Top Glove shareholders must take 定心丸 (Steady Heart Pill) - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 22 Jul 2020, 05:51 PM

The 3 Chinese words are “steady heart pill”. Since many investors have followed me to buy Top Glove, some of them are worried by the daily price fluctuation. The price chart below shows that the price has been fluctuating a few sen up and down in the last few days. It is not plunging down.

8 research houses updated their target prices for Top Glove as below.

- Affin Hwang Outperform Rm 46.40 20/7/2020

- Credit Suisse Outperform Rm 37.00 15/7/2020

- Kenanga Investment Bank Outperform Rm 32.00 13/7/2020

- TA Securities Buy Rm 31.66 14/7/2020

- Hong Leong Buy Rm 31.31 15/7/2020

- Cimb Securities Buy Rm 31.30 14/7/2020

- Nomura Buy 30.65 14/7/2020

- Macquaries Outperform 30.40 14/7/2020

Affin Hwang Capital noted in a report recently, Top Glove share price could hit as high as Rm 110 on value in a bull case scenario if selling prices increase by 10% month to month each month in financial year 2021.

All investors should not worry by the daily price fluctuation because the 8 Investment Banks have just raised their target price for Top Glove which should be achievable sooner or later.

Statistics shows that long term investors can make more money if they buy and wait patiently. Short term day traders cannot make much money due to transaction cost. I can see a few people on the Top Glove forum boasting that they sold and hope to buy back at cheaper prices. They will be disappointed.

You may like to know more about Top Glove:

Top Glove is one of the top 3 largest Malaysian rubber glove manufacturers. The company owns and operates 45 manufacturing facilities in Malaysia, Thailand, and China. It also has marketing offices in these countries as well as the United States, Germany, and Brazil.

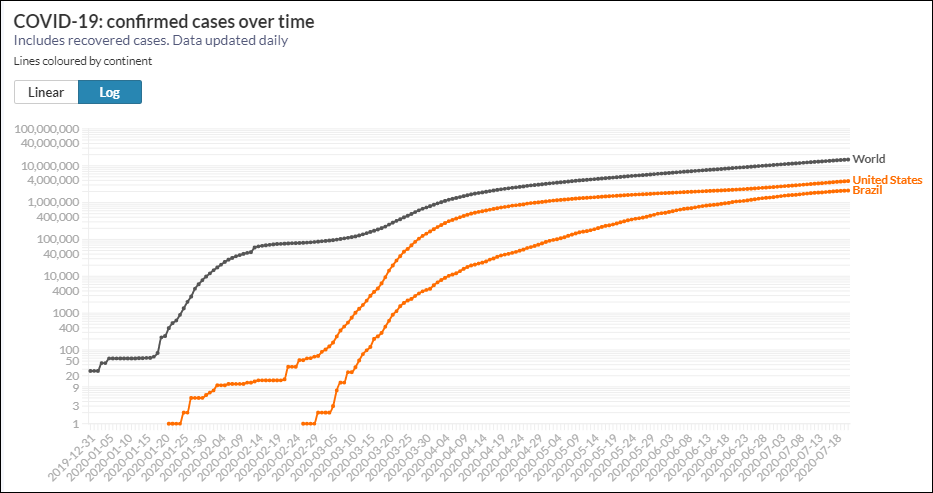

Currently there are 15,031,133 Covid 19 cases and 620,805 deaths in the world. These 2 figures are still spiking up.

Due to Covid 19 pandemic the demand for medical gloves far exceeds supply and Top Glove can easily increase its selling price. Additional selling price is pure profit because it does not involve production cost. As a result, the company will continue to report increasing profit in the next few quarters until Covid 19 pandemic is under control. Although vaccine is at its final stage of testing, many scientists predicted the pandemic will not be under control for at least 1 or more years as the number of new Covid 19 cases is still spiking as shown by the above chart.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.