Can renewable energy replace fossil fuel? Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 28 Nov 2022, 09:16 AM

Fossil fuel is a depleting commodity and its price can only go up higher and higher. The price of gas, in particular, has exploded during the recent energy crisis, which was chiefly triggered by the war in Ukraine.

Renewable energy comes from the sun and the wind. The supply of sun light and wind is free and unlimited. The cost of solar panels and wind turbines can only get cheaper and cheaper due to following reasons:

1 Constant improvement of manufacturing technology.

2 The increasing number of manufacturers creates more supply and lower prices.

3 Improve efficiency of wind turbine technology. In recent years, as manufacturers have begun to produce turbines on larger towers with wider blades.

4 Improve efficiency of solar panel technology.

The International Renewable Energy Agency (IRENA) is an intergovernmental organisation supporting countries in their transition to a sustainable energy future.

In 2021, IRENA reported that two-thirds of newly installed renewable power in G20 countries had lower costs than the cheapest fossil fuel-fired option – and they’re only set to get more affordable from here on out.

What is the cheapest source of renewable energy?

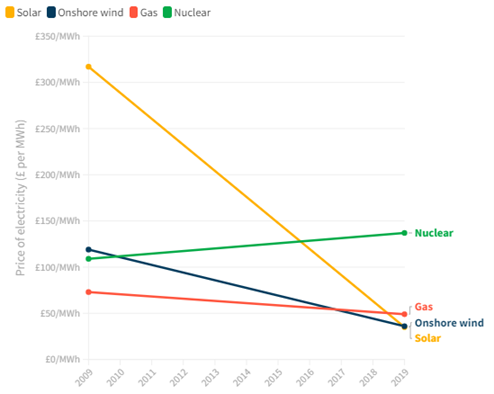

Solar was crowned as the cheapest source of energy in history in 2021 – closely followed by onshore and offshore wind – after it became more affordable than gas.

This is a dramatic improvement compared to the cost of solar energy a decade ago. In fact, the price of solar reduced by 88% between 2010 and 2021 – with the cost decreasing by 13% in 2021 alone.

Check out the chart below to get an idea of how the cost of solar compares to other sources of energy.

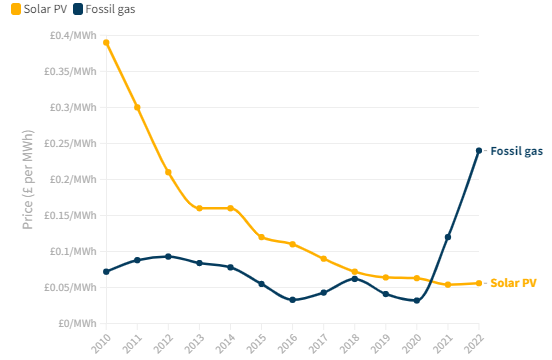

Renewable energy costs vs fossil fuel costs

As renewable energy costs continue to fall to record lows, fossil fuels are gradually becoming more expensive. European gas prices are now about 10 times higher than their average level over the past decade – a rate that has been wildly increased by the shortage of gas from Russia.

Cost of Utility-Scale Solar PV in Europe, Compared to Fossil Gas

Renewable energy in China

As a fast-growing economy, China faces multiple challenges regarding energy generation, particularly the population growth and economic pressure posed on energy demand. However, with this rapid increase in energy consumption coupled with the heavy reliance on coal, various environmental problems started to arise in China, with air pollution being the easiest to notice.

Need for clean energy

Green energy has been gaining much more attention in the last decade to cope with the deteriorating environment while sustaining economic growth. Currently, like many other countries that just started on the journey to low-emission, China's share of renewable energy in the whole energy mix is still relatively low. Crude coal is still the dominant source of energy in the country, which was also one of the culprits for the infamous air pollution. In light of public health and sustainable development, China has become a keen driver of the growth of renewable energy on a global level, especially as a leader in solar energy.

The dominance of solar power

China has the world's highest solar energy consumption share, much higher than other leading countries, such as the United States, Japan, and Germany. Solar power generation over the years has increased exponentially, reaching 330 TWh as of 2021. Wind power is the second most crucial renewable energy for China. From 2014 to 2021, the cumulative installed wind power capacity tripled to almost 282 gigawatts. Additionally, from 2004 to 2021, domestic hydropower consumption increased more than threefold to over 12 oxyjoules.

As a leading player in the solar markets in the world, the photovoltaic power generation sector has become much more of a profitable industry on its own than existing merely for environmental reasons in China. China has been transforming from a manufacturer to an innovator in the renewable energy industry, and is likely to keep influencing the market substantially in the future.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Created by Koon Yew Yin | Sep 03, 2024

State housing and local government committee chairman Datuk Mohd Jafni Md Shukor said demand for properties in Johor has gone up since last year’s announcement about the SEZ.

Discussions

Human discharge through the rear end is also wind energy.

You mean they failed to exploit that?

2022-12-05 17:10

calvintaneng

Post removed.Why?

2022-11-30 15:12