Institutional Investors have to buy up AYS - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 28 Dec 2021, 08:52 PM

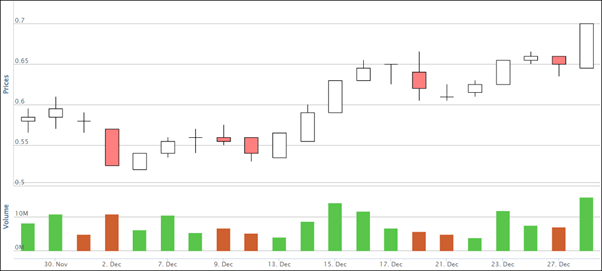

The AYS price chart below shows that AYS has been going up from 52.5 sen on 2nd Dec to close at 70 sen today, an increase of 17.5 sen or 30% in the last 17 trading days.

Today AYS shot up 5 sen.

On 26th Oct AYS peaked at 91 sen. On 2nd November AYS share price was traded at 88 sen and the company placed out 10% of its total issued shares or 38 million shares with a discount at 76 sen to big Institutional investors who are familiar with the company operation and its profit growth potential. No investor would buy 38 million AYS shares unless he knows the company’s business and its management.

Based on the above facts, Institutional investors have to buy up AYS to show that they are not losing money. If they don’t push up AYS share price, they will be sacked.

My target price for AYS

Its 2nd quarter ending Sept EPS was 6.51 sen and its 1st quarter ending June EPS was 8.5 sen, totalling 15 sen for 1st half year. All these profits were achieved during the Covid 19 pandemic MCO lockdown. Currently there is no more MCO lockdown and AYS should be able to make better profit in its 2nd half year than its 1st half year.

Assuming its 2nd half year performance is the same as its 1st half year, its annual profit EPS will be 30 sen per share.

Based on PE 3, AYS should be 90 sen.

Based on PE 4, AYS should be Rm 1.20.

Based on PE 5, AYS should be Rm 1.50.

The last traded price was 70 sen.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jun 28, 2024

Created by Koon Yew Yin | May 28, 2024

It is a human nature that most men would complain to their wives that they were overworked and the wives would tell their husbands to get some assistants. As a result, the number of staff increases...

Created by Koon Yew Yin | May 13, 2024

Eversendai Corporation Berhad recently reported its earnings results for the fourth quarter ended December 31, 2023. Here are the key financial highlights:

Created by Koon Yew Yin | May 06, 2024

Eversendai Corporation Berhad made a remarkable comeback in FY2023, reporting strong profit growth. Here are the key highlights from their financial performance:

Created by Koon Yew Yin | Apr 30, 2024

As shown on the chart below, Sendai has been dropping in the last few days. Today all shareholders must be wondering to sell, hold on or to buy some at a cheaper price.

Discussions

Koon. Don’t pretend. You are the one who sold ays at lower and bought back at higher. You used multiple accounts. As usual, you pump up to let others to escape. The sad things is that you always forget to sell.

2021-12-29 08:20

"Institutional investors have to buy up AYS to show that they are not losing money. If they don’t push up AYS share price, they will be sacked."

ARE you sure???? Uncle mau goreng also put abit effort la. Market cap less than 300M. About 400M shares. 1st shareholder holds 63% of shares and the top 3 shareholders hold 70% of shares. How do institutions want to buy? Buy abit only, already limit up. Unless you are telling me that you are the institution la ^_^. Then i have nothing to say loh.

Pls check the latest annual report shareholder. The only so-called institutional shareholder is 0.2%. Let me do uncle a favor and post the 30 largest shareholders.

THIRTY LARGEST SHAREHOLDERS AS AT 30 JUNE 2021

No. Name of Shareholders No of Shares %

1. Chiew Ho Holding Sdn Bhd 239,663,123 63.00

2. Ann Yak Siong Group Sdn Bhd 25,044,237 6.58

3. Tan Chee Kuan 7,700,000 2.02

4. See Siew Chiet 6,127,200 1.61

5. Lim Kim Yew 2,380,600 0.63

6. Kenanga Nominees (Tempatan) Sdn Bhd

Pledged Securities Account for Lim Kiam Lam (001)

1,634,700 0.43

7. Alliancegroup Nominees (Tempatan) Sdn Bhd

Pledged Securities Account for Chia Yu San (8121282)

1,608,400 0.42

8. Ong Aw Beng 1,490,000 0.39

9. Affin Hwang Nominees (Tempatan) Sdn Bhd

Pledged Securities Account for Lim Aun Chuan

1,200,000 0.32

10. Tay Buan Tong 1,200,000 0.32

11. Maybank Nominees (Tempatan) Sdn Bhd

Pledged Securities Account for Ng Beng Hoo

1,100,000 0.29

12. Maybank Nominees (Tempatan) Sdn Bhd

Mak Tin Wong

1,082,000 0.28

13. Wong Yoon Seng 1,030,000 0.27

14. RHB Nominees (Tempatan) Sdn Bhd

Pledged Securities Account for Ng Hin Seong

1,020,000 0.27

15. Affin Hwang Nominees (Tempatan) Sdn Bhd

Pedged Securities Account for Ong Siew Eng @ Ong Chai (M04)

1,000,000 0.26

16. Wong Weng Tien 900,000 0.24

17. Alliancegroup Nominees (Tempatan) Sdn Bhd

Pledged Securities Account for Ngee Peng Soon (7000564)

800,000 0.21

18. Jee Soi Phin 800,000 0.21

19. Toh Tuan Sun 794,000 0.21

20. Low Pek Lay 761,200 0.20

21. Au Cheen Hoe 750,000 0.20

22. DB (Malaysia) Nominee (Asing) Sdn Bhd

The Bank of New York Mellon for Ensign Peak Advisors Inc.

744,600 0.20

23. Cheng Chye Lye 700,000 0.18

24. Maybank Nominee (Tempatan) Sdn Bhd

Varughese A/L Koshy

680,000 0.18

25. Lim Hoe Seng 665,000 0.17

26. Cheong Lap Thian 664,000 0.17

27. Lim Seng Chee 657,000 0.17

28. Tan Aik Choon 585,600 0.15

29. Ng Han Joe 550,000 0.14

30. Gan Thiam Seng 520,000 0.14

2021-12-29 14:43

Look at name list WHERE KYY name numba 300?

Investors or speculators?

2021-12-29 14:48

To be fair, this report was published 17th Now'21 for the financial yr ending 30th June. What I like to point out is top 30 shareholding control 80% of the shares. I don't doubt mr.Koon could be holding 5% or more as 5% will cost is him $15M. By listening to KC Chong describe his investing method in JAKS which he used RM200M, he could have bought 70% of this company.....so...jeng jeng jeng.....who is the institution shareholder he is referring to??? Is the institution shareholder buying or trying to release his ticket....that 1 i dunno le. I'm not smart enough to know. I think u all know better wink! wink!

2021-12-29 15:04

dont be naive with KYY

MAYBE all those in the list are dealers from 7 diferrent brokers

KYY give money, they do goreng

2021-12-29 15:11

Mr KYY has "downsize" into ikan bilis due to multiple mis-speculation?!!

2021-12-30 00:22

vcinvestor

Adoi...

2021-12-28 21:43