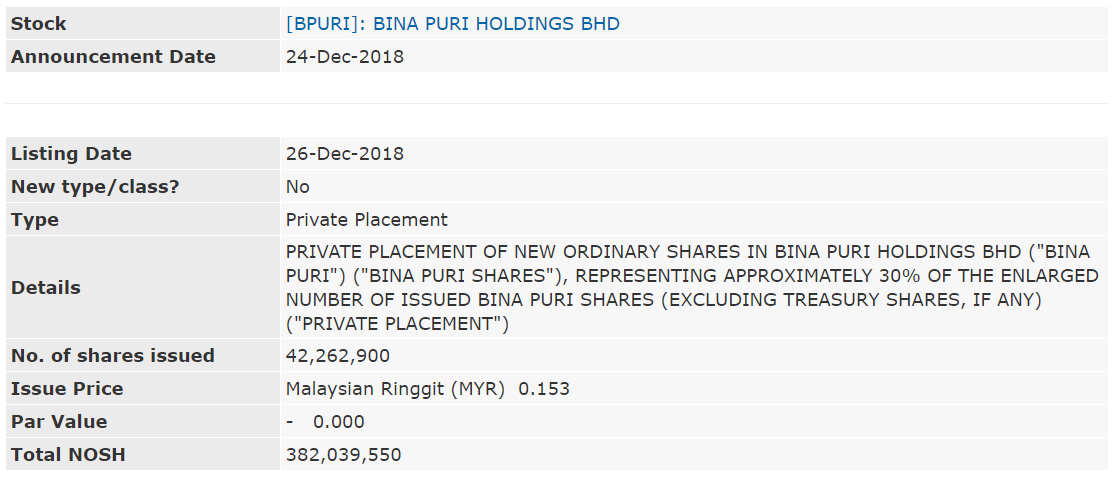

3rd Tranche

For your information, the EGM meeting were carried out on 24th December 2018.

So, you can see that almost 16% of the new shares were issued prior to the EGM.

Doesn’t get the linkage yet?

Let’s see:

- Controlling shareholders wanted to increase their shareholdings in the Company to ensure a successful EGM

- In order to do so, they had private placements prior to the EGM

- However, outcome wasn’t expected

- There is a possibility that the Board and Management team were misled and some parties in the board were planning to go against the resolutions

- The parties with hidden agenda are going head to head with the controlling shareholders now!

In order to bring down the proposals, the dark side (currently among the board and owns a certain percentage of shares) may have more shares now or on boarded some new alliances via the new private placements.

As the issued new placement shares are representing approximately 30% of the total outstanding shares, we should be worrying on how much shares are two parties owning right now.

Well, Well, Well, now everything has linked up right?

Looking at all these factors and events, we guess a board tussle is happening in Bina Puri.

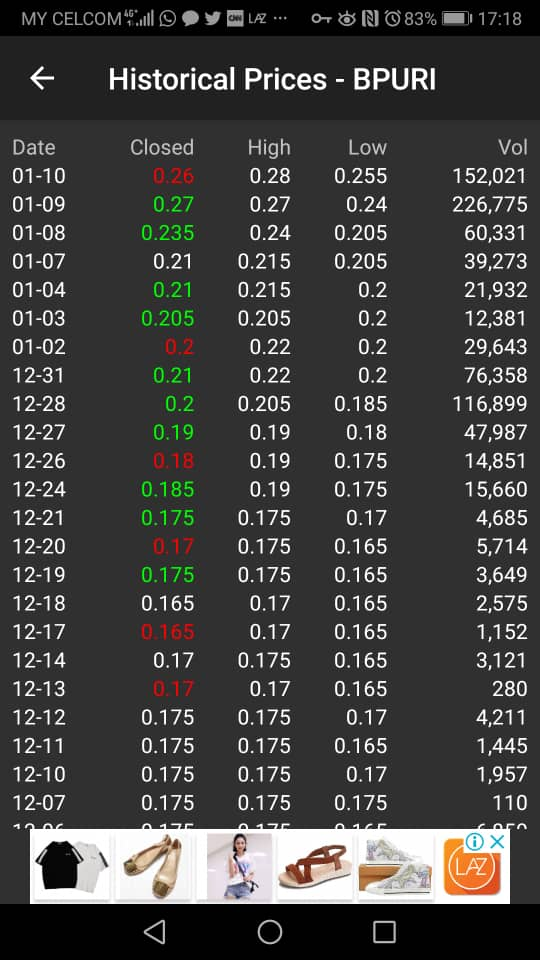

On a side note, share prices were also surging after the meeting. Failed EGM – a negative news and now the share price is moving upwards????? What?

Jesus Christ, from RM0.165 to RM0.26! (Without any significant catalyst/news)

So, what’s your view on this?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on BBBkkk

Created by kokokai1993 | Mar 17, 2019

.png)