Low rise buildings do not require piling - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 03 Jan 2023, 05:38 PM

10 years ago, I constructed my 2 storey house without piling. About 6 years ago, I constructed another two 2 storey buildings located about 100 meter away from my house for sale without piling. In the early 1970s when I was practicing as an engineering consultant, I designed a 4 storey shop called Kwong Fatt, the new 4 storey St Michael Institution, a roll of 4 storey flats and many other low rise buildings in Ipoh without piling.

I just took this photo of piling in progress for a 2 storey building nearby my house. Why should the house owner waste his hard earned saving on piling???

I am obliged to tell you my academic qualification and experience so that my readers can believe my purpose for writing this article which is to save unnecessary expenditure for piling for low rise buildings.

I am a Chartered Civil Engineer. In the early 1970s, I was Secretary General of the Malaysia Master Builders Association for 9 years. I was also a member of the Malaysia Board of Engineers for 3 terms of 2 years each as permitted by law.

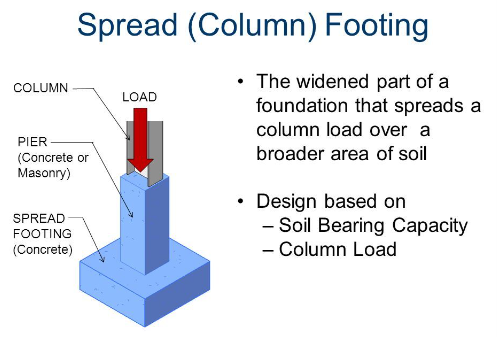

Low rise buildings do not require piling. Spread concrete foundation should be adequate as shown below.

Spread concrete foundation distributes the load of the building evenly on the ground. This system is applicable even on very soft ground. The Engineer should provide larger size spread foundation for bigger load and smaller size for lesser load to avoid uneven settlement.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jun 28, 2024

Created by Koon Yew Yin | May 28, 2024

It is a human nature that most men would complain to their wives that they were overworked and the wives would tell their husbands to get some assistants. As a result, the number of staff increases...

Created by Koon Yew Yin | May 13, 2024

Eversendai Corporation Berhad recently reported its earnings results for the fourth quarter ended December 31, 2023. Here are the key financial highlights:

Created by Koon Yew Yin | May 06, 2024

Eversendai Corporation Berhad made a remarkable comeback in FY2023, reporting strong profit growth. Here are the key highlights from their financial performance:

Created by Koon Yew Yin | Apr 30, 2024

As shown on the chart below, Sendai has been dropping in the last few days. Today all shareholders must be wondering to sell, hold on or to buy some at a cheaper price.

Discussions

https://www.theedgemarkets.com/node/653499

Yessssss finally!!!! Go after the USA!

2023-01-30 22:27

richardshelton

I want to express my gratitude for sharing this crucial information with me. Your website's content is engaging and enjoyable to read. Your website's wealth of information astounded me. I'm grateful. Visit https://geometrydashmeltdown.com

2023-01-30 17:00