Subur Tiasa: Important Observation - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 28 Apr 2022, 10:22 AM

Auditors’ opinion

The details of the unmodified audit opinion as disclosed in the Independent Auditors’ Report is extracted below:- “Material Uncertainty Related to Going Concern We draw attention to Note 5 in the financial statements, which indicates that as at 31 December 2021, the Group’s current liabilities exceeded its current assets by RM393.8 million (2020: RM458.3 million). This condition gives rise to concerns about whether the Group has sufficient cash flows to meet its obligations for the next 12 months from the end of the reporting period, and whether the use of going concern basis in the preparation of the financial statements is appropriate. This was in spite of the net profit of RM73.0 million (2020: net loss of RM25.6 million) and net operating cash inflows of RM172.5 million (2020: RM46.8 million) recorded by the Group for the financial period. In assessing the appropriateness of the financial statements having been prepared on the going concern basis, management has considered the Group’s cash flows forecast for the financial year ending 31 December 2022 taking into account the factors as enumerated in Note 5 to the financial statements. Barring any unforeseen circumstances, management has a reasonable expectation that the Group will generate sufficient cash flows for the next 12 months to allow it fulfilling its obligations as and when they arise. Accordingly, the financial statements of the Group have been prepared on the going concern basis. Our opinion is not modified in respect of this matter.”

My opinion:

Investors might be too concerned with the auditor’s opinion that the company’s current liabilities exceeded current assets. From my long experience in doing business, I usually like to borrow as much money as possible provided I know how to use the loan to make more profit. In fact, I always use margin finance to buy more shares to make more money.

My important observation:

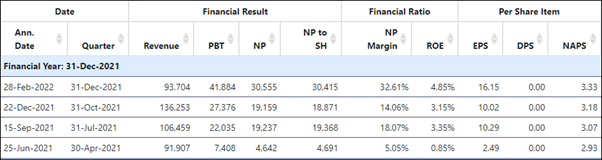

To change the financial ending in July to December, the last quarter 16.15 sen EPS is only for 2 months. Its previous 10.02 sen EPS is for 3 months as shown on the table below. Its next quarter ending March for 3 months should be much better than 16.15 sen in view of the record high CPO price.

The company offered this explanation:

In relation to the above, the Board wishes to advise on the following:-

(a) The Independent Auditors has expressed an unqualified audit opinion on the financial statements for the financial period ended 31 December 2021 (“FP2021”), and that their opinion is not modified in respect of the statement on this matter.

(b) Despite outbreak of COVID-19, Subur (“the Group”) recorded turnaround of profit after tax of RM73.0 million for FP2021 as compared to financial year (‘FY”) 2020 of RM25.6 million net loss.

(c) The Group generated net operating cash inflows of RM172.5 million, and recorded earnings before interest, tax, depreciation and amortisation (“EBITDA”) of RM207.5 million for FP2021 as compared to FY2020 of RM46.8 million and RM54.2 million respectively.

(d) Subur has been focusing on its operations in oil palm plantation segment, which has been the catalyst to the Group’s turnaround trajectory as follows: (d)1. The Group’s fresh fruit bunches (“FFB”) production recorded average annual growth rate of 23% per annum from FY2016 to FY2020. Our FFB yield continued to expand by 48% in FP2021 equivalent to 4% growth on annualised basis despite chronic manpower shortage and recurring pandemic-induced lockdown. The Group expects another double digit FFB yield growth for FY2022.

(d)2. As at 31 December 2021, the Group owned a total planted area of more than 21,000 hectares (“ha”) of oil palm plantations. Of these planted areas, 50% of the plantations are between 8 and 13 years of age, which is when the trees are expected to be at their optimum yield. 30% of the Group’s planted area is between 3 and 7 years of age, which is expected to contribute positively to future profitability and cash flows. Page 4 of 4 (d)3. During the financial period ended 31 December 2021, the oil palm operations recorded a pre-tax profit of RM165.5 million (2020: RM24.8 million) as disclosed in Note 38 to the financial statements, and contributed to net operating cash inflows of RM162.5 million (2020: RM43.8 million). The boosted profit and cash flows contribution to the Group’s oil palm plantation segment was attributed to the commendable yield improvement for the financial period, as well as the strengthening of average crude palm oil (“CPO”) price, which is expected to sustain for the next 12 months.

(e) Subur has commenced streamlining of its timber segment since middle of 2020 and has successfully implemented various cost-rationalisation measures in terms of optimising its resources and reshuffling of its manpower, which has resulted in significant operational efficiencies and cost-savings. (f) The Group has been able to meet all its debt obligations during the financial period and these financial facilities which are subject to periodic review have been renewed consistently:

(f)1. As at 31 December 2021, the Group’s total borrowings amounted to RM637.1 million (2020: RM713.8 million), of which RM423.3 million (2020: RM483.7 million) were classified as current liabilities. Details of these borrowings are disclosed in Note 24 to the financial statements. Of these borrowings of the Group, RM368.4 million are subject to yearly review. The balance of the borrowings is those with fixed repayment terms. The Group believes that the cash flows from the oil palm plantation segment are sufficient to address borrowings with fixed repayment terms including those borrowings of the timber logging and manufacturing operations.

(f)2. For the financial period ended 31 December 2021, the Group have reduced their borrowings by RM76.6 million (2020: RM13.5 million). Furthermore, the Group has generated net operating cash inflows of RM172.5 million (2020: RM46.8 million) for the financial period. The Group believes that they will continue to have the support of the bankers as they have not defaulted in any repayment obligations and the bankers have consistently renewed the credit facilities that were subjected to annual review without any material modifications. To meet any shortfall in working capital requirements as at the reporting date, the Group has available approved unutilised credit facilities of RM172.4 million.

(f)3. Accordingly, the Group’s debt-to-equity ratio has improved significantly from 1.31 (FY2020) to 1.01 in FP2021 and is expected to further improved to below 1.0 in FY2022. In view of the above, the Board strongly believes that the Group’s business is still relevant with the positive market outlook for its plantation segment. Management is confident that the Group will be able to improve its operational results and profitability, and generate sufficient cash flows for the financial year ending 31 December 2022.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Created by Koon Yew Yin | Sep 03, 2024

State housing and local government committee chairman Datuk Mohd Jafni Md Shukor said demand for properties in Johor has gone up since last year’s announcement about the SEZ.

Discussions

Your article is very good and useful, thank you for sharing, https://bk8vn.asia/ hopes that next time you will have more good articles to send to all readers.

2022-05-04 00:22

emsvsi

DO YOU KNOW WHO ELSE HAS PLANTATIONS ?

GENTING (3182) !

AN WHILE PLANTATION STOCKS HAVE RUN UP, GENTING IS STILL CHEAP (NTA=RM8.26) !

GENTING (3182) WELCOMES ALL TO THE NUMBAWAN TOP PICK SHURE WIN STOCK IN 2022 THE YEAR OF THE TIGER THE KING OF THE MOUNTAIN

2022-04-29 15:16