US will likely fall into recession - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 22 Aug 2022, 09:30 AM

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

US inflation reached a four-decade high in June, with consumer prices soaring by 9.1% compared to the previous year, the US government said. It is the biggest consumer price hike since 1981 and alone is up from an 8.6% price hike in May.

The cost of necessities is rising faster than incomes. Lower income minorities have been hit particularly hard as a larger portion of their income goes to essentials such as food, transportation and housing.

The US economy will likely fall into recession by the end of 2022 as the Federal Reserve raises rates to tame prices, according to economists at Nomura Holdings Inc.

Nomura warns that financial conditions will tighten further, consumers sentiment is souring, energy and food supply distortions have worsened and the global growth outlook has deteriorated.

With rapidly slowing growth momentum and a Fed committed to restoring price stability, we believe a mild recession starting in the fourth quarter of 2022 is now more likely than not.

Excess savings and consumer balance sheets will help mitigate the speed of economic contraction, they said, but noted that monetary and fiscal policy will be constrained by high inflation.

Nomura has lowered its real GDP forecast for this year to 1.8%, compared to 2.5% earlier, while the projection for next year is seen declining 1%, from 1.3% growth earlier.

The analysis comes as Treasury Secretary Janet Yellen said that “unacceptably high” prices are likely to stick with consumers through 2022 and that she expects the US economy to slow down.

Separately, Federal Reserve Bank of Cleveland President Loretta Mester said that the risk of a recession in the US economy is increasing, and that it will take several years to return to the central bank’s 2% inflation goal.

They expect ongoing rate hikes to continue into 2023, but with a slightly lower terminal rate of 3.50-3.75% reached in February, compared to the previous forecast of 3.75-4.00% in March.

The biggest culprit is US military expenditure. US wants to be the policeman of the world.

Top 10 Countries with the Highest Military Expenditures (2020):

1. The United States — $778 billion

2. China — $252 billion [estimated]

3. India — $72.9 billion

4. Russia — $61.7 billion

5. United Kingdom — $59.2 billion

6. Saudi Arabia — $57.5 billion [estimated]

7. Germany — $52.8 billion

8. France — $52.7 billion

9. Japan — $49.1 billion

10. South Korea - 45.7 billion

US military expenditure is higher than the total military expenditures of the other 9 countries combined. US has 750 military bases around the world. They are spread across 80 nations! After the U.S is the UK, but they only have 145 bases. Russia has about 3 dozen bases, and China just five. This implies that the U.S has three times as many bases as all other countries combined.

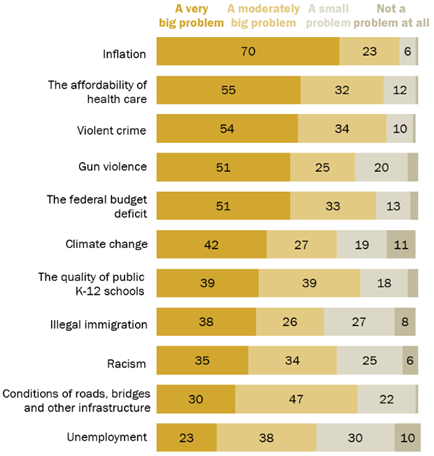

What are the biggest internal problems in US?

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Discussions

EU countries are sure to fall into recession due to high energy cost.

As of US, US is now exporting oil and gas to EU at very high price and US O&G companies are making lot and lot of money.

2022-08-23 09:09

If not mistaken, Janet Yellen retired as the Fed Chair in 2018...He was succeeded by Jerome Powell. KYY need to be more careful with facts when putting out articles like this. It was a casual observation..have not looked into the details..

2022-08-23 12:35

I know KYY has a very softspot for China..Looking forward to knowing more about how its economy is doing. Besides the US, its economic outlook can impact Malaysia and other countries

2022-08-23 12:38

Drought 1950s become Great Chinese Famine bring back memories

Grow what also died, 50M chinese died. no money to import rice after years of japanese invasion

NEXT 50years communists blame for killing 50M chinese

Will superpower USA be blame for killing 2M americain? blame Fauci better

2022-08-23 14:17

Uncensored remains here. People are craving syok and protecting personal interests ma. As usual, there is the price for accumulating too much syok.

https://youtu.be/WGv4TTf9-Es

2022-08-31 21:00

uncensored

China’s Economic Collapse Just Got Worse

China is experiencing an economic downturn as they lower interest rates, spending decreases, and property values decline - here's what this means for everyone watching - Enjoy! Add me on Instagram: GPStephan

https://www.youtube.com/watch?v=4JEdz1eA2vQ

2022-08-22 21:19