Dayang: A great buying opportunity - Koon Yew Yin

Koon Yew Yin

Publish date: Sat, 11 Jan 2020, 06:50 PM

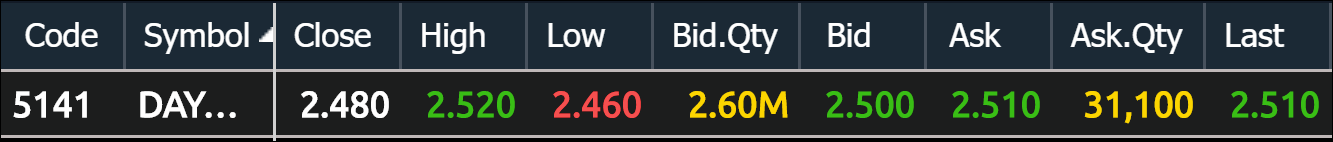

At the close yesterday, UBS Investment Bank, with HQ in Zurich was queuing to buy 2.6 million shares at Rm 2.50 and there were only 31,100 shares selling at Rm 2.51. The closing price was Rm 2.51.

With UBS Investment Bank’s strong support, Dayang share price can only go up higher and higher. Every investor should not hesitate to take advantage of this great opportunity to make more money.

As I said many a time before, I posted the most buy recommendations for Dayang than any other stock in my life. Many readers did not believe me. This has proven all my critics wrong.

With UBS Investment Bank’s aggressive buying, the price will continue to go up higher and higher for many more years to come. Even if the price of petroleum dropped drastically, Petronas will continue to pump oil because the company has already paid for all the oil rigs and Dayang will be given more and more maintenance contracts.

Dayang is in a monopolistic position where there are practically no competitors. Carimin and Uzma are too small to compete with Dayang. That is why the prices of these 2 stocks remained so depressed.

This aggressive buying by UBS also means that those who have sold earlier cannot expect to buy back at cheaper prices. What are they going to do with the sale proceeds? They cannot find another stock with the same profit growth prospect. They should be humble and admit their mistake so that can take advantage of this golden opportunity to make money.

When UBS is wanting to buy Dayang so aggressively, you cannot lose money if you buy as soon as possible. I will use all my available margin finance to continue buying.

As I said before, readers must remember your buying or selling will not affect the share price because UBS is buying aggressively.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-21

DAYANG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANGMore articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.