Supermax is the best performer - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 23 Nov 2020, 03:03 PM

Due to the Covid 19 pandemic, the demand for medical gloves far exceeds supply. As a result, all the glove makers are increasing their selling prices for their products to make more and more profit. In fact, the pandemic is affecting almost all the listed companies except medical gloves, medical products for the virus prevention and a few other businesses.

Which is the best glove stock to buy?

The surge of demand for medical glove began in early March. As shown on the price charts below, on 3 march the price for Supermax was 81 sen, Top Glove was Rm 1.90, Kossan was Rm 2.39 and Hartalega was Rm 6.06. The last closing prices for the 4 stocks were Rm 8.08, Rm 7.28, Rm 6.23 and Rm 14.40 respectively.

Supermax share price shot up from 81 sen to Rm 8.08, an increase of 10 times.

Top Glove share price shot up from Rm 1.90 to Rm 7.28, an increase of 3.8 times.

Kosssan share price shot up from Rm 2.39 to Rm 6.23, an increase of 2.6 times.

Hartalega share price shot up from Rm 6.06 to Rm 14.4 an increase of 2.38 times.

Supermax is the best performer among all the top 4 glove stocks since the Covid 19 pandemic began in early march. It will continue to report more earning per share (EPS) than any of the other glove company because it has the best profit growth rate per share as reported in its quarterly profit.

Hartalega price chart below

Why Supermax can shoot up faster than any of the glove stocks?

Among all the stock selection criteria such as NTA, good cash flow, healthy account, dividend yield etc the most powerful catalyst to push up the share price is profit growth prospect. Supermax has been reporting better profit per share (EPS) than any of the other glove stocks.

Supermax has the best profit growth rate.

Besides the reasons why Supermax could shoot up faster than any of the other glove stocks as I mentioned above, Supermax has its own brand and sale outlets in all the major cities in US and in many other countries. Almost all of the other glove makers do not have their own brand and sale out. They cannot sell their gloves at higher prices because they have to sell their gloves through agents or middle men.

Supermax Corp Bhd last week posted a record quarterly net profit of RM789.52 million, up almost 32 times from RM24.75 million a year ago, thanks to the continued booming demand for rubber gloves amid the Covid-19 pandemic.

The glovemaker’s bumper earnings for its first quarter ended Sept 30, 2020 came as revenue surged 265.6% to RM1.35 billion, from RM369.94 million a year ago. The group attributed the stellar earnings growth to higher average selling prices for gloves and continuous robust demand.

About 1 week ago, Supermax reported its 1st quarter ending Sept EPS 30.58 sen, an increase of 100% from the previous quarter ending June EPS 15.29 sen.

What is the easily achievable target price for Supermax?

1St quarter ending Sept its EPS was 30.58 sen. Assuming Supermax does not increase its selling price for each of the next 3 quarters, the total EPS for the whole financial year will be 30.58 sen X 4 = Rm 1.22.

Based on PE 15 X Rm 1.22 = Rm 18.30 per share.

Based on PE 10 X Rm 1.22 = Rm 12.20 per share.

The last closing price on Friday was Rm 8.08.

What is the future for all the glove stocks?

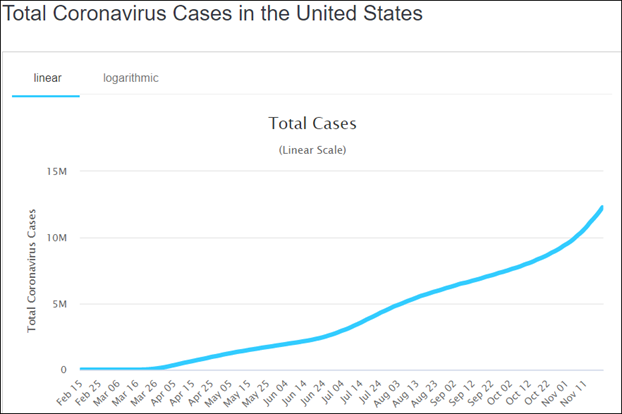

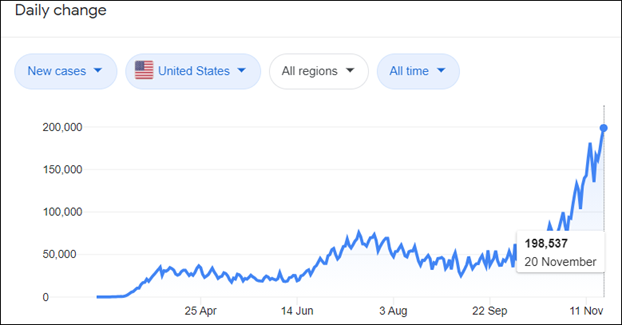

Currently US has 10.57 million Covid 19 cases and 245,936 deaths. The daily number of cases is still surging as shown on the chart below. Yesterday a new record of 198,537 new cases is established.

The US has the most cases in the world.

Since the number of new Covid 19 cases is still increasing, the demand for medical gloves will continue to exceeds supply for a long time. All the glove makers will continue to increase their selling prices to make more and more profit.

Supermax 1st quarter ending September, its EPS was 30.58 sen. Since Supermax has the best profit growth rate, its profit for the 2nd quarter ending December should be better.

Investors should just buy Supermax and wait patiently for about 2 months to see Supermax’s 2nd quarter result.

The vaccine discovery will increase the demand for more gloves. All medical workers must wear gloves to inject the vaccines and do contact tracing

Many Scientists believe to be effective in stopping the spread of the virus, at least 70% of the population of the world are required to be vaccinated. It will take a long time to produce so much of vaccines. In fact, to vaccinate so many people, a lot more medical workers will be required and all of them have to wear medical gloves to inject the vaccines.

Additional buy recommendations from CGS-CIMB, Kenanga Research and RHB Research.

CGS-CIMB is forecasting Supermax to achieve a record high 256.2% year-on-year growth in net profit for FY21, driven by better-than-expected margin expansion and economies of scale.

“The stronger earnings expected in FY21 is also due to the commissioning of new production lines in Block B of Plant 12, which will see an additional production capacity of 2.2 billion pieces of gloves per annum.

“We project ASPs to rise by 40% for FY21, later reducing by 15% and 3% for FY22 and FY23, respectively.

“According to Supermax, its order book visibility remains strong for the next 10 to 12 months, ” the research house said.

CGS-CIMB added that Supermax has collected prepayments amounting to RM892.4mil from its customers as of end-June 2020.

As such, Supermax has a net cash position of RM852.7mil.

Kenanga Research: According to Kenanga Research, Supermax commands an undemanding FY21 price-earnings ratio of 17 times, compared to its expected earnings growth of 200%.

“We like Supermax because its OBM model enables it to extract higher margin from distributor prices, compared to the original equipment manufacturing (OEM) model at lower factory prices.

“We upgrade the group’s FY21 and FY22 net profit by 57% and 58% after raising ASPs as well as raising earnings before interest, tax, depreciation and amortisation (Ebitda) margin from 36% to 48%,” said Kenanga Research.

Similarly, RHB Research has also increased its earnings forecast for Supermax, by 6% to 12% for FY21 to FY22, to reflect higher ASPs, in line with industry trends.

Supermax reported a four-fold year-on-year increase in net profit to RM525.6mil for the financial year ended June 30,2020 (FY20).

In a press release statement on Monday, the glove maker highlighted that “the highest average selling prices (ASPs) have not been reflected in the fourth quarter of FY20” and it is “optimistic that the own-brand manufacturing (OBM) cum distribution business model will exhibit even healthier performance in the coming quarters.”

RHB Research:

Apart from that, RHB Research noted that Supermax has invested RM8mil to venture into face mask manufacturing. The targeted commercial production is slated for the fourth quarter of 2020, with an initial production capacity of eight million pieces of masks per month.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-07

HARTA2025-01-07

HARTA2025-01-07

SUPERMX2025-01-07

TOPGLOV2025-01-06

HARTA2025-01-06

HARTA2025-01-06

KOSSAN2025-01-06

KOSSAN2025-01-06

SUPERMX2025-01-03

HARTA2025-01-03

HARTA2025-01-03

HARTA2025-01-03

KOSSAN2025-01-03

KOSSAN2025-01-03

SUPERMX2025-01-03

TOPGLOV2025-01-02

KOSSAN2025-01-02

KOSSAN2024-12-31

HARTA2024-12-31

KOSSAN2024-12-31

KOSSAN2024-12-31

KOSSAN2024-12-30

HARTA2024-12-30

KOSSAN2024-12-30

KOSSAN2024-12-30

KOSSAN2024-12-30

KOSSAN2024-12-30

SUPERMX2024-12-30

TOPGLOV2024-12-30

TOPGLOV2024-12-29

SUPERMX2024-12-27

HARTAMore articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Actually back then before CNY 2020, Supermax was trading at lower PE of 12 as compared its peers: Topglove (pe=30), Kossan (pe=25), Harta (pe=45)

It's more like investor began to see that it's undervalued and the PE now is reflecting better than previously.

2020-11-23 17:19

Once upon a time, top glove is the best , than kossan, harta also in list. Suddenly AT also in the list. On 17/11/2020 changed mind, AT not good and making losses, should sell. Today promote supermx. Next week said , supermx not good, buy kossan

2020-11-23 18:32

Syed Saddiq insists Malaysia’s glove makers pay windfall tax of ‘just’ RM4.8b, cites Top Glove’s Covid-19 cluster as justification

https://klse.i3investor.com/blogs/savemalaysia/2020-11-24-story-h1536581110-Syed_Saddiq_insists_Malaysia_s_glove_makers_pay_windfall_tax_of_just_RM.jsp

2020-11-24 09:34

mywb

KYY, are you going to buy more supermax share?

2020-11-23 15:18