Why Coal price is dropping and how it can benefit CMSB - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 07 Feb 2023, 11:00 AM

Indonesia is the world's largest exporter of thermal coal, while Australia ranks second and Russia third.

The softer prices for thermal coal are occurring as demand for seaborne cargoes appears to be weakening among Asia's top two importing nations, China and India.

Coal price has been dropping as chart below:

China, the world's biggest coal importer, is forecast to import 23.96 million tonnes of all grades in January, down from 28.33 million in December last year.

China is consuming less coal as a result of the government's initiatives to curb carbon emissions to combat global warming. Moreover, China is the largest producer of renewable energy from the sun and wind in the world. With improved technology and manufacturing process, the cost of energy from solar and wind is cheaper than fossil fuel.

India, the second-ranked importer, is expected to land 16.20 million tonnes in January, roughly in line with December's 16.22 million, but it's worth noting that December was the weakest month for imports since February 2022.

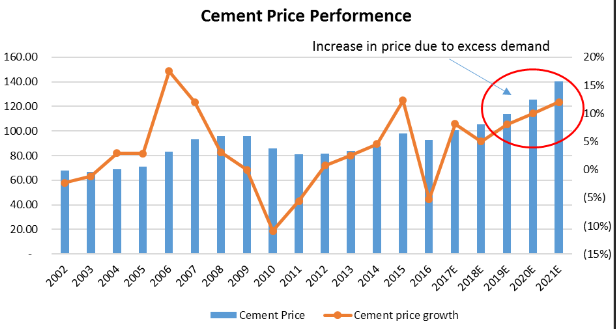

To produce 1 ton of cement requires about 300 kg of coal. Despite cheaper coal, cement price has been going up as chart below:

What role does coal play in cement production?

Coal plays a very important role for manufacturing plants is undeniable. In many applications from gasification technology, liquefaction, production of chemicals, the role of a fuel in the production process is the most prominent and important. Therefore, it is impossible not to mention the use of coal in the cement production process – one of the industries with both domestic demand and export market growing positively.

2 uses of coal for cement production: fuel and raw materials

Before going to the application of coal in making cement, do you understand the important components of cement? Cement is made from a mixture of calcium carbonate (usually in the form of limestone), silica, iron oxide, and alumina. A kiln for cement production typically uses coal as a fuel to heat a mixture of raw materials at 1450°C, transforming the chemical and physical components to form a new substance called a clinker – a gray pebble-like material consisting of special compounds that give cement its characteristic binding properties. Clinker is mixed with gypsum and ground into a fine powder, from which cement is made. According to calculations, a large amount of energy from coal is used to produce cement, of which it takes about 200 kg of coal to produce one ton of cement and about 300-400 kg of cement to produce one cubic meter of concrete.

In addition to being a fuel, industrial coal also contributes to being one of the raw materials involved in the cement production process. More specifically, the mixture of raw materials includes coal extracted from lime stone mountains, shale, rolled steel flakes, fly ash and small amounts of bauxite.

300 kg of coal to produce 1 ton of cement

According to calculations, a large amount of energy from coal is used to produce cement, of which it takes about 300 kg of coal to produce one ton of cement.

Cheaper coal price will benefit all cement producers.

There are 4 listed cement producers in Malaysia. CMSB is located in Sarawak and Malayan Cement, Hume Industries and YTL are located in Malaysia Peninsular.

Comparison:

CMSB price Rm 1.27, latest quarter EPS 14.37 sen and EPS 3.69 sen for its previous quarter.

Malayan Cement price Rm 2.47, latest quarter EPS 0.07 sen and EPS 2.61 sen for its previous quarter.

Hume Industries price Rm 1.03, latest quarter EPS loss 2.33 sen and EPS 0.98 sen for its previous quarter.

YTL price 57 sen, latest quarter EPS 0.33 sen and EPS 0.08 sen for its previous quarter.

By comparison CMSB is the best stock to buy. Its share price is cheaper than any of the other 3 cement companies in terms of PE ratio.

The scarcity of cement supply in Sarawak has also affected cement prices. Sarawak’s average cement unit price is 15 per cent more than in Peninsular Malaysia and 4 per cent higher than in Sabah.

Cheaper coal will benefit CMSB

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jun 28, 2024

Created by Koon Yew Yin | May 28, 2024

It is a human nature that most men would complain to their wives that they were overworked and the wives would tell their husbands to get some assistants. As a result, the number of staff increases...

Created by Koon Yew Yin | May 13, 2024

Eversendai Corporation Berhad recently reported its earnings results for the fourth quarter ended December 31, 2023. Here are the key financial highlights:

Created by Koon Yew Yin | May 06, 2024

Eversendai Corporation Berhad made a remarkable comeback in FY2023, reporting strong profit growth. Here are the key highlights from their financial performance:

Created by Koon Yew Yin | Apr 30, 2024

As shown on the chart below, Sendai has been dropping in the last few days. Today all shareholders must be wondering to sell, hold on or to buy some at a cheaper price.