Why should AYS rebound - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 17 Nov 2021, 10:32 AM

The Budget 2022 announcement on 1st Nov, has been pulling down all the listed stocks, especially big companies. The biggest culprit is the additional prosperity tax increase from 24% to 33% for big companies whose annual profit exceeds Rm 100 million. Although smaller companies like AYS is not affected by the additional prosperity tax, it is being drag down. Its price chart is showing a down trend which encourages weak holders to sell.

No stock can drop continuously for whatever reason. After some time, it must rebound.

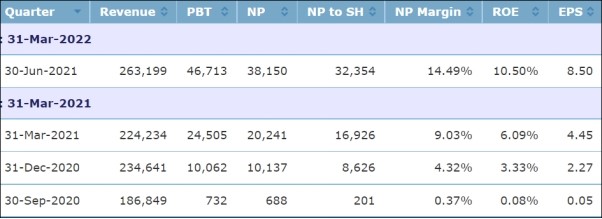

The last column of the above table shows EPS for AYS. Its latest EPS was 8.5 sen and its previous EPS was 4.45 sen, an increase of nearly 100%. Its EPS for next quarter ending September which will be announced before the end of this month, should be more than 10 sen EPS. AYS deserves a much higher rating.

Why Steel price does not affect AYS?

AYS does not produce steel. It buys steel from the cheapest steel producer to sell the construction contractors.

Back ground:

AYS Ventures Bhd is an investment holding principally involved in the trading and manufacturing of steel related products. The company is organized into three segments namely trading, manufacturing and others. The trading division trades and markets a diverse range of steel products and construction materials whilst the manufacturing division manufactures and trades pressed steel and fiberglass reinforced polyester sectional water tanks, steel purlin, and wire products. Other segment includes investment holding, warehousing and storage services and dormant. The products serve customers in the construction, engineering for heavy steel industries, fabrication, oil and gas, power plant and shipbuilding sectors. The group principally operates within Malaysia.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Created by Koon Yew Yin | Sep 03, 2024

State housing and local government committee chairman Datuk Mohd Jafni Md Shukor said demand for properties in Johor has gone up since last year’s announcement about the SEZ.

Created by Koon Yew Yin | Aug 30, 2024

KSL announced its total 4 quarter EPS of 42.3 sen and its net tangible asset (NTA) backing of RM3.86. It is selling for less than 50% of its net tangible asset (NTA). KSL is undervalued. Its share...

Discussions

Sometime I wonder is money really that important especially at that age..hmmm.....

2021-11-17 20:41

Dulu kata Tomei cantik...eps x 4....manyak undervalue

Qtr result baru keluar....gg result..

Uncle, how leh

2021-11-17 23:10

Malaysia share market is ....ada untung jual......no long term invest......eventhough some counter give bonus issue or dividend....glove counters is one very expensive lesson......i help u ,you help me....hahaha...don't listen n follow economist or Analyst said too much buy n sell ...you very ....dissapoiment....duit masuk pocket yang penting.

2021-11-18 10:13

No stock can drop continuously...no stock can going up forever.

There are 2 types of angel as highlighted in the Lecture.

1. Angel from heaven send from God, firstly will be coming down to the world to perform the commanded task. Upon finishing the task, the angel will be returning to God by going up.

2. Angel from men is the angel elevated/installed by men. Basically, we flourished him/her with names and titles/positions/recognitions so that he/she is going up, like the share price. But, when the people had decided to dump him/her after some unfortunate turns of event, he/she will be going down for good/long time, like prices of certain shares in the market.

2021-11-18 11:05

bruh Steel stocks will eventually stabilize and do sideway movement. steel demand isnt high now since China has their construction problem and WINTER has come. tell me which country other than China would buy at expensive steel prices to use..... none its too expensive to place infrastructure in recovery plan. most country opt for tourism for recovery plan which leads to more import covid cases more dumb.... its an endless cycle.

2021-11-18 18:26

why AYS should rebound ... so that the crook and his cronnies can sell!!

2021-11-18 19:41

a hit on a broken record it has become. a hit that rode (up and down) with voluminous highs on the two-stage afterburners of lower-volumed heavyweights : AJ for stage 1, then LI for stage 2 (when AJ couldn't sustain). refer and superimpose all 3 charts this year for review.

any rebound-to-sell is likely to be proxy-driven by AJ and LI, the main protaganists it needs to trigger any sustained move. can see that move again this morning.

2021-11-19 12:38

Titan

I can see desperation.....

2021-11-17 19:16