Why US wants to protect the dollar - Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 18 Dec 2022, 10:32 PM

World War II ended with the unconditional surrender of Germany in May 1945. In the East, the war ended when The Japanese surrender occurred after the United States dropped atomic bombs on Hiroshima and Nagasaki on Aug. 6 and 9, respectively. Japan surrendered unconditionally on Aug. 14, 1945.

After the World War II, US became the most powerful nation in the world and enjoys the right to print money.

The U.S. dollar is the world’s dominant reserve currency, among other such currencies including the euro, the yen, the pound, the renminbi (RMB), the Canadian dollar, the Swiss franc, and the Australian dollar. A reserve currency is a currency held by central banks in significant quantities. It is widely used to conduct international trade and financial transactions, eliminating the costs of settling transactions involving different currencies.

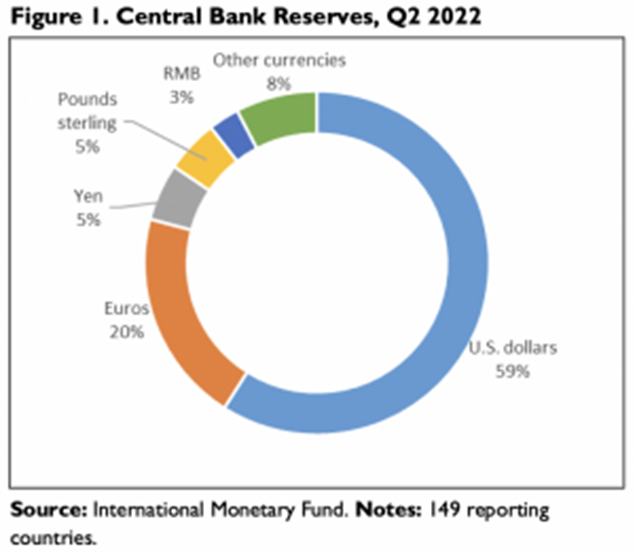

The dollar has functioned as the world’s dominant reserve currency since World War II. Today, central banks hold about 60% of their foreign exchange reserves in dollars (Figure 1). About half of international trade is invoiced in dollars, and about half of all international loans and global debt securities are denominated in dollars. In foreign exchange markets, where currencies are traded, dollars are involved in nearly 90% of all transactions.

The dollar is the preferred currency for investors during major economic crises, as a “safe haven” currency. During the global financial crisis of 2008-2009, for example, and amidst the economic turmoil associated with the Coronavirus Disease 2019 pandemic in 2020, investors sought U.S. dollars, expecting the dollar to retain its value. In both crises, the U.S. Federal Reserve adopted extraordinary monetary authorities and currency swap lines with other central banks to provide liquidity and dollars.

Implications for the United States

The U.S. economy generally benefits from the dollar’s status as the world’s dominant reserve currency, once famously referred to as the United States’ “exorbitant privilege” by France’s finance minister in the 1960s. Because many central banks and financial institutions around the world want to hold U.S. dollars and dollar-backed securities like U.S. Treasury bonds, there is strong demand for U.S. dollars. That demand, in turn, allows the United States to borrow more cheaply (at lower interest rates) than it would otherwise.

Strong demand for dollars also allows the U.S. government, firms, and consumers to borrow from foreign creditors in dollars rather than foreign currencies. As a result, the value of that debt does not depend on fluctuations in exchange rates. When other governments, firms, and individuals borrow in foreign currencies, they incur the risk that swings in exchange rates will cause their real debt level (the size of the debt in the borrower’s national currency) to increase, potentially quickly and significantly. U.S. firms and consumers also benefit by saving on transaction costs.

The widespread use of the dollar entails economic risks. Low borrowing costs can lead to the accumulation of debt, and the funds borrowed may not be channeled into productive investments. Additionally, the demand for the dollar associated with its position as a reserve currency can lead to a stronger U.S. dollar. A strong U.S. dollar generally makes it harder for U.S. producers to compete in global markets and can lead to persistent trade deficits, although U.S. consumers may benefit from less expensive imports. For example, the dollar has strengthened since mid-2021 as the Fed tightened monetary policy to combat rising inflation. In addition to the impact of a rising dollar on U.S. exporters, it will create challenges for many other countries servicing their debts amidst higher interest rates and slowing global economic growth.

Challenges to the U.S. Dollar’s Global Role?

Historically, shifts from one dominant international currency to another occur over many years. For example, in the 20th century the U.S. dollar replaced the British pound sterling as the dominant international currency over many decades (including two World Wars and the Great Depression) after the United States overtook the United Kingdom as the world’s largest economy and exporter. The U.S. dollar has persisted for seven decades as the world’s dominant reserve currency through a number of major shifts, including the collapse of fixed exchange rates, trade and financial globalization, technological development, and geopolitical changes.

Some observers have speculated whether changes in the global economy, and geopolitical shifts more generally, could cause a shift from the dollar to other currencies. Focus in particular is centered on China’s economic rise, U.S. sanctions, and digital currencies.

China’s Global Economic Role

China’s growing role in the global economy since the 1990s has prompted China’s government to consider how to promote the use of China’s currency, the RMB, in global trade. To date, this push has been limited by the government’s own caution in liberalizing China’s capital account, as well as investor concerns about potential risks associated with the lack of transparency and predictability of the government’s role in the market.

The RMB plays a marginal role in international finance. According to the Bank for International Settlements (BIS), the RMB is the 8th most traded currency. It is the 6th most active currency for global payments by value, with a share of 1.66 %. By contrast, the U.S. dollar and the euro combined account for 75% of all transactions. China’s central bank is developing a digital currency to try to influence global finance and e-commerce, and diversify from U.S. dollar financing. While such an effort may take time to develop, it could allow China to challenge U.S. sanctions and dollar leadership in certain instances.

When America prints a lot of money, other countries’ foreign reserves in dollars shrink in value.

Furthermore, to prevent exports to America become expensive, these countries have to print money too, which devalues the savings of the people, and causing inflations in these countries. For some countries, inflation can be mitigated by producing more. But for the lower tier exports like agricultural products, ramping up production is not possible in a short time due to limited time and resources, so the developing countries are most affected by inflation. It is estimated that our wealth in cash depreciate about 9% every year since the abolishment of the Bretton Wood System, after which America started to print money with no more gold-backing and rely on just creditability.

The money from the money printers (plus American tax payers’ money) are used to fund the huge military, which receives the combined military budgets of the next top 11 countries in the world (year 2021). And the US military in turn protects the hegemony of the dollar around the world.

For the record, USA had no mercy on anyone threatening the dollars:

1 In 2000 Saddam Hussein said he would start selling oil in Euros not Dollars and US attacked and killed Saddam.

2 In 2009 Gaddafi made Libya export oil in Gold Dinars. And Gaddafi was killed by US-backed NTC.

3 Syria had an independent Central Bank NOT under Federal Reserve controlled Bank of International Settlements (like Iraq and Libya once had before US regime change). Obama attempted to overthrow Bashar al-Assad.

4 Iran has been trading oil in currencies other than US dollars since 2011 and Iran was being sanctioned by the US.

5 In 2019, Putin completely ditched dollars in oil trades. And it’s now the forerunner in de-dollarization. America wants to topple Putin.

6 China introduced the Belt and Road Initiatives in 2013 which helps many Asian, African, South American countries to grow, used non-dollar in oil trades with Iran and Russia, and introduced the CIPS which is an alternative to the West’s SWIFT system, and China’s economy size is catching up fast. As a result, China has become America number 1 target.

If a country supports the dollar, it’s being looted; if a country doesn’t support the dollar, the government is changed by America. This is financial slavery.

Today America’s debt has reached 30 Trillion dollars. This huge bubble and weaponisation of the dollar by sanctioning 39 countries has increased the urge in other countries to de-dollarize in trades and also to reduce US debt holdings. The dollar is in a creditability crisis. Therefore America want to take on Russia and China. And since the Euro is a competitor to the dollar, America is dragging European countries into a war with Russia (along with other agenda such as arm sales, forcing the cancellation of the Nord Stream II, attracting investment from Europe)

After the dissolution of the USSR in 1991, US President Bill Clinton had the choice to integrate Russia into Europe and abolish NATO, OR, to slowly alienate Russia to keep them divided. Clinton chose the latter, because if there’s no more Russia “threat”, there would be no more NATO to control Europe.

As the first NATO Secretary General, Lionel Ismay described NATO: “To keep America IN, to keep Russia OUT, to keep Germany (Europe) DOWN”.

Remember, after WW II, Europe, Russia, Japan and China were devastated, but America emerged as the world’s biggest economy and the dollar became the world’s reserve currency. This is a plan to breathe new life into the ailing Anglo-American Empire.

To understand a situation, don’t watch mainstream media, don’t listen to politicians. Just look at the think tanks’ plans.

U.S. Financial Sanctions

Through economic sanctions that impede access to the U.S. financial system (financial sanctions), the United States leverages the role of the dollar to advance foreign policy objectives. Access to the U.S. financial system is generally needed to settle transactions denominated in dollars, even when both parties on the transaction are located outside the United States. The U.S. government has increasingly restricted access to U.S. dollars and the U.S. financial system in an effort to alter the objectionable behavior of foreign governments. Most recently, the United States and allies have imposed significant sanctions on Russia that impede the country’s ability to conduct many cross-border transactions.

Treasury officials in the Obama, Trump, and Biden Administrations have cautioned that extensive use of financial sanctions could threaten the central role of the dollar and U.S. financial system. Many foreign governments targeted by U.S. financial sanctions and their economic partners are increasingly exploring and creating ways to reduce their reliance on the U.S. dollar. Countries are doing so through a variety of tools: contracts denominated in non-dollar currencies, currency swap lines, digital currencies, and non-dollar payment processing systems.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jun 28, 2024

Created by Koon Yew Yin | May 28, 2024

It is a human nature that most men would complain to their wives that they were overworked and the wives would tell their husbands to get some assistants. As a result, the number of staff increases...

Created by Koon Yew Yin | May 13, 2024

Eversendai Corporation Berhad recently reported its earnings results for the fourth quarter ended December 31, 2023. Here are the key financial highlights:

Created by Koon Yew Yin | May 06, 2024

Eversendai Corporation Berhad made a remarkable comeback in FY2023, reporting strong profit growth. Here are the key highlights from their financial performance:

Created by Koon Yew Yin | Apr 30, 2024

As shown on the chart below, Sendai has been dropping in the last few days. Today all shareholders must be wondering to sell, hold on or to buy some at a cheaper price.

Discussions

BECAUSE OF PRIDE, EGO AND THE HEGEMONIC CHARACTERISTICS OF THE US, USD MUST STAY STRONG. BUT UNTIL A TIME, USA GOES BANKRUPT HAVING NO MONEY TO PAY ALL THEIR CREDITORS WHO BOUGHT THEIR TREASURY BILLS, USA HAS TO LET GO. USD WAS NOT BACK BY GOLD SINCE 1971 AND THEY WANTED SAUDI OIL TO BACK THE USD SINCE. BUT RECENTLY, SAUDI ARABIA SEEMS MOVING AWAY FROM THE US CONTROL. THERE COMES A TIME FOR A CHANGE. AT PRESENT, ALL CURRENCIES IN THE WORLD ARE USING FIAT CURRENCIES WITH ONLY THE GOVT STRENGTH AS THEIR TRUST AND BACKINGS. BUT WHEN USA INFLUENCES GO DOWNWARDS, USD WILL LOSE ITS STRENGTH IN DUE COURSE. THOSE COUNTRIES THAT USE GOLD RESERVE AS THEIR CURRENCIES BACKING WILL PERFORM BETTER IN THE FUTURE. FIAT CURRENCIES WILL SLOWLY GO DOWN THE DRAINS AS USELESS CURRENCIES UNLESS THEIR OWN COUNTRIES POSSESS STRONG GOLD RESERVES IN THEIR TREASURY.

2022-12-19 16:47

CURRENTLY USA IS PRACTICING A VERY BAISED MONETARY POLICY. THEY USE TO PRINT NEW CURRENCIES WHENEVER THEY WANT TO RESOLVE THEIR OWN FINANCIAL CRISIS SUCH AS FINANCIAL CRISIS 2007-2009, COVID-19 PANDEMIC AND THE CURRENT INFLATION.

2022-12-19 17:00

ever since the collapse of the Soviet Union, the US has turned from being the good guy to the bad guy.

Sad!

2022-12-19 22:48

henry888

To reaps the benefits of the above-mentioned status, US must keep her currency stronger than any other currencies at any time and so is the excessive printing of the US dollars without commensurable placements of tangibles.

2022-12-19 07:09