Problems facing UK - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 06 Sep 2022, 10:35 AM

On 25 August I wrote and posted this article which you can read if you click the link below:

UK is in a mess - Koon Yew Yin - I3investor

After Boris Johnson’s colleagues had pushed him out following a string of scandals, 11 MPs declared their ambition to succeed him. The race to choose the next leader of the Conservative Party, and Britain's next prime minister, has been going on in the last 6 weeks. The final 2 candidates were Liz Truss and Rishi Sunak.

Finally the Conservative Party members have chosen Liz Truss to lead the party and be the new UK Prime Minister.

She has to solve so many problems currently facing the nation.

Front day 1 of her campaign, Liz Truss had been saying that she would cut taxes which the voters like to hear and chose her to be PM. Currently there are so many problems facing UK and I doubt she has the faintest clue to solve all these problems.

Since Rishi Sunak was the former finance minister, he should be in a better position to do the job.

In 2022, the UK economy is struggling with very weak economic growth and one of the highest inflation rates in the OECD. Some of these problems can be attributed to global short-term problems, in particular recovery from Covid lockdowns and rising oil prices which have caused the worst cost-push inflation since the 1970s. However, short-term issues aside, there are also long-term challenges from the costs of Brexit, poor productivity growth and a decline in competitiveness with our major trading partners.

Here are the main problems facing UK economy

Low productivity growth.

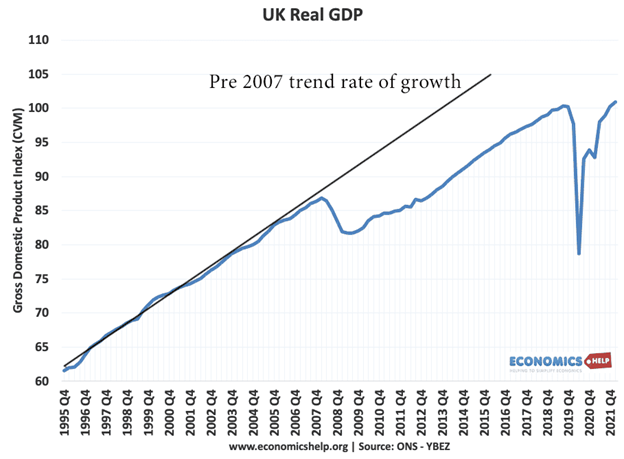

Since 2009, labour productivity has stagnated, falling considerably behind previous the UK’s trend growth. Poor productivity is a major factor behind the very limited growth in real GDP and a flat lining of average real wages. The UK is not the only country to face a slowdown in productivity growth, but the record of the UK is one of the lowest in the G20.

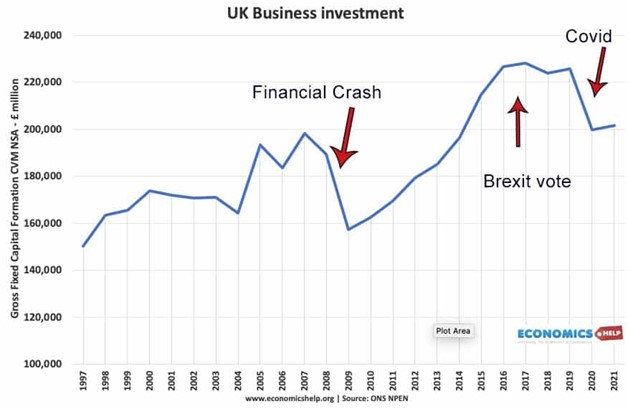

Reasons for low productivity growth include a lack of investment in new technology and a short-term approach from both business and the government. This unwillingness to invest in new technology has certainly been exacerbated by Covid disruptions, but the problem goes back to well before Covid and even before the Brexit vote.

The OECD calculate the UK will record lowest growth in G20 (except Russia) in the coming year. With low growth, there is less capacity for real wage growth and it will hit government finances at a time when there is need for more public spending and a wish to reduce taxes.

Brexit. The UK has not only left the EU, but also the Single Market and the Customs Union. This is caused considerable disruption to EU trade, which in 2016 accounted for over 50% of UK trade. Firms exporting to Europe are faced with an increase in regulation, custom forms and charges for selling goods in the EU. The OBR claim the effects of Brexit will cut UK GDP by 4% – this is up to £100 bn in lost output and £40 bn less revenue to the Treasury (OBR). Another think tank Centre for European Reform (CER) models that the cost of Brexit is a shortfall in GDP of 5.2%.

The row over the NI Protocol has meant further problems with the EU’s relationship with the UK. In retaliation, the EU has not ratified Britain’s associate membership of Horizon science funding. Further barriers to trade may occur. It was hoped Brexit would lead to liberalising trade with non-EU countries. But, many trade deals are quite similar to the UK had within the EU anywhere, also there are definitely barriers to switching trade from your geographical neighbours to the other side of the globe. It makes sense to trade with those countries geographically the closest.

Labour shortages. Another impact of Brexit is the loss of migrant flows from the EU. This has led to considerable labour shortages in areas such as lorry drivers, fruit pickets, hospitality and transport. Labour shortages have contributed to queues at airports and fruit remaining unpicked. Recently the chief executive of EasyJet, Johan Lundgren claimed that 8,000 EU job applications were rejected because they could no longer work in the UK.

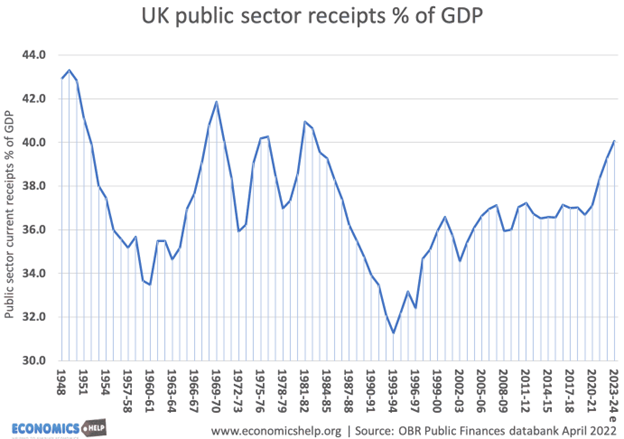

High tax burden to GDP ratio

Since 1993, we have seen a sharp rise in tax burden as a share of GDP. But, the problem is there isn’t a strong dividend of higher public sector investment. The rising tax burden highlights the weakness of tax revenues and the need for higher government spending on Covid bailouts and also from increased spending on health care and welfare. The concern is that pressures on government spending will continue as we face an ageing population, ongoing Covid treatments, and a cost of living crisis which puts pressure on social security spending.

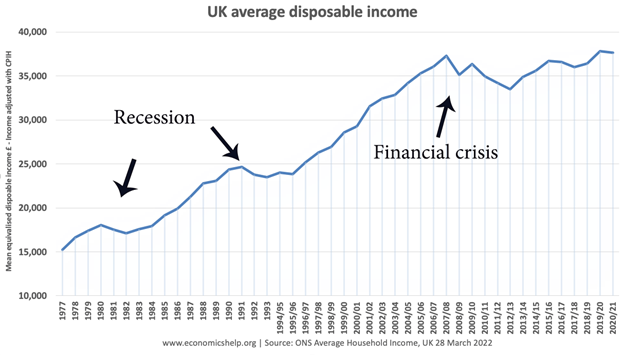

This shows there has been limited real income growth since 2009. In 2007/08 real median disposable income was £37,310. By 2020/21 that was only a very small increase of £37,622 or less than 1% growth over 13 years. It was hoped that Brexit labour shortages, would push up wages, and in some sectors, there have been sporadic increases in real wages. But, with productivity stagnant and a lack of bargaining power in many labour sectors, real wage growth has been patchy at best.

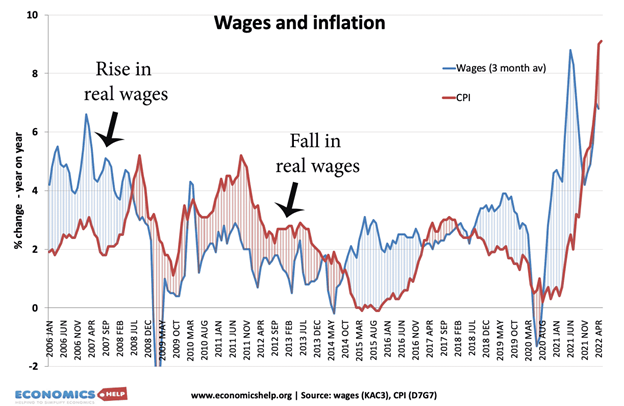

The problem of real wage growth has been exacerbated by the recent cost-push inflation, which has seen the highest inflation since the early 1980s. With inflation at over 9% in the summer of 2022. Whilst, inflation is a global problem, the UK still has one of the highest inflation rates in the OECD, despite weak economic growth.

A knock-on effect of poor real wage growth is that it has led to industrial action, with train staff going on strike and other sectors threatening to join a wave of industrial action.

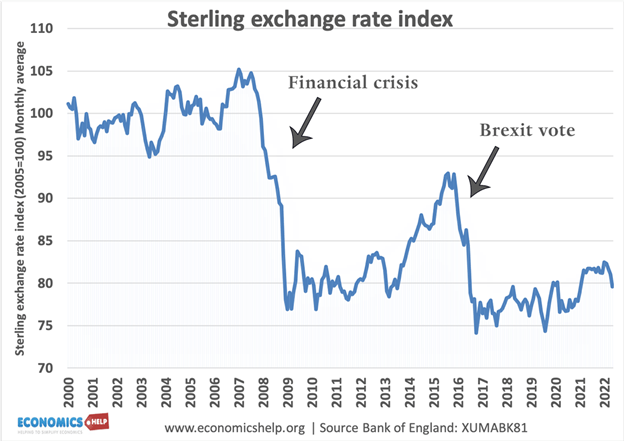

Post-Brexit devaluation

Since the Brexit vote in 2016, the Pound has devalued 16%, causing an increase in the cost of imports and contributing to domestic inflation. Whilst a devaluation, in theory, makes exports more competitive, there is little sign of a prolonged boost in exports. A good example of the effect of devaluation on the cost of living is how the UK is paying more for petrol. In 2008, oil reached $144/barrel, but petrol peaked at 120p per litre. Today, the oil price is $111 but pump prices are just below 200p per litre. (There are other factors behind petrol prices, such as bigger profit margin at refineries, but devaluation is still a major factor and helps to explain the high prices) Furthermore, recent political uncertainty and a record current account deficit have further weakened the value of Sterling.

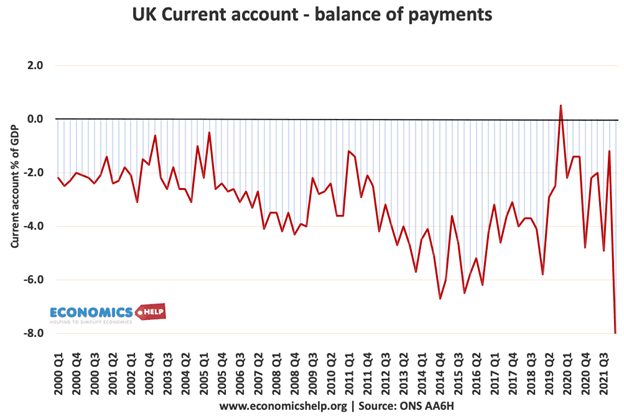

Current account deficit

The UK current account deficit hit a record 8.3% of GDP in Q1 2022. This was something of an anomaly with the higher price of raw materials contributing to a record trade deficit, but even discounting this quarter, the underlying trade deficit is a cause for concern, especially since the devaluation of the Pound has done little to improve the current account. The concern is that with Brexit, high inflation and low productivity growth, there is a continued lack of competitiveness with major trading partners. In the past, the UK has been able to finance the current account deficit by attracting capital flows (e.g. China, Russia, Middle East) buying UK assets and saving in UK banks. Post-Brexit, the UK has become less desirable as a destination for capital flows. If these capital flows do slow down, it will put further downward pressure on Sterling.

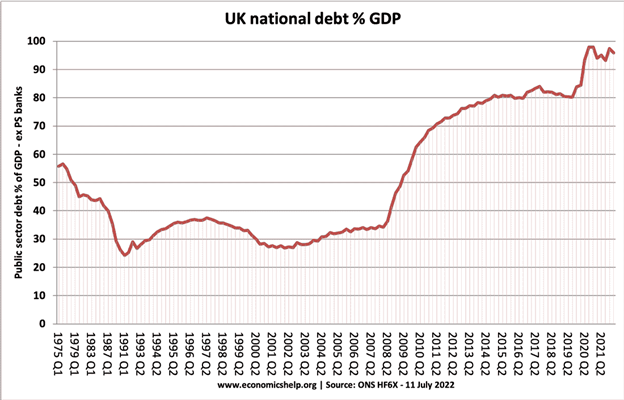

National debt

UK public sector debt has increased since 2008, and with demographic factors, the OBR predict a worse-case scenario of public sector debt of 320% of GDP within 50 years.

Brighter aspects of UK economy

It is worth pointing out, it is not all doom and gloom. It has also been a testing time for all economies around the world with the twin problems of Covid lockdowns, and cost-push inflation. Given these challenges, it is unsurprising that the UK economy faces many problems.

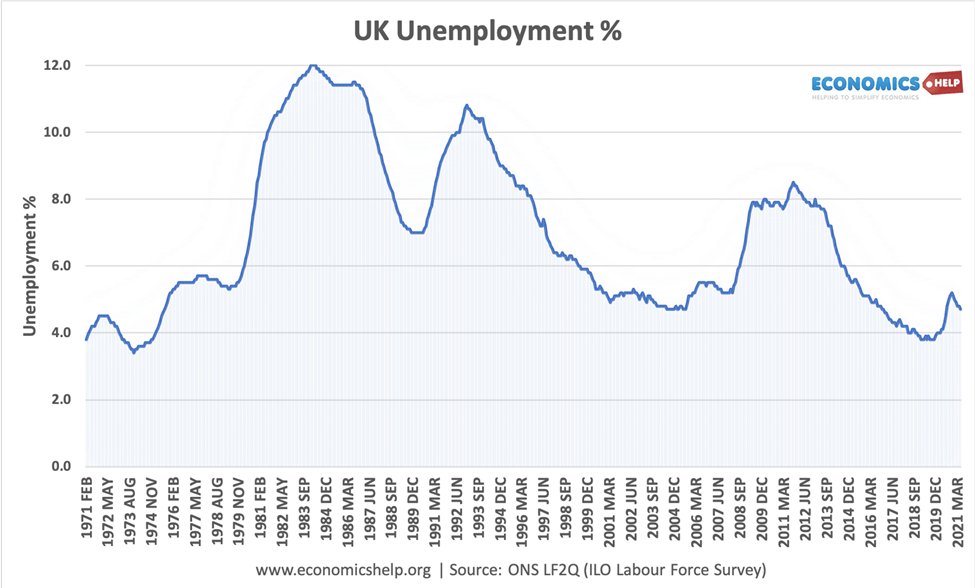

One success of the UK economy is the lowest rate of unemployment since the 1970s.

However, despite short-term challenges there are definitely concerns about the long-term future of the UK economy with a lack of skilled labour, and a lack of investment in both public sector infrastructure and business investment which will enable a boost to competitiveness and productivity.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Created by Koon Yew Yin | Sep 03, 2024

State housing and local government committee chairman Datuk Mohd Jafni Md Shukor said demand for properties in Johor has gone up since last year’s announcement about the SEZ.

Created by Koon Yew Yin | Aug 30, 2024

KSL announced its total 4 quarter EPS of 42.3 sen and its net tangible asset (NTA) backing of RM3.86. It is selling for less than 50% of its net tangible asset (NTA). KSL is undervalued. Its share...

Created by Koon Yew Yin | Aug 26, 2024

In 2012, I wrote my first book “Malaysia: Road Map For Achieving Vision 2020” which was launched by former Financial Minister Tengku Razaleigh.

Discussions

I saw a clip about a chef in Netherland who had to get his food from food bank! A chef! Mind you! And he has to get food from food bank!

2022-09-07 22:09

Thanks to the US , more and more protests will take place in EU in a few months and more EU political leaders will step down due to rising costs.

2022-09-08 08:11

many companies in EU will file for bankruptcy in the near future and unemployment rate will shoot up.

2022-09-08 08:14

How will they endure the cold this coming winter in the midst of energy crisis?

2022-09-08 13:42

MMSV(0113) had already met the uncle Koon Yew Yin golden rule for share selection criteria which the stock must have reported increasing profit for 2 quarters ant it is selling at projected PE below 15

2022-09-08 15:04

Henry Kissinger once said, "To be an enemy of the US is dangerous. But to be a friend is fatal." EU including Ukraine deserve to be suffering.

2022-09-09 10:07

Qqq3! US will go the same path as UK! Once upon a time, Great Britain rule the world! Today, UK is full of migrants who are demanding more rights that ever!

2022-09-09 14:27

Tobby

Some EU countries cost of living are so high now that they have to turn to food banks for their daily meals! That's how serious things are in EU right now!

2022-09-07 22:07