Why Steel Stock prices are rising? Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 06 May 2021, 09:16 AM

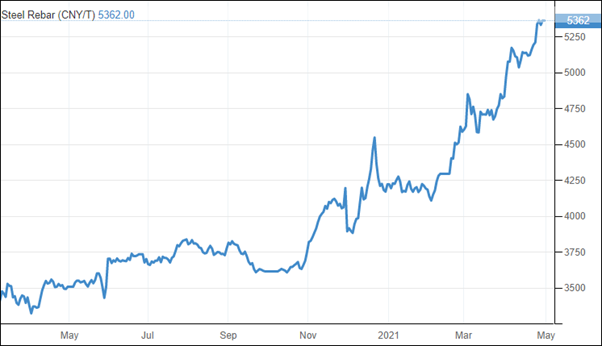

China is the biggest steel producer in the world. Since China wants to reduce the use of coal to reduce air pollution, it has reduced steel production. As a result, the price of steel has been going up as shown on the price chart below. It has gone up about 50% in the last 12 months.

All the steel products makers will benefit because their steel stocks and manufactured goods have also gone up in price. That is why all the steel stock prices have been going up.

Profit growth prospect

Among all the stock selection criteria such as NTA, dividend yield, cashflow, EPS, PE ratio, debt or healthy accounts etc, profit growth prospect is the most powerful catalyst to move stock price.

When a company reports increased profit, its stock price should go up. That is why all the steel stock prices are going up.

|

Name |

Price |

Latest EPS |

4 X EPS |

PE |

|

Leon Fuat |

Rm 1.20 |

5.84 sen |

23.4 sen |

5.1 |

|

Hiap Teck |

66 sen |

2.21 sen |

8.84 sen |

7.5 |

|

Melawa |

71.5 sen |

3.21 sen |

12.8 sen |

5.6 |

|

CSC Steel |

Rm 1.90 |

5.80 sen |

23.2 sen |

8.2 |

|

Astino |

Rm 1.66 |

6.34 sen |

25.4 sen |

6.5 |

Leon Fuat Bhd

The table above is a comparison of steel stocks. Leon Fuat is the cheapest in term of PE ratio.

Leon Fuat Bhd is engaged in the provision of management services through its subsidiaries. It operates through three segments: Trading of Steel Products, Processing of Steel Products, and Others. It mainly involves in the buying and selling of flat and long steel products and also offers value-added services to flat and long steel products in the form of cutting, levelling, shearing, profiling, bending, and finishing as well as production of expanded metal and Other segment includes steel materials such as tool steel and non-ferrous metal products such as bronze, brass, aluminium, and copper. It operates in two geographical areas; Malaysia and Republic of Singapore. The majority of the company's revenue is derived from the Trading of Steel Products and Processing of Steel Products.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Gloves company make Billions but steel company only make millions. As an investor sure I choose glove mah!

2021-05-06 12:43

If you are contractor, you know rising steel price will kill you! Especially if you already sign contract with your client! Eat up your margin!

2021-05-06 12:47

Last time kyy said glove price keep up. End up he sell all his stake. I think don't enter steel as the price is peak now n going down soon as oversupply n steel hike cool down soon

2021-05-06 12:49

Why ignore prestar? Prestar PE lower than Leon Fuat. You no buy so ignore?

2021-05-06 12:57

Why ignore Chuan Huat Resources Berhad? NTA much higher that all of them. Paid up capital very small too.

2021-05-06 16:09

like gloves manufacturer, will the steel price continue to rise? and the steel counter continue to enjoy increase in Net profit after they sell their old stock?

2021-05-06 17:31

Keep quiet la this YKK.

Cakap kosong saja.

You want to tipu ikan Bilis and bring them to Holland kah?

Very sad.

2021-05-06 19:08

Guess the recent private placement uncle involve it.. his cost at 0.850

Listing tomorrow

2021-05-06 19:22

Steel stock prices are rising bcos steel stocks are the latest games in town now

for us to play play n make esee moni !

No believe ?

Just try a little bit, then U know lah !

2021-05-06 21:23

Next is oil palm plantation mah!

Remember 2 of the most richest & savvy investors w.buffet & bill gates like investing in farmland now mah!

U can emulate them now too mah....!!

Quickly Buy into palmoil plantation now b4 it price shoot up mah!

Time to be a little bit more contraian in view of mkt at reasonable high level mah!

Warren buffet says inflation is definitely coming in view of low interest interest and speculative sign such as bitcoin, rubbish stock price run up sky high and unrealistic stock valuation & expectation and now raw commodities price run up mah!

Bill Gates already bought alot of farmland at low in preparation & in anticipation for the coming armmagedoom coming mah!

Why would one the world tech best richest owner switch alot of his investment into farmland, this bcos farmland or value real estate if it is bought at reasonable low price, u cannot go wrong over longterm bcos the availability of land is limited, u cannot manufacture land like bitcoin mah!

Coming back to msia the equivalent to farmland is oil plantation, u still can get it real cheap & it is paying u reasonably good dividend loh...this is the best defensive & offensive play like bill gates and warren buffet had highlighted mah!

As calvin sifu said timber is at record price & palmoil at record price surely some optimism will spillover to plantation & timber share price mah!

But this up 1 to 2 sen is chicken feed mah, why up so little leh ??

Timber & palmoil share r suffering from lack of production mah and also huge impairment losses on its assets mah & previous falling share price mah!

Thus they are jittery on recovery of palmoil & timber share loh!! They want to see actual profit b4 jump in loh!!

That means if u base on profit...as indicator that means the share price will be lagging loh!

Then why promote Wtk leh ??

1. The owner , directors and insiders already accumulating quietly without fanfare mah!

2. The palmoil & timber production volume of wtk, mhc, jtiasa, boustead, ijm plant already creeping up loh...this is further support by the record price of its commodities. Just imagine u have higher prices & higher volume....that will be a very important sign of higher big profit coming mah!

3. The share price already corrected over 3 yrs of downtrend previously, when there is a big shakeout of all the weak holders...u can only grow more optimistic as time past by loh!

4. Wtk is sitting on some prime land that invested at a very low cost near major town & city, they are good development mah!

5. With all the liquidity & quantitative easing & low interest rate environment, u can see big inflation will be coming loh...!! Wtk in commodities business plus very big cheap land bank is a very good inflation protector mah!

Based on the above i think wtk , jayatiasa & ijmplant is the best pick to make profit & this is concur by sifu calvin findings also mah!

2021-05-06 21:49

promoting steel not stop already, means con man have already accumulated enough silently when he exited glove silently previously. When KYY calls to buy, you SELL. do the opposite! time and history and track has proven his modus operandi. No matter how he deny it in his latest article, when one's integrity is lost, IT IS LOST. ask the ppl in this forum esp those long enough here over the years, I can assure you at least 2/3 will say KYY is a U-turn man. trust him 1% also u can die

2021-05-07 09:07

i doubt even 100 KYY can manipulate the price of a steel counter. Steel stocks are commodity price based

2021-05-07 09:43

EatCoconutCanWin Last time kyy said glove price keep up. End up he sell all his stake. I think don't enter steel as the price is peak now n going down soon as oversupply n steel hike cool down soon

06/05/2021 12:49 PM

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

peak? learn to read a chart. if steel is oversupplied, why is it so expensive?

https://www.barchart.com/futures/quotes/R-M21

2021-05-07 09:46

ahbah Steel stock prices are rising bcos steel stocks are the latest games in town now

06/05/2021 9:23 PM

~~~~~~~~~~~~~~~~

in town? its worldwide.

everyone use steel. you think everyone eat your stoopid gloves?

2021-05-07 09:54

I think it is due to recovery prediction and supply crunch and not China.

2021-05-07 10:33

KYY must have bought at low price. I think he is trying to dispose bit by bit.

2021-05-07 11:08

I thought u only makan nasi lemak ?

Posted by ahbah > May 7, 2021 12:23 PM | Report Abuse

Now I onli makan kayu / oil palm / timber n besi.

2021-05-07 12:24

Uncle is treating like every steel player will enjoy huge profits. In order to enjoy profits like Leon Fuat, you need to have steel stockpile that you accumulated earlier in the year. During that time, steel price hovered between 2800 and 3200. Now the price of these has increased to 4400. If you had a lot of leftovers, then yeah, good profits... however unless steel price starts to trend downwards, you will be stuck importing high price steel from China once your stock depleted.

2021-05-07 12:38

KYY didn't explain why steel price increase. It's due to :

-steep increase in the prices of iron ore (due to China-Australia trade war, many Australian coal went to China via third countries with 70% increase in price)

-strong growth in steel demand from China, the US, Europe and other emerging markets, as global markets recover from a year-long slowdown with the reopening of business activities and vaccination drive

2021-05-07 23:07

Spot on 914601117!

Posted by 914601117 > May 7, 2021 11:07 PM | Report Abuse

KYY didn't explain why steel price increase. It's due to :

-steep increase in the prices of iron ore (due to China-Australia trade war, many Australian coal went to China via third countries with 70% increase in price)

-strong growth in steel demand from China, the US, Europe and other emerging markets, as global markets recover from a year-long slowdown with the reopening of business activities and vaccination drive

2021-05-08 00:06

Why is steel stocks tumbling, Sir Chimpanzee Fool You Yin?

You are the King Clown of i3.

Thank your Sir Chimp.

2021-05-08 00:12

strong growth in steel demand from China, the US, Europe and other emerging markets, as global markets recover from a year-long slowdown with the reopening of business activities and vaccination drive https://www.magelang1337.com/

2021-05-09 23:41

I also eat nasi lemak with lots of santan n coconut oil which can protect us from getting covid 19 ! Guaranti !

2021-05-12 12:43

Many water fishes were caught in Hiap Teik, LLB, and Masteel when promoters like KYY were giving unreasonable high TP in 2021. Those water fishes still suffering until today.

2 months ago

Bullbursa

What about prestar? reported good QR and NTA 1.66

2021-05-06 09:58