Why Hibiscus Share Price Fluctuates - Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 13 Jan 2019, 10:06 AM

As you know, I have posted my buy recommendation on Hibiscus Petroleum a few days ago on my blog and on i3investor.com. I also recommended it during my talk to 750 young investors at Ideal Convention Centre Shah Alam, KL yesterday.

As a result of my recommendation, many readers who have bought it would ask me why the price came down. When the price went up, buyers would not ask nor they would thank me. A few critics, would always say that whenever I recommended any stock, they would sell because they did not believe my honesty. Fortunately, the daily traded volume is several million shares, these small punters would not affect the share market.

Although Hibiscus’ production cost is only about US $18 per barrel, its share price fluctuates because investors always look at the oil prices to decide to buy or sell. That is why the share price fluctuates.

It EPS for the last 4 quarters from 31 Sept 2018 to Dec 2017 were 6.3 sen, 6.22 sen, 5.26 sen and 0.72 sen, totalling 17.9 sen.

If you examine the share price chart and the oil price chart carefully, you will notice that the share price varies according with the oil price.

However, just based on the EPS for the last 4 quarters of 17.9 sen and its share price at around Rm 1.00, it is selling at 5 P/E.

Since the company is cash rich, I think it is a good buy because it has reasonable profit growth prospect which is the most powerful catalyst to move share price.

Remember you readers and small punters buy or sell does not affect the share price because the daily volume traded is several million shares

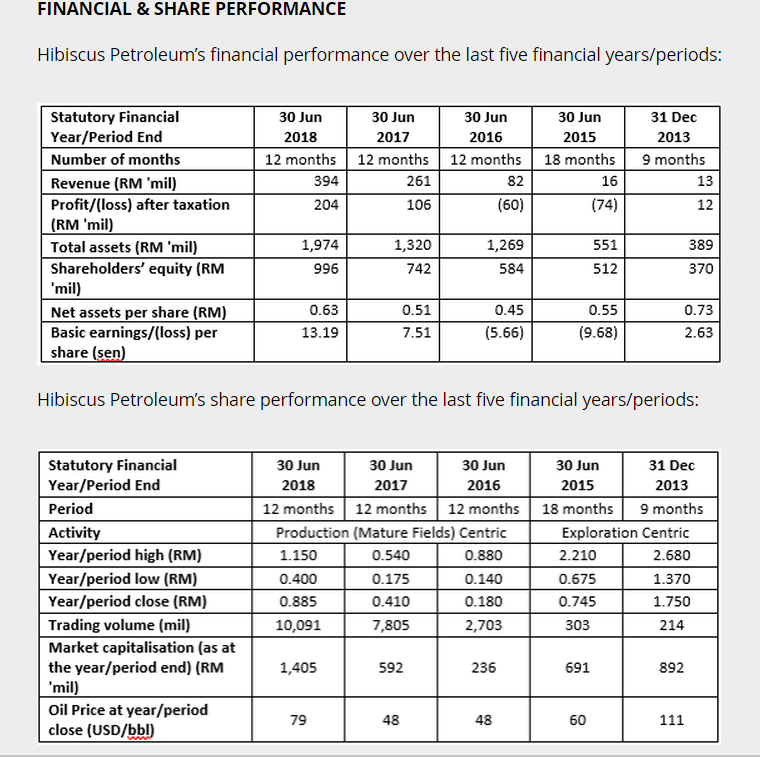

The above table shows its 5 years track record of revenues and production volumes, oil prices etc. It is a good stock to buy for long term, provided you do not use too much margin finance.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.