Harbour Link has good profit growth - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 15 Sep 2022, 10:50 AM

If you Google: My Share Selection Golden Rule - Koon Yew Yin, you can read the details.

Incorporated in 2002, Harbour-Link Group Berhad consolidated all related business activities and was officially listed on the Main Market of Bursa Malaysia Securities Berhad on 6 January 2004. With its roots firmly planted in the shipping and total logistics services, engineering & construction industry for the past 40 Years, Harbour-Link Group has grown steadily and built multi-disciplinary industry expertise covering a comprehensive range of services to fulfill its client’s needs.

Harbour-Link operates a fleet of 12 container vessels with a total capacity of 6,200 TEUs. It deploys four set of tugboats and barges to service these operations

The company describes the fleet as the ideal size that corresponds to the existing demand of its niche market within the group’s achievable high rate of utilization.

The company is also actively involved in the sea transportation of timber products, mainly sawn timber and round logs, servicing within the Asean region, namely Vietnam, the Philippines and Thailand.

Today, Harbour –Link Group’s business footprint extends across the Intra-Asian region and it has successfully established itself as a reputable brand-name within the industries that it operates.

Thanks to the strong freight rates and better utilisation of shipping space from intra-Asian trade, the shipping and marine division saw its revenue rose by seven per cent or RM24.4 million to RM396 million in FY2021 from RM371.6 million in FY2020.Group’s after-tax profit attributable to shareholders more than doubled to RM60.6 million from RM25.9 million in the previous year.

Red line is the 20 day moving average and the blue line is the 50 day moving average. When the red line crosses over the blue line means its share price is trending up positively.

The whole stock market is badly affect by the slump of the US stock market. The US Central Bank the Fed has to increase interest rate to counter inflation which is at the highest in the last 40 years.

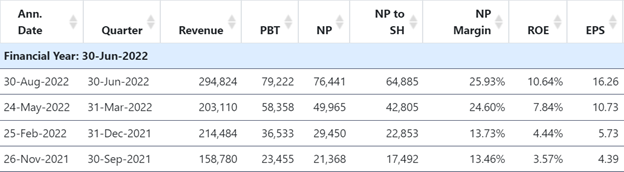

The company has good profit growth as shown in the last 4 quarters above. It reported 16.26 sen EPS for the quarter ending June. Its NTA is Rm 1.53 and has net cash.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Created by Koon Yew Yin | Sep 03, 2024

State housing and local government committee chairman Datuk Mohd Jafni Md Shukor said demand for properties in Johor has gone up since last year’s announcement about the SEZ.

Discussions

Hihihaha! Here we go again! Fortunately i bought Optimax last week! Still going up, surprising!

2022-09-15 16:14

航运业急速降温:泰越航线出现“负运价” 船公司利润率或降八成

界面新闻

2小时前

33评论

8、9月通常是航运市场的旺季,但今年入秋以来航运市场却持续遇冷,运价大幅下滑。其中,东南亚航线运价下滑最为明显,泰越航线甚至出现了“零”运价、“负”运价。而一向为业内所关注的美西航线,去年高峰时期运价曾达3万美元,如今已跌破3000美元大关,如同坐上了过山车。

究其原因,通胀率高企、地缘冲突风险以及疫情等多种因素叠加,导致运输需求大幅萎缩,运价下跌的趋势短期内仍将持续。

泰越航线贴钱揽货,美西航线跌去九成

美线的涨跌一直是行业关注的焦点,近日却让泰越航线“抢”了风头。有行业内媒体报道称,泰越航线近期出现了“零”运价、“负”运价的情况。

界面新闻也注意到,9月13日,一站式国际物流服务平台运去哪发布了一则东南亚航线的优惠活动公告,其中9月18日宁波-泰国林查班港的运费为-10美元/20GP,40GP和40HQ规格的集装箱运费为-20美元。这意味着,货主通过运去哪订舱,不仅不需要支付运费,反而会得到补贴。

东南亚的其他航线价格也十分具有吸引力,9月16日上海-越南胡志明卡莱港口的运费仅需1美元,9月15日深圳蛇口-越南海防港口的运费在100-200美元之间。9月上旬,运去哪发布的9月8日上海-越南胡志明卡莱港口的运费甚至低至-69美元/40HQ。

不过,“零”运价、“负”运价并不意味着货代和船公司一定亏钱。在海运费用中,除了基本的运费之外,还有附加费、码头操作费、燃油附加费、清关费用、仓储费、配送费等等。“零”运价、“负”运价只免去基本的海运运费,其他费用还需要照常缴纳,货代公司和船公司给出特惠价,考虑的也是多项费用叠加后的收益情况。

宁波出口集装箱运价指数(NCFI)印证了泰越航线的下行趋势。该指数显示,进入6月份以来,泰越航线运价下滑明显,9月9日泰越航线运价指数已经跌至202.40点。在过去十年中,泰越航线运价指数最低点为243.19点,最高点为去年12月10日的3605.59点。这也意味着,泰越航线运价触及最高点仅仅半年后,便暴跌至近10年中的最低水平,下跌速度史无前例。

宁波出口集装箱运价指数(NCFI)显示,自群爱你12月至今,泰越航线运价已经从3605.59点下降至202.40点。图片来自宁波航运交易所

运去哪航线专家MAX告诉界面新闻,疫情后,头部船东增加供给资源(船舶运力),市场价格短时间内出现回落。但他同时表示,从运去哪平台大数据分析和判断,每年第三季度到第四季度,海运价格都会经过短暂下降后再回升,尤其是东南亚市场,随着四季度销售旺季到来,运价也会随之回暖。

除泰越航线以外,全球主要的海运航线近期都出现了大幅下滑。9月9日,上海航运交易所发布的上海出口集装箱综合运价指数(SCFI)为2562.12点,较上期下跌285.5点,周跌幅达10.0%。目前该指数已连续13周下跌,较去年同期下跌43.9%。

9月3日至9月9日,宁波航运交易所发布的宁波集装箱运价指数(NCFI)报收于1910.93点,较上周下跌11.6%。21条航线中,只有1条航线运价指数上涨,20条航线运价指数下跌。“海上丝绸之路”沿线地区主要港口中,16个港口运价指数均下跌。

另有航运自媒体报道称,近期,美西、欧地航线运价、货量和市场需求均继续大幅下行,有货代爆出盐田至长滩港大柜报价跌破3000美元至2850美元,而在去年峰值时期,一个大柜的价格在3万美元左右。

2022-09-16 18:40

BursaKakis

Mr Koon, how about Ruberex ? Ruberex purchased Reszon for RM180m or PE multiple of approximately 3.6 times. RM54m will be paid by cash & RM126m paid by issuing Ruberex shares @ 0.7091 per share. After this deal, Ruberex still has cash resources of about 126m. Reszon is providing a profit guarantee of RM50m for each year of financial years 2022 & 2023. Based on enlarged capital of 1,038,367,281 shares & 50m profit guarantee, eps is about 4.8 cts and forward PE 10 will be 48 cts. This is excluding their gloves business. Both Scomnet & UMC are trading above pe of 35 times. Ruberex will be changing it's name to Hextar Healthcare Berhad.

2022-09-15 12:11